Premium Only Content

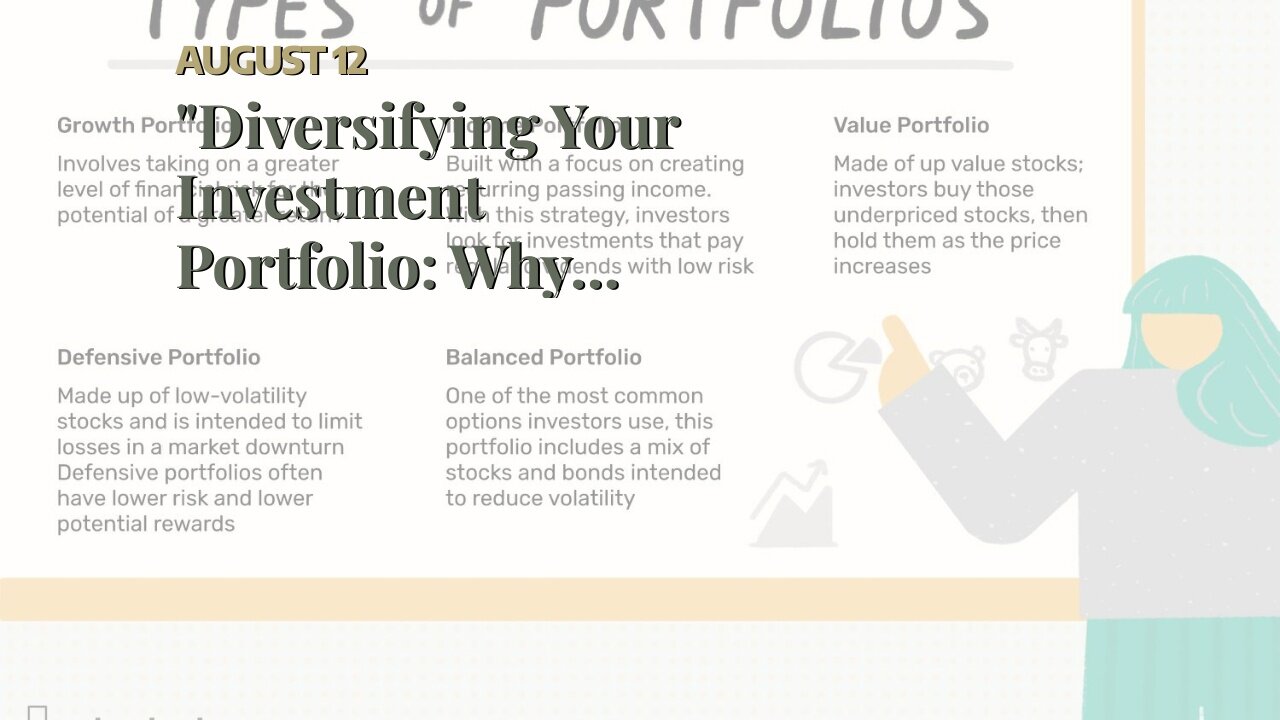

"Diversifying Your Investment Portfolio: Why Adding Gold Can Be Beneficial" Fundamentals Explai...

https://rebrand.ly/Goldco6

Join Now

"Diversifying Your Investment Portfolio: Why Adding Gold Can Be Beneficial" Fundamentals Explained, gold rate investing

Goldco helps customers protect their retired life savings by rolling over their existing IRA, 401(k), 403(b) or various other competent pension to a Gold IRA. ... To discover exactly how safe house rare-earth elements can help you construct as well as protect your wide range, and also even protect your retirement phone call today gold rate investing.

Goldco is one of the premier Precious Metals IRA firms in the United States. Safeguard your riches and livelihood with physical rare-earth elements like gold ...gold rate investing.

The Role of Central Banks in Shaping the Global Gold Fee: What Investors Need to Know

Gold has constantly held a special spot in the souls and thoughts of investors. Its ageless glamor and credibility and reputation as a safe-haven asset have created it a prominent selection for those looking to branch out their portfolios and secure their riches. But what lots of real estate investors might not discover is that the international gold price, which establishes the cost of this priceless steel, is intensely influenced by central banks around the world.

