Premium Only Content

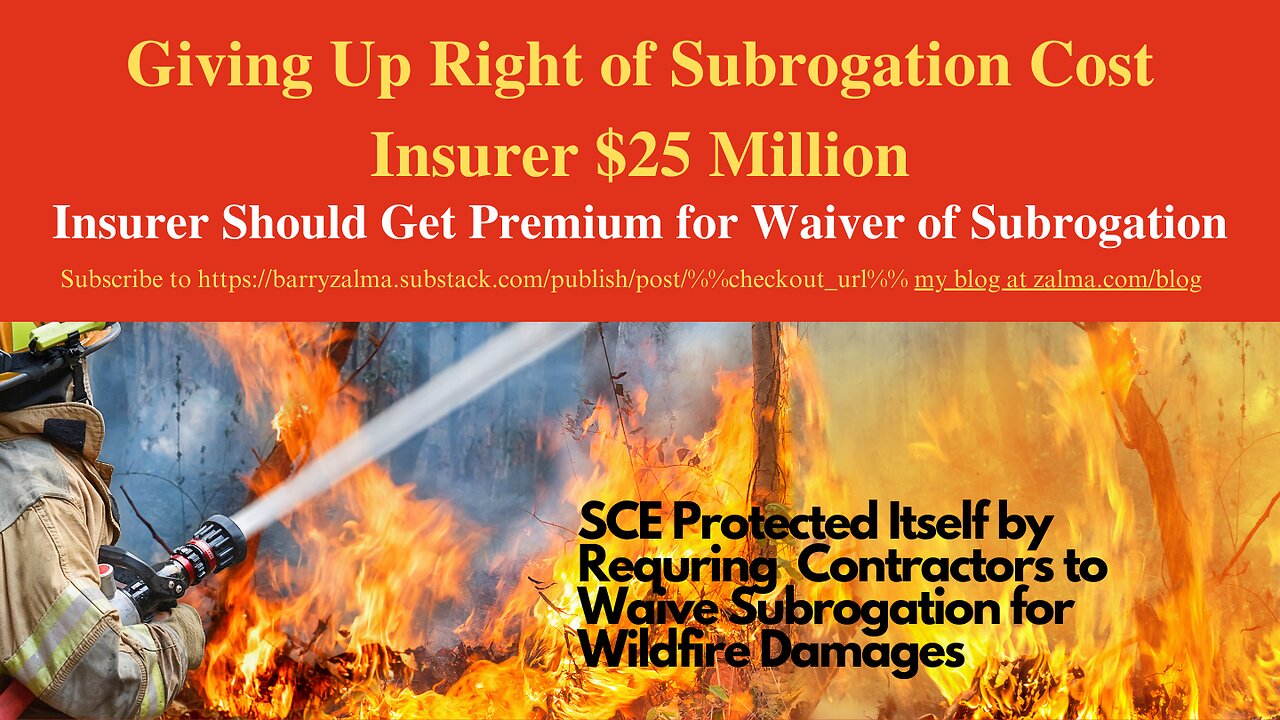

Giving Up Right of Subrogation Cost Insurer $25 Million

Insurer Should Get Premium for Waiver of Subrogation

Evanston Insurance appealed from a judgment entered after the trial court granted summary judgment in favor of Southern California Edison Company (SCE) and against Evanston Insurance Company (Evanston) as to Evanston's claims for equitable subrogation, equitable indemnity, restitution, and declaratory relief.

In Evanston Insurance Company v. Southern California Edison Company, B320392, California Court of Appeals, (September 29, 2023) Evanston contributed $25 million to settle claims by property owners against its insured, The Original Mowbray's Tree Service, Inc. (Mowbray's), which was a subcontractor of Utility Tree Service, Inc. (UTS) under UTS's contract with SCE to manage certain vegetation proximate to SCE's equipment.

According to Evanston, the property owners' claims arose out of a wildfire they alleged was caused by a tree hitting power lines that were owned and operated by SCE. Evanston asserted that the wildfire resulted solely from SCE's negligence.

In its motion for summary judgment, SCE argued that the following waiver provision in Mowbray's subcontract with UTS barred Evanston's claims: "Subcontractor [(Mowbray's)] waives and will require all of its insurers to waive all rights of recovery against Contractor [(UTS)] or the Owner [(SCE)], their affiliates, their directors, officers and employees, whether in contract, tort (including negligence and strict liability) or otherwise." The trial court agreed and entered judgment in SCE's favor.

On appeal, Evanston contended the waiver provision is ambiguous and that the trial court erred in failing to analyze separately whether SCE's waiver defense applied to Evanston's equitable indemnity and restitution causes of action. Regardless, the Court of Appeals concluded that the plain language and context of the waiver provision demonstrated that the provision unambiguously precludes Evanston's equitable subrogation claim against SCE.

FACTUAL BACKGROUND

In February 2015, a wildland fire ignited in Bishop, California on property owned by the Los Angeles Department of Water and Power (Round Fire). Evanston alleged that property owners and their subrogated insurers filed at least 10 lawsuits in the aftermath of the Round Fire to recover damages. Evanston asserts that the plaintiffs in the lead action (underlying action) alleged that the fire was caused by a tree (subject tree) that contacted power lines owned and operated by SCE.

The subcontractor agreement included the obligation to carry $41 million per occurrence in insurance coverage.

