Premium Only Content

Commercial Real Estate Looming Threat to the U.S. Economy, Future Community Standard of Living

Recently, I had the privilege of attending a captivating real estate investors' conference, where hedge funds, lenders, and property owners converged. The hot topic on the agenda? The uphill battle faced by landlords, especially those owning non-prime properties, to secure financing. The offered interest rates are soaring, hovering around a staggering 15%, more than double the existing financing rates. It's a warning sign, folks!

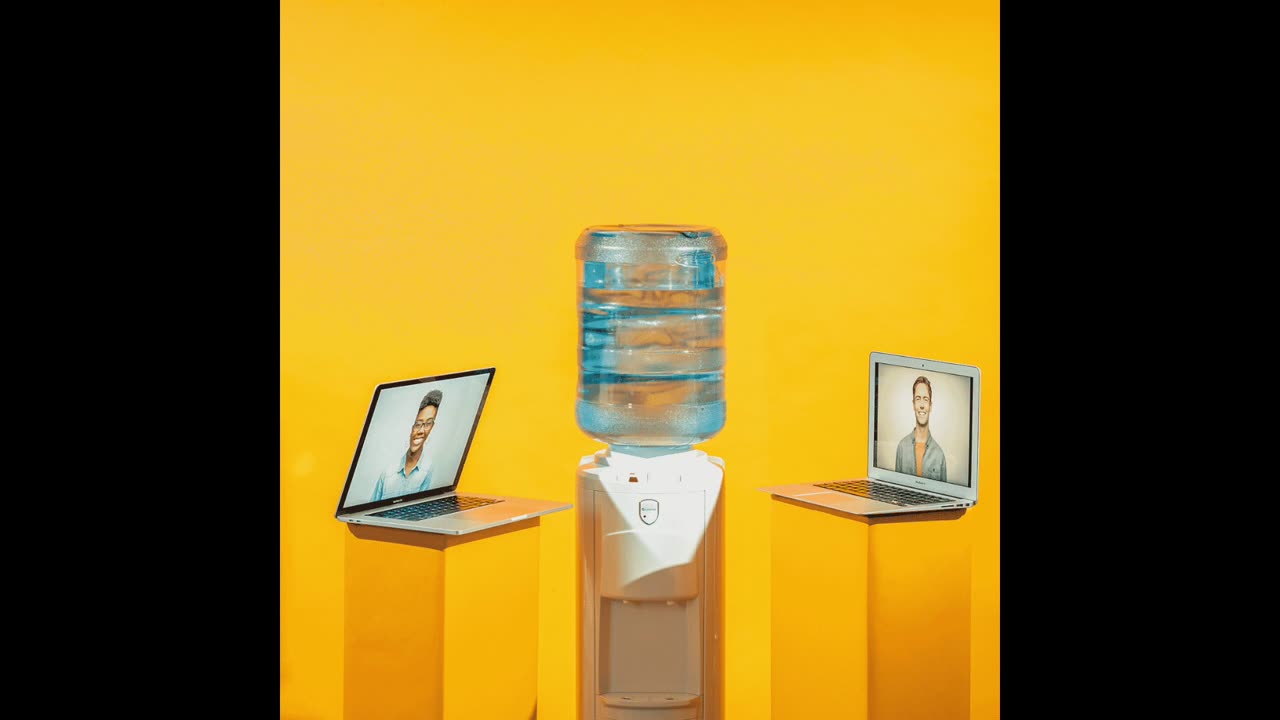

Now, here's the twist: This issue isn't confined to the real estate realm; it carries the potential to become a substantial menace to the entire American economy. Major banks and tech giants have been advocating for a return to the office, with mandates of three or more in-person workdays. However, the numbers tell a different story. Even post-Labor Day, national and New York office attendance rates remain below 50%. If this trend persists, we could witness an upsurge in defaults, with a precarious triangle forming between banks grappling with rising office loan defaults, struggling property owners, and cities facing dwindling tax revenues.

When Jamie Dimon, the head honcho of J.P. Morgan Chase, emphasizes the importance of a return to the office for productivity's sake, it's not mere workplace discipline; there's a genuine concern at play. Yet, bringing employees back to the office is no walk in the park. We need innovative solutions beyond free lunches. How about short-term tax credits for employers and employees, or even reduced or free transit fares? These incentives might lure individuals back to their office desks.

Here's the twist in the narrative: Some of the initial research touting the productivity of remote work is facing scrutiny. Researchers, including Nicholas Bloom from Stanford, have revealed that fully remote work could be linked to a 10% drop in productivity compared to fully in-person work. Challenges in remote communication, mentoring, building a cohesive culture, and self-motivation all contribute to this effect.

However, it's all about perspective. From a company's viewpoint, having employees out of the office might decrease efficiency but reduce real estate costs. It's a delicate balance, and there's no one-size-fits-all solution.

As the battle for the office continues, corporate impatience clashes with employee desire for remote work flexibility. But time is of the essence. According to Trepp CMBS Research, the special servicing rate for office properties keeps climbing, reaching 7.72% in August 2023. That's a significant 456 basis point increase from August 2022, signaling an impending danger as loans mature and buildings require refinancing.

In a nutshell, this is a vital urban saga gaining significance month by month. Converting a handful of office buildings to residential spaces won't suffice. Our cities and banking system hang in the balance, and the stakes are high.

Commercial Real Estate,Office Space,Office Crisis,Real Estate Investors,Office Loan Defaults, Remote Work Productivity,Economic Threat,Office Building Refinancing,Banking System,Workplace Flexibility,Urban Development,Office vs. Remote Work,Economy,Corporate Challenges

-

9:05:24

9:05:24

MyronGainesX

14 hours ago $22.89 earnedSam Seder Embarrasses Ethan Klein, The Truth On MLK's Murder, And Trump's First 100 Days In Review

69.9K14 -

1:09:38

1:09:38

Man in America

10 hours agoEXPOSED: How Militaries Worldwide Are Engineering DEPOPULATION w/ Todd Callender

55.4K32 -

LIVE

LIVE

SpartakusLIVE

9 hours agoNEW Update, NEW Weapons, NEW META?!? || Quads in VERDANSK

278 watching -

5:14:28

5:14:28

Jokeuhl Gaming and Chat

6 hours agoEmpyrion - Galactic Survival Long Range Jump Aquired

27.7K1 -

4:42:30

4:42:30

Right Side Broadcasting Network

1 day agoLIVE REPLAY: President Trump Gives Commencement Address at University of Alabama - 5/1/25

157K20 -

16:58

16:58

T-SPLY

12 hours agoDems’ Bad News: El Salvador Rejects Abrego, Democrats Fume!

89.6K61 -

18:56

18:56

Nick Shirley

8 hours ago $4.88 earnedAsking People About Trump’s First 100 Days… How are Americans Feeling?

33.6K41 -

4:21:02

4:21:02

NellieBean

6 hours ago🔴 LIVE - COD and Thunder!

13.5K2 -

1:46:46

1:46:46

megimu32

7 hours agoON THE SUBJECT: Gaming, Beats & Rumble MUSIC with Lumpypotatox2 🎮🎶

32.8K7 -

9:50

9:50

Melonie Mac

10 hours agoXbox raised their prices

21.4K30