Premium Only Content

"Retirement Planning Made Easy: Expert Tips for Choosing the Right Investment Plan" Fundamental...

https://rebrand.ly/Goldco3

Get More Info Now

"Retirement Planning Made Easy: Expert Tips for Choosing the Right Investment Plan" Fundamentals Explained, retirement savings investment plan

Goldco assists customers safeguard their retired life savings by surrendering their existing IRA, 401(k), 403(b) or other certified retirement account to a Gold IRA. ... To find out exactly how safe haven precious metals can help you construct and also secure your wealth, and even safeguard your retired life call today retirement savings investment plan.

Goldco is just one of the premier Precious Metals IRA companies in the United States. Shield your wide range and livelihood with physical rare-earth elements like gold ...retirement savings investment plan.

Retirement Planning Made Easy: Professional Tips for Selecting the Right Investment Plan

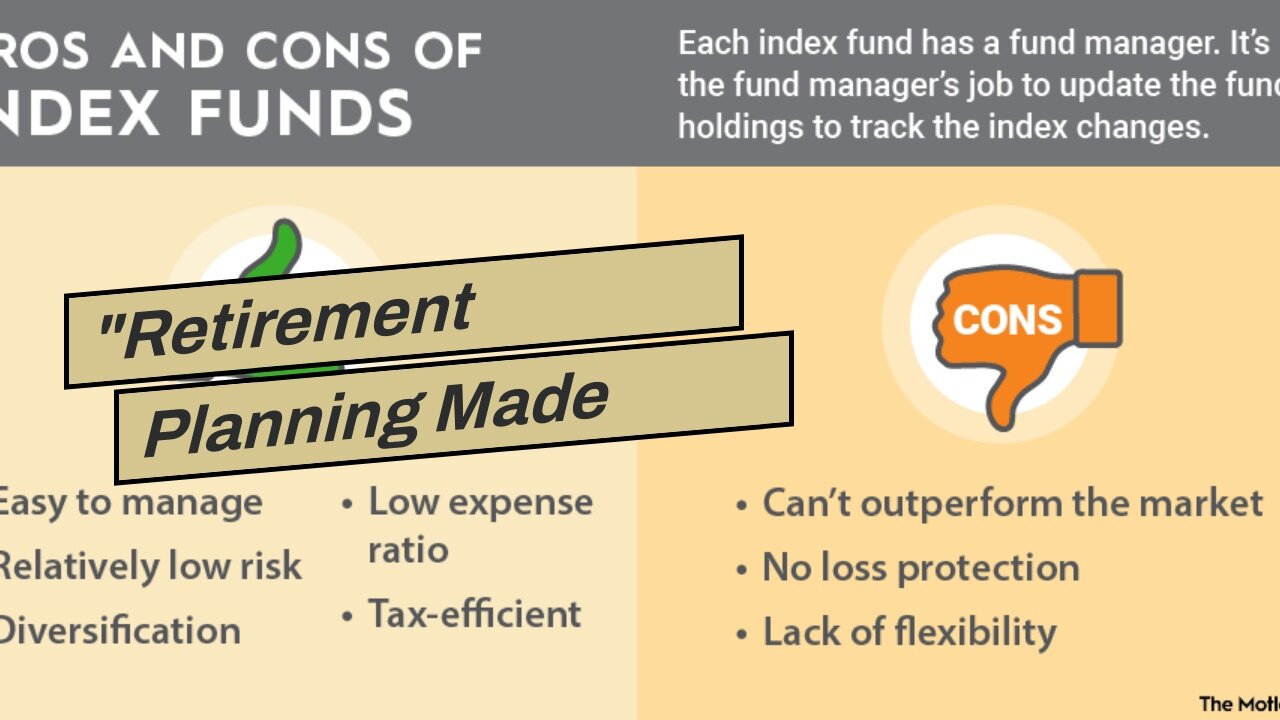

Retired life is a period of life that everyone appears ahead to. It's a time when you can lastly kick back and appreciate the fruits of your work. Having said that, in purchase to create the most of your retired life years, it's essential to possess a sound program in spot. One critical facet of retirement life planning is selecting the right assets program. With thus numerous options offered, it may be mind-boggling to decide which one is most effectively suited for your needs. In this short article, we will certainly provide expert recommendations on how to pick the best investment program for your retirement.

