Premium Only Content

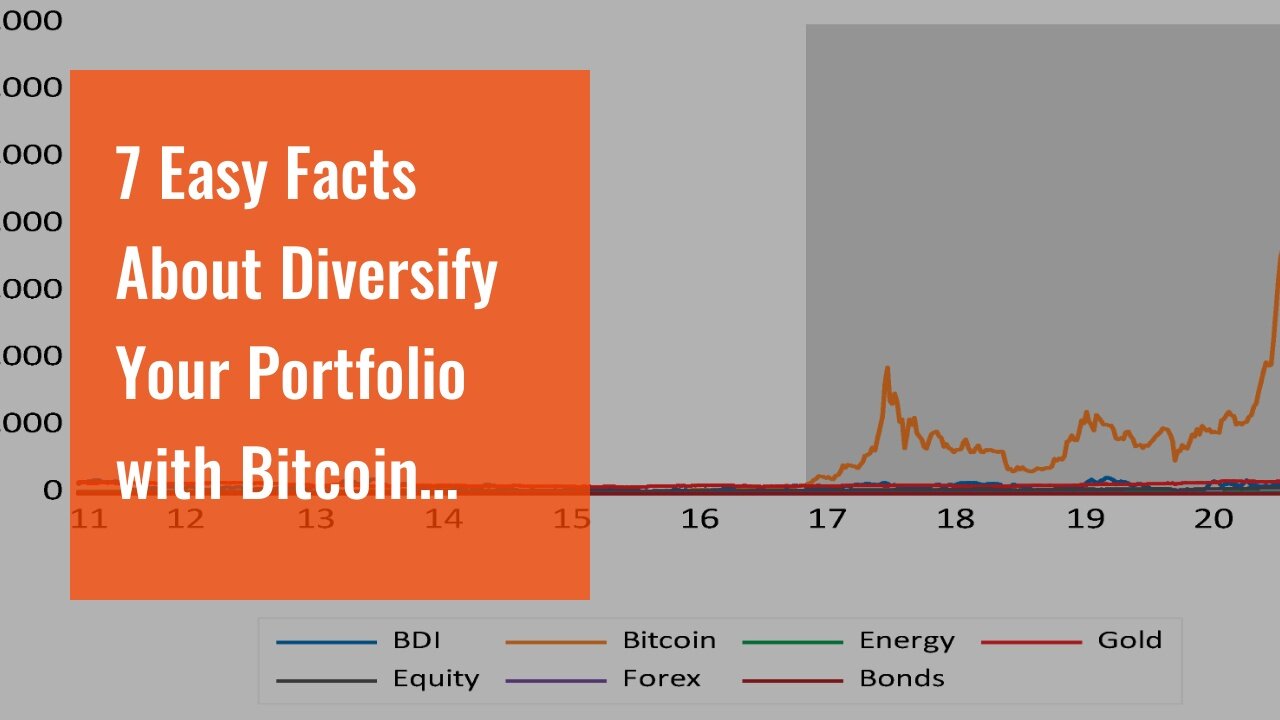

7 Easy Facts About Diversify Your Portfolio with Bitcoin Investments Explained

https://rebrand.ly/Goldco4

Join Now

7 Easy Facts About Diversify Your Portfolio with Bitcoin Investments Explained, bitcoininvest

Goldco aids clients safeguard their retirement financial savings by surrendering their existing IRA, 401(k), 403(b) or other professional retirement account to a Gold IRA. ... To find out just how safe haven precious metals can aid you construct and protect your riches, as well as even safeguard your retirement call today bitcoininvest.

Goldco is one of the premier Precious Metals IRA companies in the United States. Protect your riches and income with physical precious metals like gold ...bitcoininvest.

Decoding Cryptocurrency Jargon: A Glossary for New Bitcoin Investors

If you're brand new to the world of cryptocurrency and are taking into consideration putting in in Bitcoin, you may locate yourself overloaded with the amount of jargon and specialized conditions being thrown around. Coming from blockchain to mining, it may be challenging to comprehend what these terms imply and how they relate to your assets. To help you browse this complicated yard, we've put all together a thorough reference of cryptocurrency jargon exclusively customized for brand-new Bitcoin capitalists.

