Premium Only Content

How Supply and Demand Does Work

Supply and Demand is a fundamental concept in economics, and it also plays a crucial role in forex trading. In forex trading, the interaction between supply and demand levels can help traders identify potential areas of market reversal, continuation, and price movement. Here's how Supply and Demand works in forex trading:

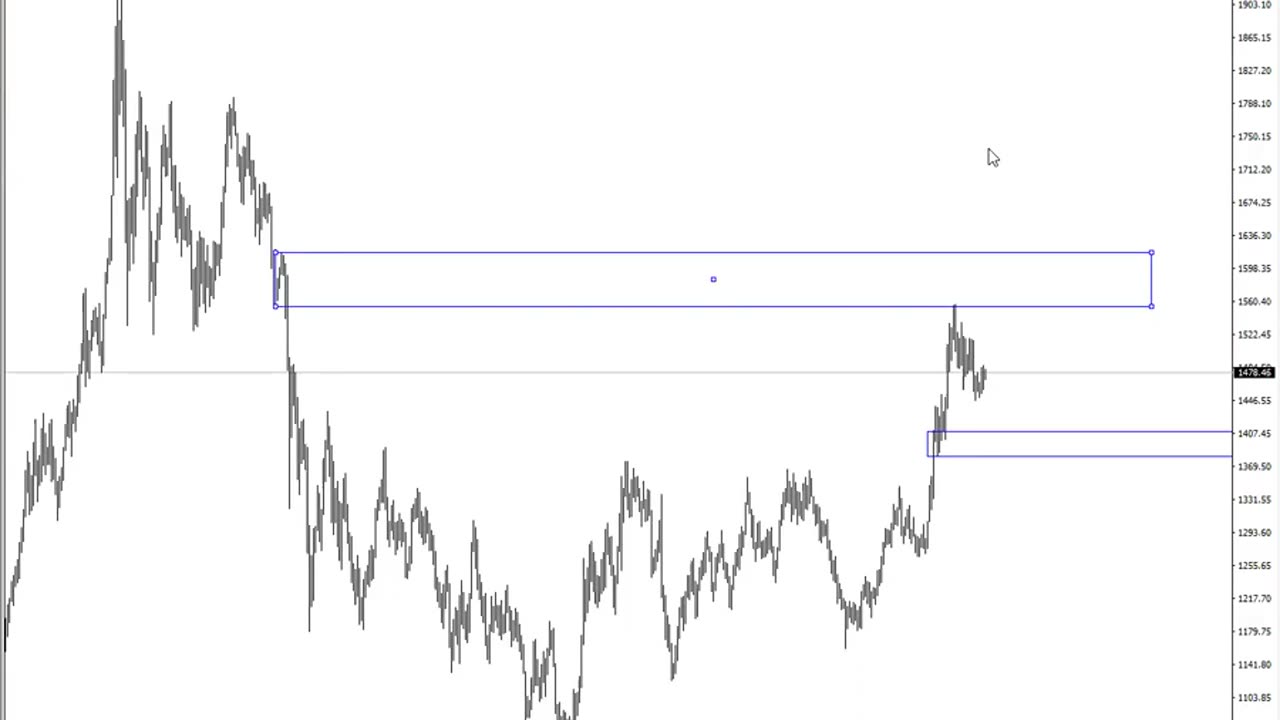

Supply and Demand Zones:

Supply zones are price levels where there is a higher concentration of sellers compared to buyers. These levels are considered areas of potential resistance, where price may stall or reverse.

Demand zones are price levels where there is a higher concentration of buyers compared to sellers. These levels are considered areas of potential support, where price may stall or reverse.

Market Dynamics:

When price reaches a supply zone, sellers may be more inclined to sell, believing that the price is likely to decline. This increased selling pressure can lead to a potential reversal or a temporary halt in an upward trend.

Conversely, when price reaches a demand zone, buyers may be more inclined to buy, anticipating a potential price increase. This increased buying pressure can lead to a potential reversal or a temporary halt in a downward trend.

Price Reactions:

Price tends to react to supply and demand zones due to the imbalance between buyers and sellers at those levels. These reactions can result in price reversals, bounces, or consolidations.

A strong reaction from a supply or demand zone could lead to significant price movement, while a weaker reaction might result in a smaller price fluctuation.

Identifying Supply and Demand Zones:

Traders often identify supply and demand zones by looking for areas where price previously reversed or exhibited a significant change in direction.

These zones can be identified using tools like support and resistance levels, trendlines, chart patterns, and volume analysis.

Trading Strategies:

Traders often use supply and demand zones as part of their trading strategies. They might look for opportunities to buy near demand zones in uptrends or sell near supply zones in downtrends.

Some traders combine supply and demand analysis with other technical indicators or candlestick patterns to enhance the accuracy of their trading decisions.

Confirmation and Risk Management:

It's important to remember that not all supply and demand zones lead to significant price movements. Traders often look for confirmation signals before entering trades.

Proper risk management is crucial, as trading based solely on supply and demand zones can still involve risks and uncertainties.

Supply and Demand analysis is a versatile tool used by both technical and price action traders. However, it's important to note that while supply and demand zones can be effective, no trading strategy is infallible. It's recommended to practice, backtest, and gain experience before incorporating supply and demand concepts into your trading strategy

-

LIVE

LIVE

LFA TV

16 hours agoLFA TV - ALL DAY LIVE STREAM 4/2/25

1,390 watching -

LIVE

LIVE

Mally_Mouse

4 hours agoLet's Play!! -- Split Fiction

84 watching -

1:28:21

1:28:21

Russell Brand

3 hours agoUK Unhinged: Arrested for a School WhatsApp Rant! – SF559

124K48 -

1:09:50

1:09:50

Sean Unpaved

3 hours agoFinal Four Showdown Predictions with Former Coach Fran Fraschilla To Join!

18.5K2 -

2:35:29

2:35:29

Nerdrotic

6 hours ago $3.21 earnedNerdrotic Nooner 477 w Chris Gore

38.2K8 -

1:16:44

1:16:44

Mike Rowe

8 days agoGary Sinise Shares the Lessons He Learned From His Late Son, Mac Sinise | #429 | The Way I Heard It

30.8K7 -

1:02:24

1:02:24

Timcast

3 hours agoGOP CRUSHED In Wisconsin, Trump Impeachment FEARED After Dems Win, Voter ID PASSES

147K143 -

2:05:58

2:05:58

Steven Crowder

6 hours ago🔴 Why the Deported El Salvador Father Story Is One Huge Media Lie!

401K271 -

58:31

58:31

The Rubin Report

4 hours ago‘The View’s’ Whoopi Goldberg Shocks Crowd by Going Even Further Left

72.8K119 -

19:10

19:10

Neil McCoy-Ward

2 hours ago🔥 While Υοu're Working HARD, They're ΡLΑNNING To ΤΑKE Everything From Υou!

28.8K5