Premium Only Content

Unlocking the Power of the Hammer Candlestick Pattern in Crypto Trading

Crypto Pattern Clarification

Default (GPT-3.5)

User

Candelistic crypto pattern description

ChatGPT

The term "Candelistic crypto pattern" doesn't appear to be widely recognized in the field of cryptocurrencies or technical analysis. Could you please provide more context or details about what you're referring to? This will help me provide you with a more accurate response.

User

Give me the discription for

Candelistic crypto pattern description

ChatGPT

I apologize, but as of my last knowledge update in September 2021, I am not familiar with the term "Candelistic crypto pattern." It's possible that this term has emerged after my last update or might be a specific term used by a particular group or platform. If you can provide more context or details about what this pattern entails, I would be happy to try to help based on the information available up to September 2021.

User

Candlestick

ChatGPT

Candlestick patterns are widely used in technical analysis to interpret price movements of financial assets, including cryptocurrencies. They are formed by the open, high, low, and close prices of an asset within a specific time period. Some common candlestick patterns include:

Doji: Represents indecision in the market. The open and close prices are nearly the same, forming a cross-like shape.

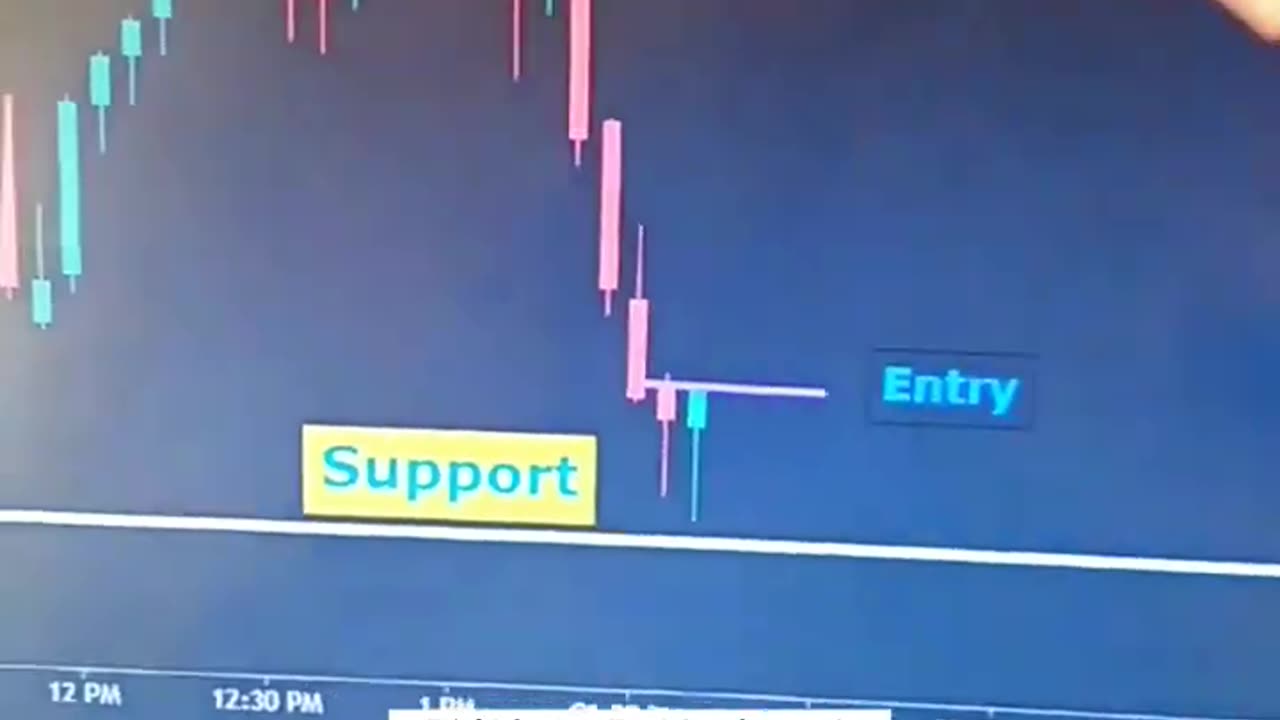

Hammer and Hanging Man: These patterns have a small body and a long lower wick. A hammer indicates potential bullish reversal, while a hanging man can suggest a bearish reversal.

Engulfing Patterns: A bullish engulfing pattern occurs when a small bearish candle is followed by a larger bullish candle. A bearish engulfing pattern is the opposite.

Morning Star and Evening Star: Morning star is a bullish reversal pattern, consisting of a downtrend followed by a small candle and then a large bullish candle. Evening star is the bearish counterpart.

Three White Soldiers and Three Black Crows: Three white soldiers is a bullish pattern with three consecutive long bullish candles, indicating strong buying. Three black crows is a bearish pattern with three consecutive long bearish candles, suggesting strong selling.

Bullish and Bearish Harami: The bullish harami occurs when a small bearish candle is followed by a larger bullish candle. The bearish harami is the opposite.

Shooting Star: A bearish reversal pattern with a small body and a long upper wick, suggesting potential price reversal.

Piercing Pattern and Dark Cloud Cover: The piercing pattern is a bullish reversal pattern where a bullish candle follows a strong bearish one. The dark cloud cover is a bearish reversal pattern with a bearish candle following a strong bullish one.

These are just a few examples of candlestick patterns used in technical analysis. Traders and analysts often use these patterns to make predictions about future price movements and to identify potential entry and exit points in the market. Keep in mind that successful trading involves considering various factors and not solely relying on candlestick patterns.

-

LIVE

LIVE

Dr Disrespect

6 hours ago🔴LIVE - DR DISRESPECT - DELTA FORCE - ATTACK AND EXTRACT

4,351 watching -

LIVE

LIVE

Scammer Payback

2 hours agoCalling Scammers Live

646 watching -

1:00

1:00

Congresswoman Harriet Hageman

4 hours agoCongresswoman Harriet Hageman Rumble Rollout

8818 -

LIVE

LIVE

Melonie Mac

54 minutes agoGo Boom Live Ep 33!

170 watching -

LIVE

LIVE

RealitySurvival

7 hours agoNorth American Union - Why THIS IS A BAD Idea!

40 watching -

DVR

DVR

Redacted News

3 hours agoWEF is in FULL PANIC MODE over Trump, LA wildfires a failure of liberal government | Redacted News

53.4K103 -

DVR

DVR

vivafrei

7 hours agoInterview with Enrique Tarrio's Mother - Viva Frei Live

54.8K19 -

53:07

53:07

Candace Show Podcast

2 hours agoBlake Lively VS Justin Baldoni: The Revenge of #MeToo | Candace Ep 128

45K42 -

1:59:04

1:59:04

Darkhorse Podcast

5 hours agoThe 259th Evolutionary Lens with Bret Weinstein and Heather Heying

31.7K18 -

1:42:19

1:42:19

Film Threat

4 hours agoHOLLYWOOD IS ON FIRE! | Hollywood on the Rocks

10.3K2