1. Cryptocurrency: A digital or virtual kind of currency that uses cryptography for safety and security. Bitcoin is one example of a cryptocurrency.

2. Blockchain: A decentralized ledger that capture all purchases throughout numerous computer systems or nodes in a system. Each purchase is taped in a "block" which is added to the establishment, producing an unalterable file.

3. Bitcoin: The first and most well-known cryptocurrency, produced by an anonymous person or team using the pen name Satoshi Nakamoto in 2009.

4. Altcoin: Any cryptocurrency other than Bitcoin. Instances consist of Ethereum (ETH), Ripple (XRP), and Litecoin (LTC).

5. Wallet: A electronic wallet used to store cryptocurrencies securely. It contains private secrets that make it possible for individuals to access their funds.

6. Public vital/private key: A pair of cryptographic tricks utilized in asymmetric security units like cryptocurrencies. The public key is utilized to receive funds, while the exclusive key is needed for spending or transferring funds.

7. Exploration: The method through which brand new Bitcoins are produced and deals are validated on the blockchain network via solving complex algebraic problems using highly effective pcs.

8. Hash rate: The speed at which a exploration maker runs when solving mathematical concerns on the blockchain network.

9. Fork: A crack or divergency in the blockchain resulting from modifications produced to its rules or method by creators or miners.

10. ICO (Initial Coin Offering): Identical to an IPO (Initial Public Offering) in the conventional economic world, an ICO is a fundraising strategy used by cryptocurrency startups to raise funding. Investors obtain tokens or coins in exchange for their expenditure.

11. Substitution: A platform where customers may get, offer, and business cryptocurrencies. Examples consist of Coinbase, Binance, and Kraken.

12. FUD (Fear, Uncertainty, and Doubt): A term used to define negative feeling or stories spread concerning a certain cryptocurrency or the overall market to make panic and steer costs down.

13. HODL: Originally a misspelling of "store," HODL has come to be a preferred term in the cryptocurrency community for storing onto cryptocurrencies despite market changes.

14. Whale: An person or entity that stores a large amount of cryptocurrency and has actually the potential to determine market costs along with their activities.

15. Clever contract: Self-executing deals along with conditions written directly in to code on the blockchain system. They immediately execute when predefined conditions are satisfied.

16. Whitepaper: A document commonly discharged through cryptocurrency ventures that describes their goals, modern technology, and strategy for progression.

17. Market hat: The total worth of all coins in flow multiplied through their present price every piece. It is an indication of a cryptocurrency's dimension and appeal.

18. Fiat money: Standard government-issued currency like the US buck or Euro that is not supported by a physical commodity like gold or silver.

19. Bull market: A market disorder characterized by increasing prices and optimism one of capitalists.

20. Bear market: The opposite of a upward market...

-

9:04

9:04

GBGunsRumble

11 hours agoGBGuns Armory Ep 134 Walther PDP F Pro

2.85K -

13:12

13:12

Melonie Mac

19 hours agoAspyr Teases Possible New Tomb Raider Games in Classic Remastered Style

3.65K5 -

44:49

44:49

Chrissy Clark

13 hours agoThe Rise Of Female Shooters, ABC News’ $16M Settlement, & MORE I Underreported Stories

2.46K2 -

2:49:13

2:49:13

InfiniteWaters(DivingDeep)

21 hours agoIt's Over - The Matrix Is Cooked | Infinite Waters

2.29K3 -

15:49

15:49

Chris From The 740

1 day ago $0.97 earnedThe EAA Girsan Influencer X - Not Your Grandpa's 1911

1.67K1 -

25:38

25:38

Producer Michael

16 hours agoLuxury Souq's MULTI-MILLION DOLLAR Watch Collection!

68K5 -

17:06

17:06

Sleep is CANCELED

21 hours ago10 SCARY Videos To Keep You Up All Night!

44.7K2 -

2:37

2:37

Canadian Crooner

1 year agoPat Coolen | Let It Snow!

27.6K9 -

2:44

2:44

BIG NEM

12 hours agoWhat's Really Behind the Fake Alpha Male Epidemic?

23.5K4 -

57:20

57:20

State of the Second Podcast

7 days agoThe Inventor of Bump Stock Fights Back! (ft. Slide Fire)

15.9K5