Premium Only Content

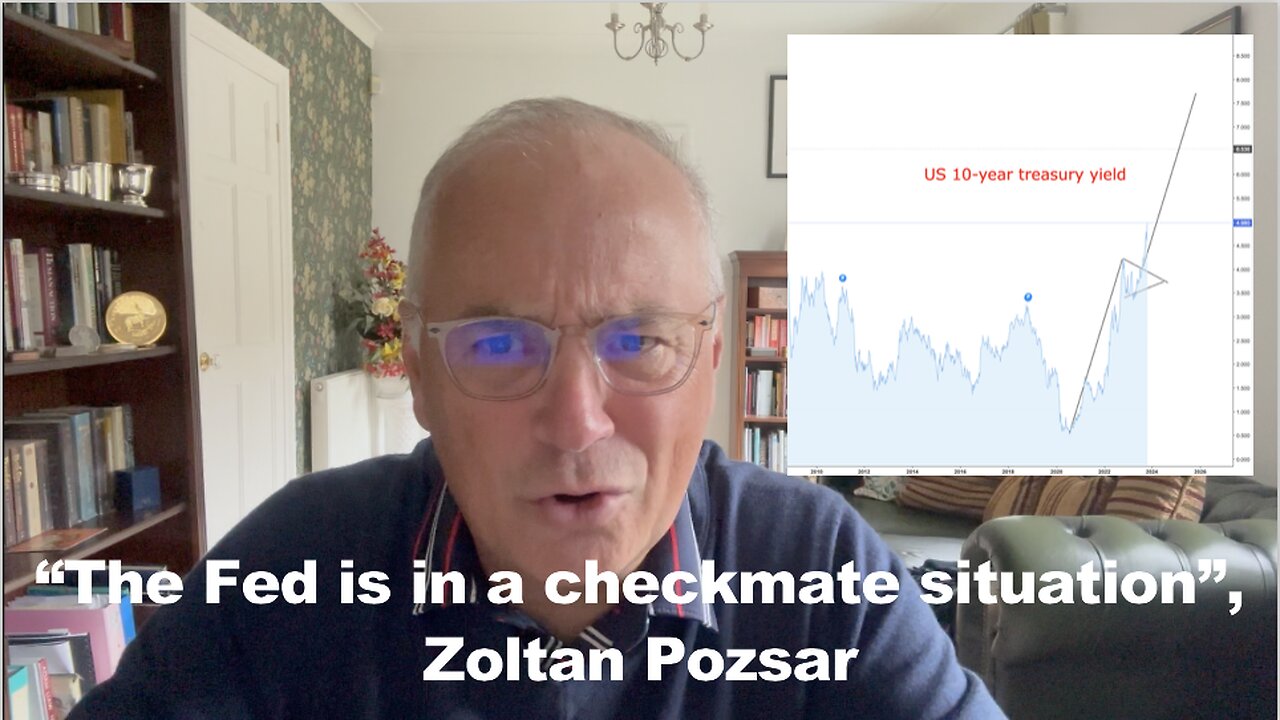

The Fed is About to Succumb to Higher Treasury Yields.

#federalreserve #interestrates #credit #economy

Keep your possessions safe with The Dirtyman Safe - Use the maneco10 promo code to get a 10% discount: https://www.dirtymansafe.com/

Where to Buy Precious Metals:

In the U.K. but will ship worldwide:

Use promo code maneco64sov to get a 5% discount on "various dates" sovereigns at https://www.goldinvestments.co.uk/

For all other products use promo code maneco64 separately for a 0.5% discount

In North America:

Are you looking for ways to protect your wealth during these uncertain times? Learn how to develop a customized strategy to safeguard your assets with ITM Trading's expert Gold and silver analysts team. Learn more ➡️ https://learn.itmtrading.com/maneco64 or call 866-989-4368. US mailing address required.

Miles Franklin Precious Metals Investments: send an email to info@milesfranklin.com and mention Mario or maneco64 or call on 1-800-822-8080

In the U.K. and U.S.

GlintPay App, Save and Spend in Gold - Use referral code marioGlint79

https://glintpay.com/

SUPPORT the Channel:

https://wideawake.clothing/?sca_ref=4111775.wgYmKdIDoj

Teespring Store: https://www.youtube.com/channel/UCAvSnci_3qHF_7c2LQnP_wg/store

PayPal: https://www.paypal.me/maneco64

Patreon: https://www.patreon.com/maneco64

maneco64 blog: www.maneco64.net

DISCLAIMER: I am not a financial adviser. These videos are for educational purposes only. Investing of any kind involves risk. Your investment and other financial decisions are solely your responsibility. It is imperative that you conduct your own research and seek professional advice as necessary. I am merely sharing my opinions.

AFFILIATE DISCLOSURE: Some of the links on this channel are affiliate links, meaning at no cost to you I earn a commission if you click through and make a purchase. However, I only recommend products or services that I believe in.

Today we will look at why Central banks around the world and in particular the Federal Reserve are under immense pressure to reverse their QT or quantitative tightening policies.

This policy is leading to a massive problem in the bond market and the bond market is the heart of our debt-based system which pumps blood or credit into the economy.

As the Fed and others like the Bank of England continue to sell the bonds they hold as a result of all the QE they did from 2009 to 2021 it drives long-term yields higher and increases the cost of not only issuing new debt for governments but also carrying existing debt.

We will look at why the Fed will most probably blink and basically reverse its QT policy and this is not just me saying it but people like Zoltan Pozsar and Luke Gromen.

-

DVR

DVR

Josh Pate's College Football Show

3 hours ago $0.32 earnedCFB’s Top 12 Programs | TV Executives & Our Sport | USC Changes Coming | Early Championship Picks

2.92K1 -

LIVE

LIVE

Vigilant News Network

7 hours agoUK Government BUSTED in Secret Plot to Extract Your Data | Media Blackout

1,319 watching -

1:03:32

1:03:32

Winston Marshall

3 days ago"War On Children!" The DEMISE Of The West Starts With Schools - Katharine Birbalsingh

73.6K62 -

48:02

48:02

Survive History

10 hours ago $1.67 earnedCould You Survive as a Sharpshooter in the Napoleonic Wars?

21.1K2 -

12:03

12:03

Space Ice

10 hours agoSteven Seagal's China Salesman - Mike Tyson Knocks Him Out - Worst Movie Ever

13.4K14 -

11:37

11:37

Degenerate Jay

10 hours ago $1.60 earnedJames Bond Needs Quality Over Quantity From Amazon

12.5K2 -

15:23

15:23

Misha Petrov

10 hours agoTrad Wives & Girl Bosses Go to WAR!

14K33 -

2:03:11

2:03:11

TheDozenPodcast

8 hours agoFootball villain fighting the state: Joey Barton

15.4K1 -

LIVE

LIVE

Scottish Viking Gaming

11 hours ago💚Rumble :|: Sunday Funday :|: Smash the Blerps and Vape the Terpes

543 watching -

1:45:00

1:45:00

RG_GerkClan

13 hours ago🔴LIVE Sunday Special - It's Time for World Domination - Civilization VII - Gerk Clan

66.1K27