4 Easy Facts About "Retirement Saving Strategies for Different Income Levels: Tips and Tricks"...

https://rebrand.ly/Goldco1

Sign up Now

4 Easy Facts About "Retirement Saving Strategies for Different Income Levels: Tips and Tricks" Shown, retirement savings investment plan

Goldco aids customers shield their retired life savings by rolling over their existing IRA, 401(k), 403(b) or various other certified pension to a Gold IRA. ... To discover exactly how safe haven precious metals can help you build as well as protect your riches, and even secure your retired life telephone call today retirement savings investment plan.

Goldco is among the premier Precious Metals IRA companies in the United States. Secure your wealth and income with physical precious metals like gold ...retirement savings investment plan.

Opting for the Right Investment Options for Your Retirement Savings Plan

When it comes to organizing for retirement, one of the very most crucial decisions you will definitely possess to make is where to put in your hard-earned cash. With a large assortment of investment possibilities on call, it can be frustrating to calculate which ones are the finest match for your retired life financial savings strategy. In this write-up, we will definitely look into some essential aspects to take into consideration when opting for the right investment options for your retirement financial savings strategy.

Danger Endurance

One of the first things you ought to take into consideration when picking assets possibilities for your retirement life cost savings plan is your danger tolerance. Danger tolerance recommends to how relaxed you are with prospective fluctuations in the market value of your investments. Generally, investments that supply much higher profits also happen with greater threats. If you have a high danger tolerance, you might be more inclined to put in in stocks or shared funds that possess the possibility for more significant increases but likewise higher reductions. On the various other hand, if you possess a reduced threat endurance and choose additional reliability, bonds or fixed-income expenditures may be extra suited for you.

Assets Time Horizon

An additional critical aspect to take in to account is your assets opportunity perspective - that is, how long until you organize to resign. The longer your opportunity horizon, the much more aggressive and growth-oriented your assets strategy may be. This is because longer-term investments often tend to possess additional time to bounce back from short-term market fluctuations and likely produce much higher profits over time. Conversely, if you are nearing retirement grow older and have a shorter time perspective, it might be sensible to center on preserving resources and putting in in less unstable possessions.

Variation

Variation is an crucial guideline in investing that includes spreading out financial investments all over different possession courses and fields. Through transforming your profile, you may minimize threat through not counting also intensely on any kind of singular expenditure or industry. Different resource courses - such as supplies, connections, actual real estate - perform differently under various market disorders; consequently transforming can easily aid smooth out the ups and downs of your overall profile. It is essential to note that diversification does not promise revenues or shield against reductions, but it can easily aid alleviate threat.

Asset Allocation

Property allowance recommends to the amount of your profile that is invested in different property classes. It is a vital element of any sort of financial investment technique and ought to straighten with your risk resistance, expenditure goals, and opportunity horizon. A well-balanced asset allotment can easily aid you achieve variation while remaining within your comfort zone. For example, a younger entrepreneur along with a longer opportunity horizon might have a higher allowance towards stocks for possible development, while an more mature capitalist nearing retirement may possess a even more conventional appropriation along with a more significant emphasis on income-producing assets.

Expenses and Expenditures

When deciding on investment possibilities for your retirement life cost savings planning, it is important to take into consideration the expenses and expenses connected along with each choice. Some investments may charge higher control expenses or commissions that can easily consume right into your yields over opportunity. It's...

-

5:51

5:51

The Gun Collective

3 hours agoExposing the way to make her LOSE.

1451 -

LIVE

LIVE

Exploring With Nug

22 hours agoTYRANT Fire Chief Threatens Helicopter Pilot With ARREST!

327 watching -

1:52:55

1:52:55

The Quartering

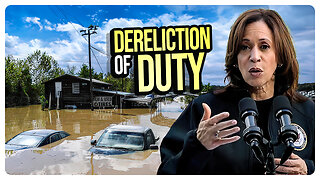

5 hours agoKamala Harris INSULTS Hurricane Victims, Styx Update! Woke Disney Actress Meltdown, Meme Law Fails!!

102K76 -

4:10:33

4:10:33

Drew Hernandez

8 hours agoTRUMP RALLY MICHIGAN, KAMALA'S WOMAN ABUSER & HURRICANE VICTIMS SCREWED BY FEDS

55.5K15 -

53:23

53:23

Josh Pate's College Football Show

5 hours agoUPDATED Conference & CFP Predictions | Week 6 Upset Alerts | Kirby Smart’s Test | Cole Cubelic Joins

26.5K -

2:03:29

2:03:29

Revenge of the Cis

4 hours agoEpisode 1385: The Boys Are Back

28.1K4 -

1:11:47

1:11:47

Russell Brand

7 hours agoMASSIVE VOTING SCANDAL IN ARIZONA! 218,000 Voters Non-Proof Of Citizenship - ELECTION FRAUD?! SF466

186K400 -

1:29:18

1:29:18

vivafrei

7 hours agoHurricane Helene Fallout: Kamala Harris Loves Foreign War & Illegal Aliens More Than Americans!

100K103 -

14:05

14:05

Silver Dragons

5 hours agoI Tried to Sell the World's SMALLEST Gold Coin to a Coin Shop

33.9K4 -

1:19:18

1:19:18

The New American

5 hours agoThe New American Daily | Lawfare Against Trump Resumes

29.3K4