Main banking companies play a crucial role in shaping the global gold price via various systems such as getting or offering gold reserves, executing financial policies, and influencing market feeling. In this blog blog post, we will discover the crucial aspects that financiers need to have to know about how central banking companies impact the rate of gold.

One of the most significant ways main banking companies determine the international gold price is via their gold reserves. These gets function as a shop of value and are used to support nationwide money. When central financial institutions buy or offer gold gets, it may have a extensive impact on source and requirement characteristics in the market. For example, if a significant core bank begins selling off its gold holdings, it can flood the market with supply and possibly steer down prices. On the various other hand, if central banking companies are internet buyers of gold, it can reduce supply and placed up stress on costs.

Financial policy decisions produced by main financial institutions likewise have an secondary result on the worldwide gold price. Main banking companies use interest prices to manage rising cost of living and activate economic development. When passion prices are low or unfavorable, it reduces the possibility cost of storing non-yielding assets like gold since there is actually little gain readily available on other investments. This frequently leads to enhanced requirement for gold as investors find alternative safe-haven choices.

On top of that, changes in market feeling driven by main banking company activities can easily substantially affect capitalist actions in the direction of gold. For occasion, if a main bank announces expansionary financial policies or signs worries about economic stability, it can activate anxiety and uncertainty in the market. In such scenarios, investors tend to crowd in the direction of gold as a shop of market value and bush against possible financial chaos. This increased need can easily steer up the cost of gold.

It is vital for real estate investors to carefully monitor main banking company tasks and statements as they can easily supply beneficial insights in to potential gold rate movements. Central banks usually discharge declarations or store press meetings where they cover their financial policy decisions and offer support on their potential actions. By staying informed regarding these advancements, financiers can easily create a lot more informed choices concerning when to get or sell gold.

Also, central banks are not the only players that influence the international gold rate. Other elements such as geopolitical stress, financial signs, and market conjecture additionally play a part in determining gold prices. Having said that, understanding how main financial institution actions match into the more comprehensive photo is important for real estate investors who really want to navigate the complicated world of gold investing.

In verdict, main banks participate in a pivotal part in forming the worldwide gold price with their activities and policies. Their selections pertaining to gold books, financial policies, and market belief have...

-

12:29

12:29

Mr. Build It

5 days agoWish I Knew This Before I Started Building It

35.5K15 -

2:03:57

2:03:57

Megyn Kelly

2 days agoNew Trump Derangement Syndrome, and How CNN Smeared a Navy Veteran, w/ Piers Morgan & Zachary Young

135K173 -

10:05

10:05

DIY Wife

3 years agoHow We Flip Old Furniture For Profit!

70.2K58 -

2:14:54

2:14:54

TheSaltyCracker

9 hours agoTrump Goes Gangster ReeEEeE Stream 01-26-25

146K302 -

4:42:13

4:42:13

Due Dissidence

19 hours agoTrump Calls To "CLEAN OUT" Gaza, Swiss ARREST Pro-Palestine Journalist, MAGA's Hollywood Makeover?

66.9K94 -

2:02:20

2:02:20

Nerdrotic

11 hours ago $19.97 earnedDECLASSIFIED: JFK, MLK UFO Immaculate Constellation Doc | Forbidden Frontier #089

88.3K17 -

3:00:14

3:00:14

vivafrei

19 hours agoEp. 248: "Bitcoin Jesus" Begs Trump! Rekieta Gets Plea Deal! Pardons, Deportations, Bird Flu & MORE!

206K222 -

3:44:06

3:44:06

Rising Rhino

18 hours ago $14.24 earnedWashington Commanders Vs Philadelphia Eagles: NFL NFC Championship LIVE Watch Party

97.7K4 -

13:00

13:00

Exploring With Nug

12 hours ago $7.28 earnedHe Went To Get A Haircut And Vanished WIthout a Trace!

79.3K3 -

18:53

18:53

DeVory Darkins

2 days ago $33.86 earnedTrump JUST ENDED Mayor Karen Bass During HEATED Meeting

107K224