Premium Only Content

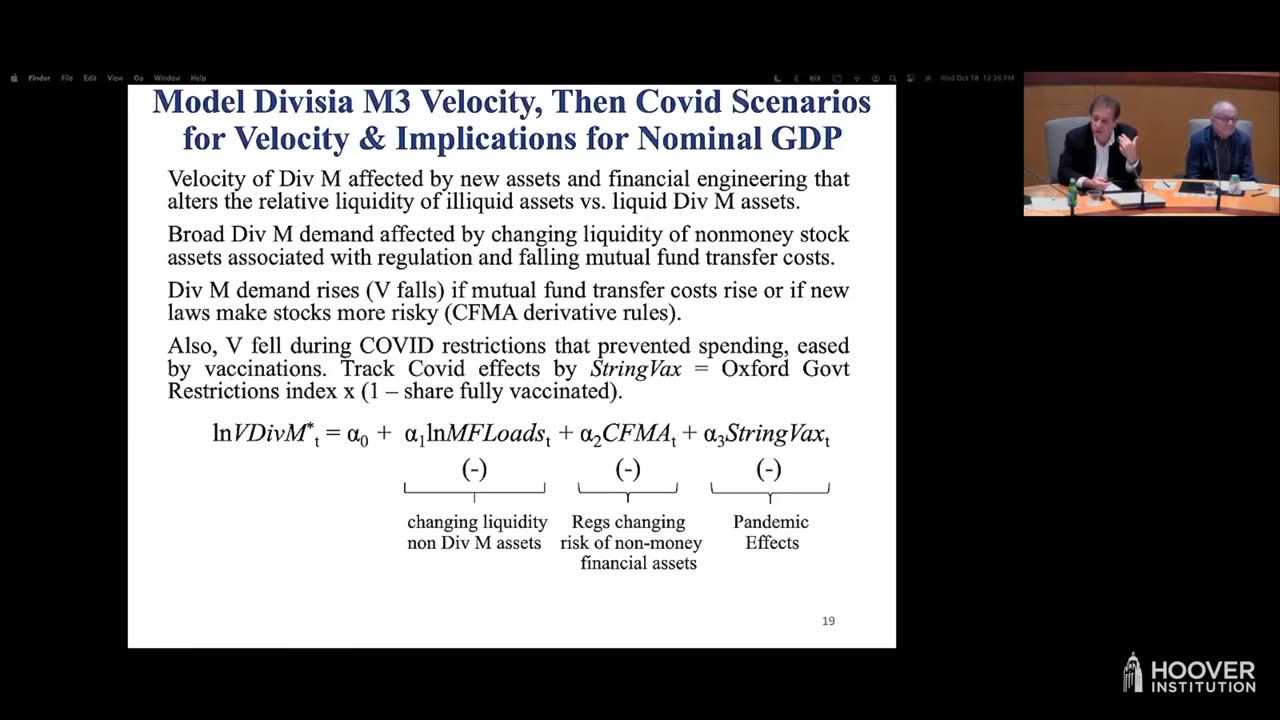

Money Matters: Broad Divisia Money and the Recovery of Nominal GDP from the Covid 19 Recession

Wednesday, October 18, 2023

Hoover Institution | Stanford University

Michael Bordo, Ilene and Morton Harris Distinguished Visiting Fellow at the Hoover Institution and Board of Governors Professor of Economics and director of the Center for Monetary and Financial History at Rutgers University, and John Duca, Danforth-Lewis Professor of Economics at Oberlin College and vice president and associate director of research at the Federal Reserve Bank of Dallas discussed “Money Matters: Broad Divisia Money and the Recovery of Nominal GDP from the Covid 19 Recession.”

PARTICIPANTS

Michael Bordo, John Duca, John Taylor, Annelise Anderson, Uschi Baches-Gellner, Christopher Ball, Michael Boskin, Pedro Carvalho, Maidul Chowdhury, John Cochrane, Steven Davis, Rongrui Duan, Darrell Duffie, Christopher Erceg, Shana Farley, Andy Filardo, Jared Franz, Bob Hall, Robert Hetzel, Robert Hodrick, Nicholas Hope, Ken Judd, Kevin Kliesen, Donald Koch, Evan Koenig, David Laidler, Mickey Levy, Livio Maya, Michael Melvin, Thomas Mertens, Radek Paluszynski, Charles Plosser, Samuel Reynard, Flavio Rovida, Paul Schmelzing, Apostos Serletis, Richard Sousa, Christine Strong, Jack Tatom, Yevgeniy Teryoshin, Victor Valcarcel, Mark Wynne

