Premium Only Content

750K Low Float Stock Review For New IPO Lucas GC Limited LGCL | Initial Public Offering

😃Join Discord to get access to perks:👇

https://www.patreon.com/bullmarketwatch

***DO NOT BUY ANY STOCK YOU SEE IN MY VIDEOS! DO YOUR OWN HOMEWORK AND DECIDE FOR YOU WHAT IS BEST TO BUY OR NOT***

Lucas GC Limited: An Upcoming Penny Stock to Watch

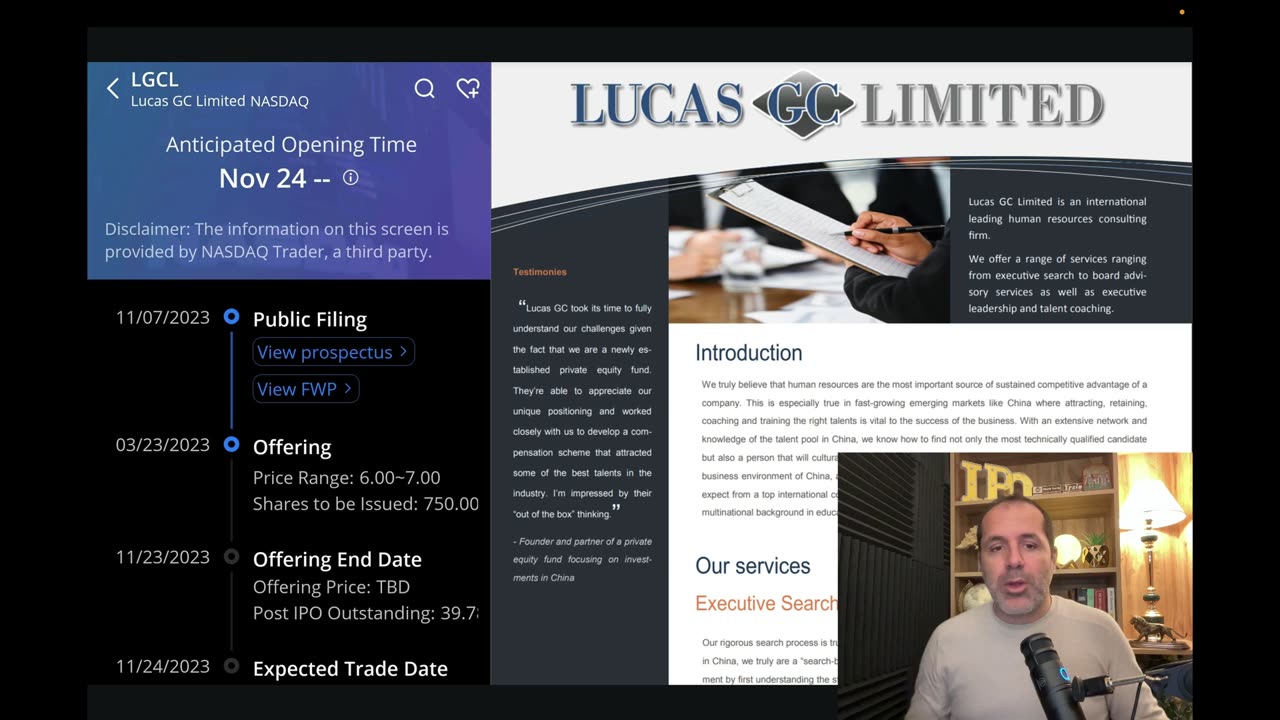

Lucas GC Limited (LGCL) is an international human resources consulting firm that is poised to make a splash on the NASDAQ stock market with its upcoming initial public offering (IPO). As a penny stock, LGCL has the potential to deliver significant returns for investors who are willing to take on a bit more risk.

About Lucas GC Limited

LGCL is a leading provider of executive search, board advisory, and talent coaching services. The company has a strong track record of success, having placed over 1,000 executives in senior positions at multinational companies. LGCL's team of experienced consultants is well-versed in the Chinese market, making it a valuable resource for companies looking to expand their operations in the region.

Why Invest in LGCL

There are several reasons why investors should consider investing in LGCL:

Strong growth potential: The global HR consulting market is expected to grow at a CAGR of 5.4% from 2022 to 2027. LGCL is well-positioned to capitalize on this growth, given its strong track record and expanding presence in the Chinese market.

Experienced management team: LGCL's management team has a proven track record of success in the HR consulting industry. This team is well-respected in the industry and has a deep understanding of the Chinese market.

Attractive valuation: LGCL is expected to price its IPO at between $6.00 and $7.00 per share. This valuation represents an attractive entry point for investors, given the company's strong growth potential.

Risks to Consider

As with any investment, there are risks associated with investing in LGCL. These risks include:

Competition: The HR consulting industry is highly competitive. LGCL will need to continue to differentiate itself from its competitors in order to maintain its growth.

Economic downturn: A downturn in the global economy could negatively impact LGCL's business.

Regulatory changes: Changes in government regulations could impact LGCL's operations.

Overall, Lucas GC Limited is a promising company with the potential to deliver significant returns for investors. However, investors should carefully consider the risks involved before investing in the company.

Welcome to our YouTube channel dedicated to providing expert insights for investors engaged in stock trading on the renowned NYSE and NASDAQ exchanges.

It is always a good idea to consult with a financial advisor or professional before making any investment decisions.

#stockmarket #finance #business

🔥 Disclaimer: Everything expressed is a personal opinion provided for entertainment value only. I am not a professional nor a financial advisor. These are not instructions, suggestions, nor directions as to how to handle your money. Please, always do your own due diligence.

-

1:58:40

1:58:40

Robert Gouveia

5 hours agoJ6 Coverup: Prosecute LIZ CHENEY; NY Judge REJECTS Immunity; Trump Breaks Gag?

50.7K20 -

2:22:06

2:22:06

WeAreChange

3 hours agoPSYOP Spreads: Drones Shut Down Airport In New York!

39.5K13 -

1:31:18

1:31:18

Redacted News

6 hours agoEMERGENCY! NATO AND CIA ASSASSINATE TOP RUSSIAN GENERAL, PUTIN VOWS IMMEDIATE RETALIATION | Redacted

183K238 -

56:45

56:45

VSiNLive

5 hours ago $4.64 earnedFollow the Money with Mitch Moss & Pauly Howard | Hour 1

51.6K2 -

52:44

52:44

Candace Show Podcast

5 hours agoMy Conversation with Only Fans Model Lilly Phillips | Candace Ep 122

63K238 -

UPCOMING

UPCOMING

tacetmort3m

5 hours ago🔴 LIVE - RELIC HUNTING CONTINUES - INDIANA JONES AND THE GREAT CIRCLE - PART 5

30.2K -

26:52

26:52

Silver Dragons

4 hours agoCoin Appraisal GONE WRONG - Can I Finally Fool the Coin Experts?

23.5K2 -

UPCOMING

UPCOMING

Bare Knuckle Fighting Championship

10 hours agoBKFC on DAZN HOLLYWOOD WARREN vs RICHMAN WEIGH IN

16K -

6:49:16

6:49:16

StoneMountain64

8 hours agoNew PISTOL meta is here?

28.3K1 -

20:58

20:58

Goose Pimples

10 hours ago7 Ghost Videos SO SCARY You’ll Want a Priest on Speed Dial

16K3