Premium Only Content

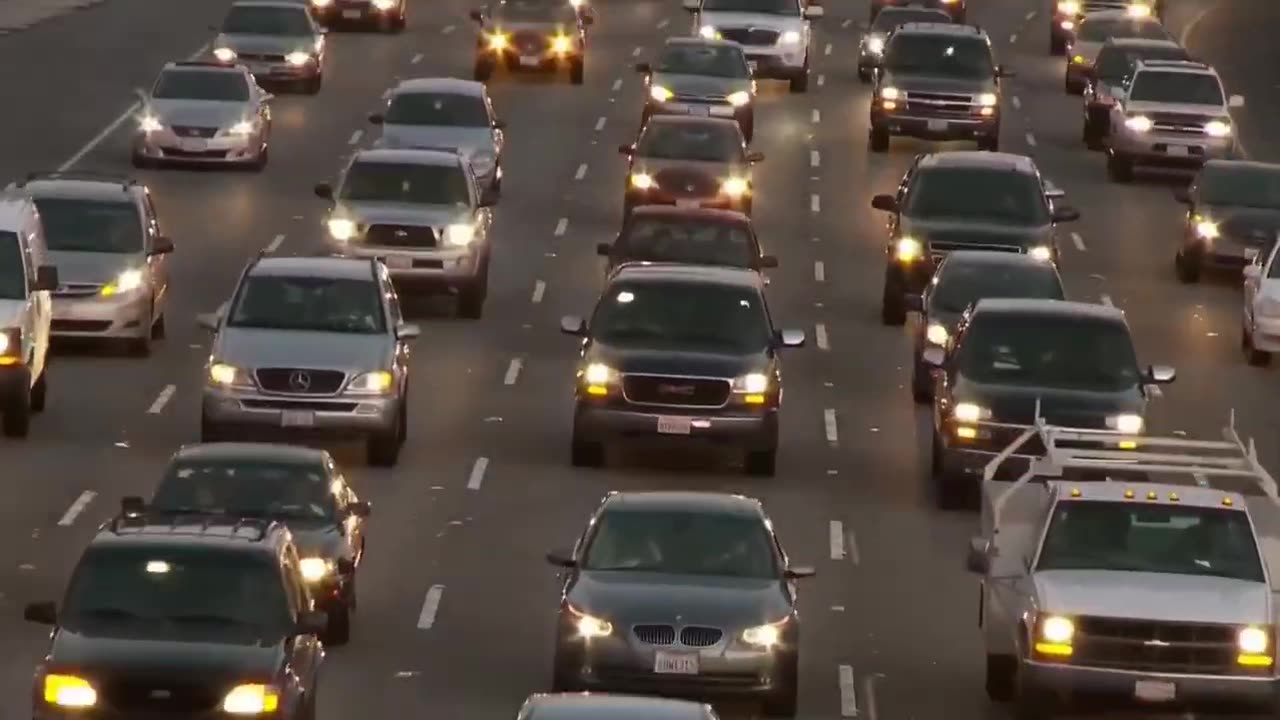

Auto Loan CRISIS Is Getting WORSE..Repos are Hitting Alarming Rates!

Although the cost of new and used cars has decreased recently, the US is still experiencing a slow-motion financing crisis, with auto loan delinquencies at an all-time high. Particularly, those who made or took out loans during the epidemic have been negatively impacted by the state of the economy. This is mostly affecting the people who were trying to save during the pandemic. The auto loan delinquencies have reached a higher rate. This is such a scary situation. Let's have a look at the current situation.

📺 Watch the entire video for more information!

💼 Business Inquiries and Contact

• For business inquiries, copyright matters or other inquiries please contact us

❓ Copyright Questions

• If you have any copyright questions or issues you can contact us.

⚠️ Copyright Disclaimers

• We use images and content in accordance with the YouTube Fair Use copyright guidelines

• Section 107 of the U.S. Copyright Act states: “Notwithstanding the provisions of sections 106 and 106A, the fair use of a copyrighted work, including such use by reproduction in copies or phonorecords or by any other means specified by that section, for purposes such as criticism, comment, news reporting, teaching (including multiple copies for classroom use), scholarship, or research, is not an infringement of copyright.”

• This video could contain certain copyrighted video clips, pictures, or photographs that were not specifically authorized to be used by the copyright holder(s), but which we believe in good faith are protected by federal law and the fair use doctrine for one or more of the reasons noted above.

-

22:04

22:04

Scammer Payback

11 hours agoCrazy Scammers Spoof Emergency 911

11.6K5 -

8:28

8:28

Misha Petrov

16 hours agoLiberals OUTRAGED Over Carrie Underwood Performing at Trump’s Inauguration

11K13 -

22:34

22:34

Degenerate Plays

19 hours ago $0.56 earnedWe're Having Bedroom Problems... Literally - Five Nights At Freddy's 4 : Part 5

4.37K -

1:00:10

1:00:10

Trumpet Daily

17 hours ago $3.78 earnedThe War to Restore America - Trumpet Daily | Jan. 14, 2025

6.15K5 -

2:51:47

2:51:47

Price of Reason

13 hours agoJimmy Kimmel ATTACKS Trump and PROTECTS Gavin Newsom! Skeleton Crew Finale REVIEW! Ubisoft DEI Woes!

22.1K12 -

5:14:42

5:14:42

JdaDelete

1 day ago $17.91 earnedThe Legend of Zelda: Skyward Sword HD | With SirPoopsMagee | Part 4

66.1K8 -

4:56:18

4:56:18

Sgt Wilky Plays

10 hours agoTesting New setup and Chillin

67.1K4 -

53:37

53:37

barstoolsports

15 hours agoOne Text Changes The Game | Surviving Barstool S4 Ep13

84.3K7 -

3:14:48

3:14:48

Laura Loomer

9 hours agoEP93: Senate Grills Trump Admin Nominees As Inauguration Approaches

43.8K23 -

1:29:23

1:29:23

Kim Iversen

10 hours agoTrump TURNS On Netanyahu! Forces Israel To END THE WAR And Stop The Bloodshed

67.4K158