ISSUES DISCUSSED

Michael Bordo, Ilene and Morton Harris Distinguished Visiting Fellow at the Hoover Institution and Board of Governors Professor of Economics and director of the Center for Monetary and Financial History at Rutgers University, and John Duca, Danforth-Lewis Professor of Economics at Oberlin College and vice president and associate director of research at the Federal Reserve Bank of Dallas discussed “Money Matters: Broad Divisia Money and the Recovery of Nominal GDP from the Covid 19 Recession.”

John Taylor, the Mary and Robert Raymond Professor of Economics at Stanford University and the George P. Shultz Senior Fellow in Economics at the Hoover Institution, was the moderator.

PAPER SUMMARY

The rise of inflation in 2021 and 2022 surprised many macroeconomists who ignored the earlier surge in money growth because past instability in the demand for simple-sum monetary aggregates had made these aggregates unreliable indicators. We find that the demand for more theoretically-based divisia aggregates can be modeled and that their growth rates provide useful information for future nominal GDP growth. Unlike M2 and divisia-M2, whose velocities do not internalize shifts in liabilities across commercial and shadow banks, the velocities of broader Divisia monetary aggregates are more stable and can be reasonably empirically modeled in both the short run and the long run through the Covid-19 pandemic and to date. In the long run, these velocities depend on regulatory changes and mutual fund costs that affect the substitutability of money for other financial assets. In the short run, we control for swings in mortgage activity and use vaccination rates and an index of the stringency of government pandemic restrictions to control for the unusual effects of the pandemic. The velocity of broad Divisia money temporarily declines during crises like the Great and COVID Recessions, but later rebounds. In each recession monetary policy lowered short-term interest rates to zero and engaged in quantitative easing of about $4 Trillion. Nevertheless, broad money growth was more robust in the COVID Recession, likely reflecting that the banking system was less impaired and could promote rather than hinder multiple deposit creation. Partly as a result, our framework implies that nominal GDP growth and inflationary pressures rebounded much more quickly from the COVID Recession versus the Great Recession. We consider different scenarios for future Divisa money growth and the unwinding of the pandemic that have different implications for medium-term nominal GDP growth and inflationary pressures as monetary policy tightening seeks to restore low inflation.

To read the paper, click the following link

https://www.hoover.org/sites/default/...

To read the slides, click the following link

https://www.hoover.org/sites/default/...

-

1:15:22

1:15:22

Donald Trump Jr.

7 hours agoDelivering the Day One Agenda: No More Neocons, Plus Interview with Charlie Kirk | TRIGGERED Ep.190

134K209 -

LIVE

LIVE

LFA TV

22 hours agoTrump Cleans House | Trumpet Daily 11.11.24 9PM EST

961 watching -

1:44:03

1:44:03

State of the Second Podcast

5 days agoColt INVENTED What? Historic Firearms Brought To Life (ft. Candrsenal)

14 -

57:55

57:55

The StoneZONE with Roger Stone

2 hours agoTrump Sends Stefanik to UN, Sticker Mule CEO Anthony Constantino to Seek Her Seat? The StoneZONE

10.4K1 -

2:20:17

2:20:17

WeAreChange

4 hours agoPANIC In "Dystopian Hellscape" DC! Kamala Can Still Be PRESIDENT

38.9K10 -

39:57

39:57

Kimberly Guilfoyle

7 hours agoBreaking News: President Trump’s Latest Hires, Plus the Meaning of Veterans Day | Ep. 173

111K51 -

1:08:23

1:08:23

Sarah Westall

3 hours agoOperation Gladio: The Operation that Funds the Cabal's Dark Projects with Colonel Towner-Watkins

22.6K2 -

1:58:54

1:58:54

2 MIKES LIVE

4 hours ago2 MIKES LIVE #141 Deep Dive Monday!

16.1K -

1:50:10

1:50:10

Redacted News

6 hours agoBREAKING! DEMS PLAN TO BLOCK TRUMP FROM INAUGURATION, BIDEN TO RESIGN TO INSTALL HARRIS | REDACTED

158K258 -

4:10

4:10

SLS - Street League Skateboarding

1 day agoJhank Gonzalez 4th Place SLS Sydney 2024 | Best Tricks

58.8K1