Premium Only Content

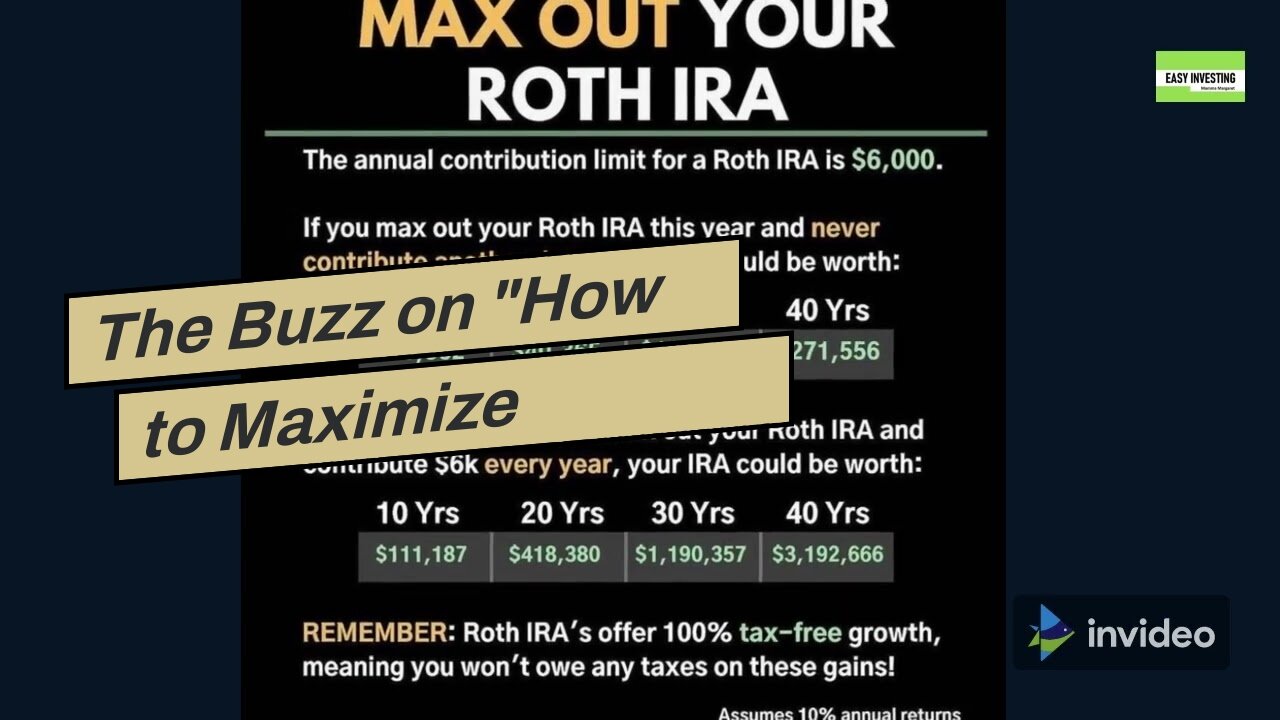

The Buzz on "How to Maximize Returns with a Roth IRA in Your Retirement Investment Strategy"

https://rebrand.ly/Goldco

Get More Info Now

The Buzz on "How to Maximize Returns with a Roth IRA in Your Retirement Investment Strategy", retirement savings investment plan

Goldco assists clients secure their retired life cost savings by surrendering their existing IRA, 401(k), 403(b) or various other qualified pension to a Gold IRA. ... To find out how safe house rare-earth elements can aid you build and safeguard your riches, and also also secure your retired life call today retirement savings investment plan.

Goldco is just one of the premier Precious Metals IRA business in the United States. Safeguard your riches and source of income with physical precious metals like gold ...retirement savings investment plan.

Retirement Planning Mistakes to Stay away from: Common Pitfalls and How to Gotten over Them

Retirement life is a opportunity of lifestyle that lots of people impatiently look forward to. It's a time when you may relax, pursue your passions, and enjoy the fruits of your labor. Having said that, in order to completely enjoy your retirement years, it's crucial to have a solid retired life planning in location. Regrettably, many individuals help make typical errors when it comes to retired life planning that can easily endanger their financial future. In this article, we will certainly talk about some of these challenges and give strategies for beating them.

