Premium Only Content

The Buzz on "Retirement Investing Made Simple: Strategies to Grow Your Savings and Achieve Fina...

https://rebrand.ly/Goldco

Join Now

The Buzz on "Retirement Investing Made Simple: Strategies to Grow Your Savings and Achieve Financial Freedom", retirement savings investment plan

Goldco aids clients safeguard their retired life savings by rolling over their existing IRA, 401(k), 403(b) or other certified pension to a Gold IRA. ... To learn just how safe haven precious metals can assist you develop as well as safeguard your wide range, and also also safeguard your retirement phone call today retirement savings investment plan.

Goldco is just one of the premier Precious Metals IRA business in the United States. Safeguard your riches as well as source of income with physical precious metals like gold ...retirement savings investment plan.

Making Your Cash Function for You: Exploring Different Investment Options for Retirement Planning

Retirement planning is a vital aspect of economic monitoring that everyone must consider. It involves preparing aside funds during your working years to make certain a comfortable and economically safeguard retirement life. One essential factor of retired life strategy is committing your loan carefully so that it may develop over opportunity. In this article, we will definitely look into various assets choices that can help you help make your amount of money work for you and secure a prosperous retired life.

1. Inventories:

Supplies are one of the very most well-known financial investment possibilities for people appearing to grow their riches over the long phrase. When you get stocks, you ended up being a investor in a provider and possess the potential to gain yields through funds recognition and dividends. Nonetheless, sells also lug a much higher degree of danger reviewed to various other assets choices due to market fluctuations. It's crucial to carry out thorough analysis and branch out your collection when committing in personal inventories.

2. Bonds:

Connects are taken into consideration much less dangerous than inventories as they give fixed revenue repayments over a certain duration of time. When you spend in connections, you practically give amount of money to the provider (typically governments or firms) in substitution for routine enthusiasm payments and the return of your key volume at maturity. Connects are an attractive alternative for senior citizens or those nearing retired life as they give steady revenue streams.

3. Shared Funds:

Mutual funds merge loan coming from a number of financiers and invest in several properties such as inventories, connections, or both. They are handled by qualified fund managers who make expenditure choices on behalf of real estate investors based on the fund's goals. Common funds supply variation advantages by spreading out expenditures around different securities, minimizing specific supply threat.

4. Exchange-Traded Funds (ETFs):

Identical to mutual funds, ETFs likewise merge cash coming from various financiers but business on inventory substitutions like individual supplies throughout the investing day at market prices somewhat than end-of-day web resource market value (NAV). ETFs offer gain access to to numerous property training class, featuring supplies, connections, assets, and real estate. They give entrepreneurs along with variation and flexibility in trading.

5. True Estate Investment Trusts (REITs):

REITs are firms that have, work, or pay for income-generating real real estate homes. Through spending in REITs, individuals can easily acquire exposure to the genuine property market without directly purchasing bodily properties. REITs generate profit through rental remittances and building gratitude. They are a preferred selection for capitalists looking for routine income flows and potential resources admiration.

6. Certificate of Deposits (CDs):

CDs are opportunity deposits provided by banking companies or credit score unions that spend a taken care of rate of interest price over a defined duration of time. They are considered low-risk expenditures as they are insured through the Federal Deposit Insurance Corporation (FDIC) up to certain limitations. CDs offer a expected yield on expenditure but might have lower profits reviewed to various other expenditure options.

7. Individual Retirement Accounts (IRAs):

IRAs are tax-advantaged retirement profiles that enable individuals to save for retired life by means of various investment choices such as inventories, connects, mutual fu...

-

14:36

14:36

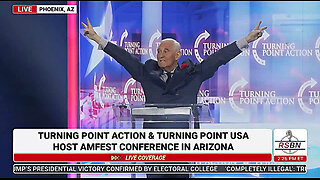

The StoneZONE with Roger Stone

1 day agoRoger Stone Delivers Riveting Speech at Turning Point’s AMFEST 2024 | FULL SPEECH

28.8K10 -

18:59

18:59

Fit'n Fire

9 hours ago $0.69 earnedZenith ZF5 The Best MP5 Clone available

1.96K1 -

58:34

58:34

Rethinking the Dollar

18 hours agoTrump Faces 'Big Mess' Ahead | RTD News Update

6.92K4 -

5:35

5:35

Dermatologist Dr. Dustin Portela

18 hours ago $1.10 earnedUnboxing Neutrogena PR Box: Skincare Products and Surprises!

8.82K1 -

11:20

11:20

China Uncensored

17 hours agoCan the US Exploit a Rift Between China and Russia?

9.89K15 -

2:08:48

2:08:48

TheSaltyCracker

12 hours agoLefty Grifters Go MAGA ReeEEeE Stream 12-22-24

208K643 -

1:15:40

1:15:40

Man in America

15 hours agoThe DISTURBING Truth: How Seed Oils, the Vatican, and Procter & Gamble Are Connected w/ Dan Lyons

123K118 -

6:46:07

6:46:07

Rance's Gaming Corner

17 hours agoTime for some RUMBLE FPS!! Get in here.. w/Fragniac

161K3 -

1:30:48

1:30:48

Josh Pate's College Football Show

17 hours ago $10.57 earnedCFP Reaction Special | Early Quarterfinal Thoughts | Transfer Portal Intel | Fixing The Playoff

93.6K1 -

23:55

23:55

CartierFamily

3 days agoElon & Vivek TRIGGER Congress as DOGE SHUTS DOWN Government

134K156