Premium Only Content

Stock Market Recap | October 23rd, 2023

Another down week for stock prices. Growing pessimism among investors is causing the number of sellers to increase, but with few interested buyers, those sellers are getting very low prices on their sales, driving just about all prices down dramatically.

Many investors are bailing simply because they cannot make sense of this stock market. Stocks are falling as though a terrible recession in coming. But home prices are rising as though there is no recession coming. Bond prices keep falling as though the Fed is going to further raise interest rates. Gold is pricing as though rates are going to fall. Oil stocks are rising as though there will be a war. The mega-stocks remain firm as though all is well. Employment data shows good employment, but credit card debt is at highs and auto loan delinquencies are rising rapidly. The housing market is paralyzed. Nothing makes sense.

In light of this, is appears investors are choosing to abandon the stock market for the safety of Treasury securities that guarantee a return that is now above +5%.

As a result of declining prices, our many short positions in Level 2 and 3 remain the source of our big gains. Level 1, regrettably, is light on these, and has also been the subject of most of our analytic shortcomings – this double-whammy producing a big under-performance for Level 1.

For all the speculation of a “possible economic recession coming”, the fact is a recession in stock prices is already here – with the Fed perfectly content to kill the stock market with sustained high rates. Many stocks are already at or near new yearly lows or 52-week lows, other than the few mega-stocks that are skewing the indexes to make the market look much healthier than it is. While the P/E ratio of the S&P493 is about 20, the P/E ratio of the 7 mega-stocks is a ridiculously high - and unsustainable - 46. When these 7 stocks that are carrying the indexes suddenly report earnings shortfalls, look out below!

-

1:26:50

1:26:50

Redacted News

4 hours agoWhat happened? Trump DESTROYS the Pete Buttigieg run FAA for tragic airline crash | Redacted News

176K109 -

43:37

43:37

Candace Show Podcast

3 hours agoThe Taylor Swift Plot Thickens | Candace Ep 142

101K79 -

LIVE

LIVE

Common Threads

1 hour agoLIVE DEBATE: Trump's Wild Handling of Plane Tragedy

228 watching -

LIVE

LIVE

LFA TV

8 hours agoConfirmation Chaos | TRUMPET DAILY 1.30.25 7pm

591 watching -

1:57:53

1:57:53

Revenge of the Cis

5 hours agoEpisode 1437: Kash Me Outside

52.1K15 -

6:34:04

6:34:04

Dr Disrespect

8 hours ago🔴LIVE - DR DISRESPECT - WARZONE - CRAZY TRIPLE THREAT CHALLENGE

146K28 -

3:10:10

3:10:10

Power Slap

9 days agoPower Slap 11: Da Crazy Hawaiian vs Dumpling 2 | Thursday January 30th 12pET/9aPT

3.64M136 -

1:19:18

1:19:18

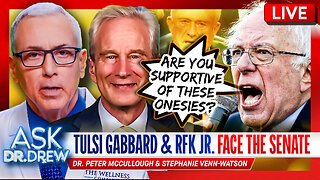

Dr. Drew

7 hours agoDr. Peter McCullough: RFK Jr. Faces Senate Hearing Circus, As 81,000 Doctors & Experts Publish New Demand For COVID-19 Vaccine Recall – Ask Dr. Drew

106K29 -

1:02:30

1:02:30

In The Litter Box w/ Jewels & Catturd

1 day agoConfirm Kash & Tulsi! | In the Litter Box w/ Jewels & Catturd – Ep. 731 – 1/30/2025

92.1K34 -

1:54:36

1:54:36

PudgeTV

7 hours ago🟡 Practical Pudge Ep 52 | Sticker Mule CEO & Future NY Congressman - Anthony Constantino

46.7K