Premium Only Content

Auto Loan Delinquencies Kickstarts Repo Crisis

Millions of Americans grapple with the unexpected challenge of managing their car payments, with far-reaching implications for the economy, job market, and lending standards. Rising new car costs and delinquent payments are at the core. Many consider returning their cars as loans surpass their vehicles' values. We reflect on the 2008 financial crisis when car prices were considerably lower. Now, the auto loan crisis is peaking, prompting major automakers like GM, Ford, and Tesla to cut prices.

This crisis extends to the student loan dilemma, with borrowers facing challenges and the looming threat of Social Security garnishment. To navigate this financial turmoil, individuals have three options: increase income, return the car, or cut expenses. As this situation ripples through the economy, it impacts job markets, real estate, and lending standards. It's vital for everyone to proactively manage their finances in these challenging times.

Grab a copy of my book:

https://partsmanagerpro.gumroad.com/l/qtqax

"The Parts Manager Guide" - https://www.amazon.com/Parts-Manager-Guide-Strategies-Maximize-ebook/dp/B09S23HQ1P/ref=sr_1_4?crid=3UZYOGZJUNJ9K&keywords=parts+manager+guide&qid=1644443157&sprefix=parts+manager+guid%2Caps%2C244&sr=8-4

Please remember to like, share and leave your comments.

Videos are uploaded weekly.

Visit my website for more!

https://www.partsmanagerprof.com/

If you want me to continue making videos like these, please donate to our paypal account: paypal.me/partsmanagerpro

Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use. No copyright infringement intended. ALL RIGHTS BELONG TO THEIR RESPECTIVE OWNERS*

This video is for educational and entertainment purposes only.

-

4:51:59

4:51:59

MyronGainesX

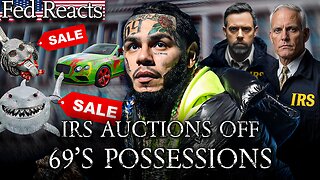

9 hours agoIRS Auctions Off Tekashi 69's Possessions

114K15 -

LIVE

LIVE

Vigilant News Network

1 day agoRFK Jr. Hearing EXPOSES Corrupt Politicians in Humiliating Scandal | Media Blackout

3,560 watching -

1:11:40

1:11:40

Josh Pate's College Football Show

8 hours ago $2.95 earnedPerfect CFB Conferences | Big Ohio State Changes | Canceling Spring Games | SEC 2025 Thoughts

39.8K -

1:08:07

1:08:07

Bek Lover Podcast

5 hours agoInteresting Times with Bek Lover Podcast

18.7K -

1:51:12

1:51:12

Tate Speech by Andrew Tate

9 hours agoEMERGENCY MEETING EPISODE 105 - UNBURDENED

164K85 -

1:01:18

1:01:18

Tactical Advisor

11 hours agoBuilding a 308 AR10 Live! | Vault Room Live Stream 016

133K11 -

2:17:02

2:17:02

Tundra Tactical

1 day ago $26.46 earnedTundra Nation Live : Shawn Of S2 Armament Joins The Boys

243K28 -

23:22

23:22

MYLUNCHBREAK CHANNEL PAGE

2 days agoUnder The Necropolis - Pt 5

193K67 -

54:05

54:05

TheGetCanceledPodcast

1 day ago $14.35 earnedThe GCP Ep.11 | Smack White Talks Smack DVD Vs WorldStar, Battle Rap, Universal Hood Pass & More...

189K35 -

8:30

8:30

Game On!

16 hours ago $0.66 earnedLakers BLOCKBUSTER trade! Luka Doncic is coming to LA!

23.6K4