1. Find out Your Goals and Risk Endurance

Before picking an investment program, it's necessary to evaluate your monetary goals and danger endurance. Are you appearing for long-term development or reliability? Can you manage short-term dryness or are you extra comfy with conservative financial investments? Understanding these elements will aid narrow down your options.

2. Take into consideration Your Time Horizon

Another factor to consider when opting for an expenditure strategy is your opportunity horizon until retired life. If you have several years up until retired life, you might be capable to take on additional risk and spend in growth-oriented resources such as supplies or shared funds. On the other palm, if you are nearing retired life grow older, it might be a good idea to concentrate on keeping funds and choose for extra conservative expenditures.

3. Examine Different Types of Investment Plans

There are different styles of expenditure program available, each with its very own perks and downsides. Some popular choices consist of Individual Retirement Accounts (IRAs), 401(k) strategy, pensions, and stock broker accounts.

- IRAs: IRAs use tax perks and can easily be either conventional or Roth IRAs. Traditional IRAs permit tax-deductible additions but demand taxes upon drawback during retirement. Roth IRAs give tax-free withdrawals but do not offer quick tax rebates.

- 401(k) Plans: 401(k) strategy are employer-sponsored retirement strategy that make it possible for employees to provide a part of their wage. Several companies additionally provide suit additions, helping make it an attractive choice for retirement financial savings.

- Annuities: Allowances are insurance policy products that provide normal income during the course of retired life. They can deliver a dealt with or adjustable price of profit, relying on the kind of annuity.

- Stock broker Profiles: Stock broker profiles provide flexibility and permit you to invest in a variety of assets such as sells, connections, and reciprocal funds. They do not have the exact same tax perks as retirement-specific accounts but supply additional command over your expenditures.

4. Find Specialist Advice

Retirement program can easily be complex, specifically when it comes to picking the appropriate financial investment program. Look at speaking to along with a financial specialist who concentrates in retirement planning. They can easily assist evaluate your condition, understand your goals, and encourage appropriate expenditure possibilities located on your threat endurance and opportunity horizon.

5. Expand Your Profile

Diversity is crucial to managing risk in any investment program. By spreading out your investments around various possession courses such as sells, connections, genuine estate, and cash substitutes, you decrease the influence of any type of singular financial investment's functionality on your general profile.

6. Review and Monitor Your Investment Plan Frequently

On...

-

23:00

23:00

Exploring With Nug

10 hours ago $2.65 earnedHis Truck Was Found Crashed in the Woods… But He’s Gone!

15.9K1 -

27:09

27:09

MYLUNCHBREAK CHANNEL PAGE

10 hours agoDilmun: Where Life Never Ends

32.5K17 -

2:59:26

2:59:26

Twins Pod

8 hours agoEMERGENCY PODCAST WITH ANDREW TATE! - Twins Pod - Special Episode - Andrew Tate

89.2K57 -

2:52:01

2:52:01

Jewels Jones Live ®

2 days agoTRUMP SECURES BORDER | A Political Rendezvous - Ep. 113

35.9K24 -

25:02

25:02

marcushouse

20 hours ago $35.68 earnedStarship Just Exploded 💥 What Went Wrong This Time?!

110K54 -

12:00

12:00

Silver Dragons

1 day agoBullion Dealer Reveals Best Silver to Buy With $1,000

65.4K9 -

12:58

12:58

NinjaGamblers

11 hours ago $12.35 earnedIs This The BEST Way to Win At Roulette? 😲

102K12 -

1:01:54

1:01:54

CharLee Simons Presents Do Not Talk

2 days agoCALIFORNIA'S DONE!

68.2K27 -

7:33

7:33

MudandMunitions

1 day agoUnboxing My FIRST Revolver! Smith & Wesson 442 .38 Special and What’s Coming Next for the Channel

93K12 -

1:01:05

1:01:05

Trumpet Daily

1 day ago $10.65 earnedGermany Started Two World Wars and Now Wants Nuclear Weapons - Trumpet Daily | Mar. 7, 2025

76.5K81