One of the most popular mistakes people produce when organizing for retirement life is beginning as well late. Numerous people undervalue the amount of money they will certainly need to have in retired life and neglect to conserve good enough during their working years. It's significant to start saving for retirement life as early as achievable in order to take perk of substance rate of interest and provide your investments time to expand.

One more blunder that people frequently produce is not expanding their investment collection. Placing all of your eggs in one container can be unsafe, especially as you approach retirement life age. Through diversifying your investments across various property lessons such as sells, connections, and genuine property, you may assist safeguard yourself versus market dryness and raise the possibility of obtaining long-term growth.

A shortage of financial literacy is yet another downfall that several people encounter when it happens to retirement program. Understanding general monetary principles such as budgeting, investing, and debt administration is crucial for creating informed decisions concerning your money. Inform yourself by reading manuals or participating in seminars on individual money or look at consulting with with a monetary expert who can help you by means of the difficulties of retirement planning.

Failing to take advantage of employer-sponsored retired life plans such as 401(k)s or IRAs is yet another usual mistake that can impair your ability to spare sufficiently for retirement. These program frequently use tax obligation perks and employer matching additions which can dramatically improve your savings over time. Produce sure you are adding sufficient to take total perk of these benefits.

Underestimating healthcare costs in retired life is another significant pitfall that can easily record a lot of people off shield. Clinical expenses tend to raise as we mature, and failing to account for these costs may rapidly reduce your retirement life savings. It's important to aspect in possible healthcare expenses when calculating how much you will certainly require for retired life and take into consideration buying long-term treatment insurance policy to safeguard yourself versus the higher expense of health care care.

An additional mistake that individuals often create is supposing that Social Security will certainly be adequate to deal with their living expenses in retirement. While Social Security benefits can easily deliver a useful resource of revenue, they are improbable to totally switch out the revenue you made during the course of your working years. It's significant to possess other resources of revenue such as pensions, expenditures, or part-time work in purchase to keep your desired standard of living.

Postponement is however one more risk that may impair reliable retired life program. Several people placed off conserving for retired life or creating required financial choices because they feel they possess a lot of opportunity. However, time has actually...

-

1:06:50

1:06:50

PMG

19 hours ago $0.07 earned"Never trust a government that leads you into the apocalypse"

5622 -

1:05:15

1:05:15

In The Litter Box w/ Jewels & Catturd

22 hours agoExternal Revenue Service | In the Litter Box w/ Jewels & Catturd – Ep. 720 – 1/15/2025

31.1K12 -

5:55:09

5:55:09

Benny Johnson

8 hours ago🚨Confirmation Hearings LIVE Right NOW | Pam Bondi, Rubio, John Ratcliffe & More| Deep State PANIC

180K293 -

6:04:07

6:04:07

Barry Cunningham

22 hours agoWATCH LIVE: Pam Bondi Attorney General Confirmation Hearing For w/ Nancy Mace Interview

33.1K18 -

6:15:44

6:15:44

Robert Gouveia

11 hours agoPam Bondi Confirmation Hearing LIVE! Trump's Nominee to FIX Corrupt DOJ as Attorney General

43.8K21 -

1:57:41

1:57:41

The Quartering

5 hours agoTrump Just FREED Hostages, Pam Bondi Hearing, TikTok To SHUTDOWN, Bill Burr Gets Woke, LA Fires

49.7K43 -

1:12:39

1:12:39

Savanah Hernandez

3 hours agoLA Fire Dept withheld 1,000 firefighters ahead of the Palisades Fire

19.9K11 -

1:38:37

1:38:37

Mally_Mouse

3 hours agoLet's Yap About It - LIVE!

26.5K1 -

9:25

9:25

Silver Dragons

4 hours agoTop 3 Types of Silver ALL Stackers NEED to Be Buying

20.9K1 -

1:24:04

1:24:04

Russell Brand

6 hours agoPfizer’s $1,000 Bribe to Push Childhood Vaccines – SF520

119K116