Premium Only Content

2-1 rate buydown explained #21buydown #mortgagerates

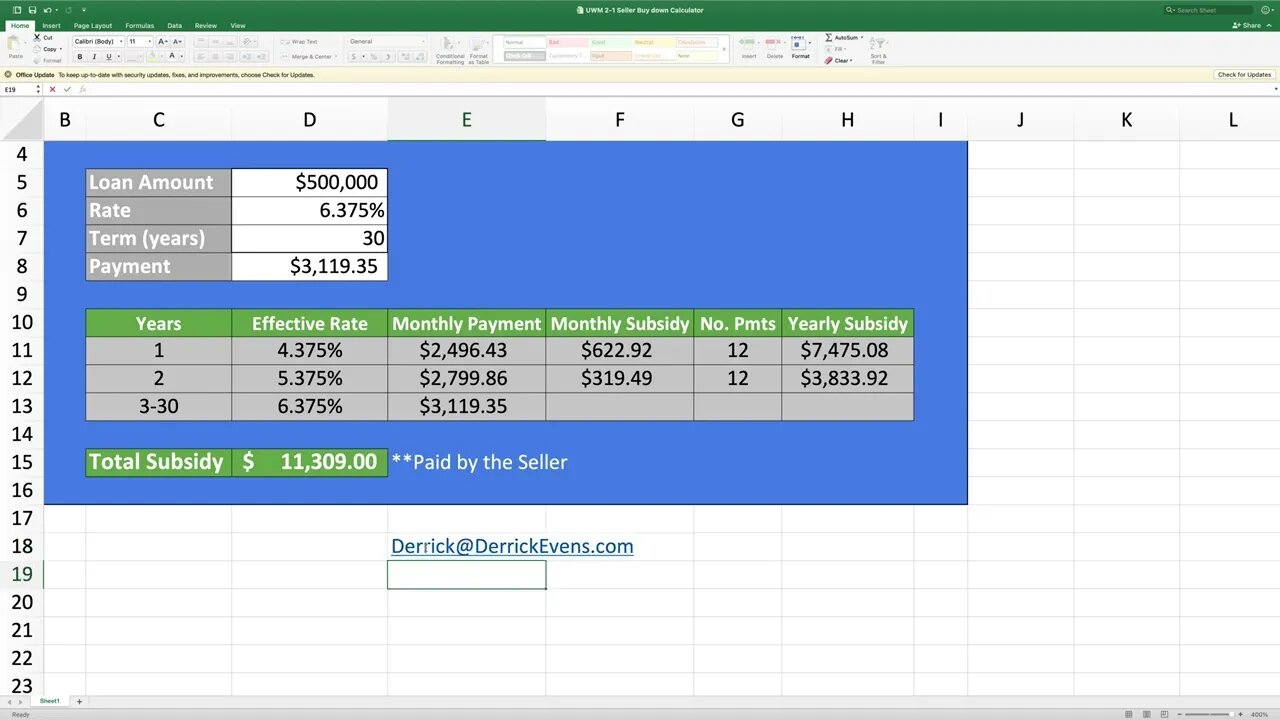

When mortgage rates are higher, people are always looking to buy the rate down. However, a traditional rate buydown will usually require at least 3-4 years to break-even. So if you refinance during that time, you'll lose the money you put in to begin with minus whatever monthly savings you experienced while you had the loan. With the 2-1 rate buydown, the seller pays the subsidy and the remaining amount is returned to you if a refinance happens within the first 2 years. Check out the video for full explanation and hope it helps!

GET A FREE LOAN QUOTE - FAST! All I need is the following:

- Loan amount

- Home Value (purchase price)

- Approx credit score

- Condo/Detached

- State property is in

APPLY for loan pre-approval 24/7 here: www.DerrickEvens.com

NEED A REALTOR IN San Diego? I know some of the absolutely best and happy to refer you to someone that works specifically in the area important to you.

Derrick Evens, Home Loan Specialist, NMLS 155010

Derrick@DerrickEvens.com

619.952.2046

-

3:23:26

3:23:26

Pardon My Take

6 hours agoSUPER MEGA THANKSGIVING PREVIEW, KIRK COUSINS WANTS TO BE IN WICKED 2 + PFT/HANK RIVARLY CONTINUES

1.86K1 -

UPCOMING

UPCOMING

The Kevin Trudeau Show

2 hours agoWhat Women Do Wrong in Relationships (From a Man’s Perspective) | The Kevin Trudeau Show | Ep. 69

101 -

19:49

19:49

This Bahamian Gyal

13 hours agoFIRED after VENTING online about ELECTION results

2047 -

LIVE

LIVE

REVRNDX

2 hours agoYOUR NEW FAVORITE RUMBLE STREAMER

105 watching -

1:04:41

1:04:41

Russell Brand

2 hours agoIs This the End? Climate Emergencies, Kamala’s Chaos & Political Meltdowns EXPOSED! – SF502

73.4K92 -

LIVE

LIVE

The Charlie Kirk Show

2 hours agoThe Harris Team's Comical Post-Mortem + Trump the Peacemaker + AMA | Paxton, Greenwald | 11.27.24

7,653 watching -

1:21:15

1:21:15

RaikenNight

2 hours ago $1.59 earnedWanted to take the time to welcome all the new people coming over to Rumble

5.66K1 -

15:12

15:12

Goose Pimples

5 hours ago7 Ghost Videos SO SCARY Your Phone Will Call 911 Itself

7781 -

![Almost Turkey Day! Ranked Heihachi into Blue Ranks? Nani?!?[Tekken 8] #RumbleTakeOver](https://1a-1791.com/video/s8/1/5/t/u/_/5tu_u.0kob-small-Almost-Turkey-Day-Ranked-He.jpg) LIVE

LIVE

CHiLi XDD

4 hours agoAlmost Turkey Day! Ranked Heihachi into Blue Ranks? Nani?!?[Tekken 8] #RumbleTakeOver

305 watching -

59:24

59:24

The Dan Bongino Show

4 hours agoCoping Hollywood Actress Says Trump Supporters Are "Uneducated" (Ep. 2379) - 11/27/2024

562K1.49K