Evanston alleged that during the underlying action, SCE, which claimed to be an additional insured under the policy, repeatedly threatened to bring a bad faith action if Evanston did not pay the full amount of the policy and it under pressure agreed to contribute the $25 million policy limit to a settlement and reserved its rights to pursue full recovery from SCE ignoring the waiver provision of the contract and Evanston's policy wording.

The trial court heard and granted SCE's motion for summary judgment.

APPLICABLE INSURANCE LAW

A judgment or order of a lower court is presumed to be correct on appeal, and all intendments and presumptions are indulged in favor of its correctness. Evanston bore the burden of rebutting the presumption of correctness accorded to the trial court's decision, regardless of the applicable standard of review

APPLICABLE SUBROGATION PRINCIPLES

In the case of insurance, subrogation takes the form of an insurer's right to be put in the position of the insured in order to pursue recovery from third parties legally responsible to the insured for a loss which the insurer has both insured and paid.

An insured's contractual waiver defeats an insurer's subrogation claim.

DISCUSSION

The waiver provision at issue appears in exhibit B of the agreement, which is a two-page document entitled "Insurance." On the first page and under the subheading "Subcontractor's Insurance" (boldface & underscoring omitted), the subcontract required the "Subcontractor" to "obtain and maintain" certain specified "policies of insurance ...." It provided that the subcontractor waived all of its rights against SCE and that its insurer agreed to the waiver.

The context of the waiver provision supports the conclusion that it encompasses claims against SCE that Mowbray's would otherwise have been able to transfer to its insurers. In sum the plain language of the waiver provision unambiguously foreclosed Evanston's equitable subrogation claim against SCE.

The waiver provision was presumably available for Evanston's review when it underwrote the insurance policy for Mowbray's and it agreed to support the waiver.

Because The Waiver Provision Is Unambiguous, The Court Rejected Evanston’s Arguments Supporting Its Construction Of The Provision

When a dispute arises over the meaning of contract language, the first question to be decided is whether the language is "reasonably susceptible" to the interpretation urged by the party. If it is not, the case is over. Because the Court of Appeals concluded for the reasons set forth above that the waiver provision's reference to “all rights of recovery against Contractor or the Owner" unambiguously included Evanston's equitable subrogation rights against SCE.

The judgment was affirmed. Respondent Southern California Edison Company is awarded its costs on appeal.

ZALMA OPINION

Insurers like Evanston issuing general liability policies often, if not invariably, agree to waive the insurer's right to subrogation. Evanston's policy allowed for the waiver and had no more rights than its insured who had waived the right by a clear and unambiguous contract and caused its insurer, Evanston, to include the waiver. Evanston tried to change the meaning of the contract on appeal but was unable to explain why it had agreed to the waiver before the issuance of the policy.

(c) 2023 Barry Zalma & ClaimSchool, Inc.

Please tell your friends and colleagues about this blog and the videos and let them subscribe to the blog and the videos.

Subscribe to Excellence in Claims Handling at locals.com at https://zalmaoninsurance.locals.com/subscribe or at substack at https://barryzalma.substack.com/publish/post/107007808

Go to Newsbreak.com https://www.newsbreak.com/@c/1653419?s=01

Follow me on LinkedIn: www.linkedin.com/comm/mynetwork/discovery-see-all?usecase=PEOPLE_FOLLOWS&followMember=barry-zalma-esq-cfe-a6b5257

Daily articles are published at https://zalma.substack.com. Go to the podcast Zalma On Insurance at https://podcasters.spotify.com/pod/show/barry-zalma/support; Go to Barry Zalma videos at Rumble.com at https://rumble.com/c/c-262921; Go to Barry Zalma on YouTube- https://www.youtube.com/channel/UCysiZklEtxZsSF9DfC0Expg; Go to the Insurance Claims Library – http://zalma.com/blog/insurance-claims-library

-

8:09:50

8:09:50

Dr Disrespect

13 hours ago🔴LIVE - DR DISRESPECT - MARVEL RIVALS - GOLD VANGUARD

186K30 -

1:15:00

1:15:00

Awaken With JP

12 hours agoMerry Christmas NOT Happy Holidays! Special - LIES Ep 71

169K136 -

1:42:21

1:42:21

The Quartering

13 hours agoTrump To INVADE Mexico, Take Back Panama Canal Too! NYC Human Torch & Matt Gaetz Report Drops!

133K100 -

2:23:15

2:23:15

Nerdrotic

13 hours ago $12.27 earnedA Very Merry Christmas | FNT Square Up - Nerdrotic Nooner 453

103K11 -

1:14:05

1:14:05

Tucker Carlson

13 hours ago“I’ll Win With or Without You,” Teamsters Union President Reveals Kamala Harris’s Famous Last Words

195K361 -

1:58:31

1:58:31

The Dilley Show

13 hours ago $33.68 earnedTrump Conquering Western Hemisphere? w/Author Brenden Dilley 12/23/2024

149K40 -

1:09:59

1:09:59

Geeks + Gamers

14 hours agoSonic 3 DESTROYS Mufasa And Disney, Naughty Dog Actress SLAMS Gamers Over Intergalactic

101K21 -

51:59

51:59

The Dan Bongino Show

15 hours agoDemocrat Donor Admits The Scary Truth (Ep. 2393) - 12/23/2024

890K3K -

2:32:15

2:32:15

Matt Kohrs

1 day agoRumble CEO Chris Pavlovski Talks $775M Tether Partnership || The MK Show

134K34 -

28:23

28:23

Dave Portnoy

1 day agoDavey Day Trader Presented by Kraken - December 23, 2024

165K44