Premium Only Content

Not known Details About "Investment Options for Retirees: Making Smart Choices to Preserve and...

https://rebrand.ly/Goldco

Join Now

Not known Details About "Investment Options for Retirees: Making Smart Choices to Preserve and Grow Your Wealth" , retirement savings investment plan

Goldco helps clients protect their retirement savings by rolling over their existing IRA, 401(k), 403(b) or other competent pension to a Gold IRA. ... To discover just how safe house rare-earth elements can help you develop as well as protect your riches, and also even protect your retired life call today retirement savings investment plan.

Goldco is one of the premier Precious Metals IRA business in the United States. Protect your wealth and livelihood with physical precious metals like gold ...retirement savings investment plan.

The Ultimate Guide to Retirement Savings: Selecting the Right Investment Plan

Retirement is a considerable milestone in life that needs careful planning and point to consider. One of the most essential components of retirement life planning is picking the ideal financial investment plan. With several possibilities offered, it can easily be difficult to figure out which one is most effectively suited for your necessities. In this supreme overview, we are going to check out numerous retirement savings choices and offer insights on how to select the ideal investment plan.

1. Know Your Goals and Risk Endurance

Prior to diving right into the specifics of various investment strategy, it is important to know your objectives for retired life and analyze your risk tolerance. Inquire yourself concerns like:

- At what grow older do I plan to resign?

- How a lot amount of money do I need for a comfortable retirement life?

- How much danger am I prepared to take with my investments?

By having a crystal clear understanding of your targets and danger tolerance, you can easily narrow down your options and create informed choices.

2. Explore Employer-Sponsored Retirement Plans

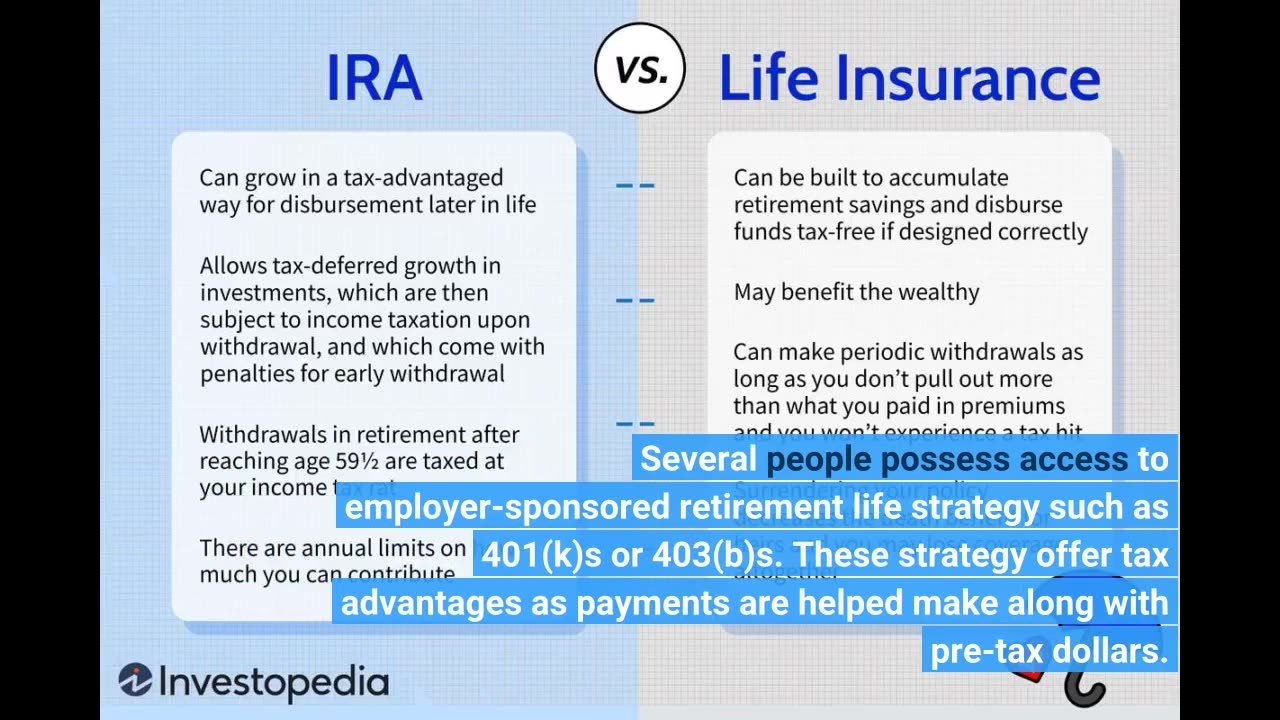

Several people possess access to employer-sponsored retirement life strategy such as 401(k)s or 403(b)s. These strategy offer tax advantages as payments are helped make along with pre-tax dollars. Additionally, some companies provide matching additions up to a specific percentage of your salary.

When reviewing these planning, think about variables such as addition limits, investment possibilities, fees, and vesting timetables. It's essential to take full advantage of any type of company matching additions as it generally supplies free of cost funds towards your retired life financial savings.

3. Individual Retirement Accounts (IRAs)

Individual Retirement Accounts (IRAs) are yet another prominent alternative for retirement life savings. There are actually two primary styles: Standard IRAs and Roth IRAs.

Standard IRAs make it possible for you to add pre-tax dollars, reducing your taxable profit in the year of addition. Nonetheless, drawbacks throughout retired life are topic to profit income tax.

Roth IRAs, on the various other palm, require after-tax payments but give tax-free drawbacks during the course of retirement life if specific ailments are fulfilled. This may be useful for people who expect their tax cost to be greater in retirement life.

When opting for between a Typical IRA and a Roth IRA, take into consideration variables such as your existing income tax bracket, future income tax desires, and qualification standards.

4. Consider Mutual Funds and Exchange-Traded Funds (ETFs)

Common funds and exchange-traded funds (ETFs) are expenditure cars that merge loan from numerous financiers to spend in a varied profile of supplies, connections, or various other properties. They supply accessibility to expert monitoring and variation without requiring substantial upfront capital.

Common funds are priced once per day at the web resource value (NAV), while ETFs profession throughout the day on an swap like personal supplies. Both possibilities provide visibility to a variety of asset training class and assets methods.

When spending in common funds or ETFs, consider elements such as expenditure ratios, fund functionality, historical returns, and the fund manager's keep track of report. Transforming your financial investments around various possession training class can help relieve threat and enhance potential yields.

5. Assess Real Estate Investment Options

Genuine estate can easily be a practical assets alternative for retirement life financial savings. Spending in rental properties or actual real estat...

-

33:47

33:47

Stephen Gardner

7 hours ago🔥Pentagon Whistleblower UNLEASHES on Biden and Obama!

79.6K102 -

2:20:30

2:20:30

The Dilley Show

9 hours ago $22.75 earnedRoger Stone in Studio plus Q&A Friday! w/Author Brenden Dilley 12/27/2024

68.4K16 -

1:57:02

1:57:02

The Charlie Kirk Show

7 hours agoThe Great H-1B Battle + AMA | Lomez | 12.27.24

146K198 -

11:39

11:39

Russell Brand

1 day agoWhat You're Not Being Told About The Syrian War

155K228 -

DVR

DVR

Bannons War Room

1 year agoWarRoom Live

101M -

1:49:21

1:49:21

Film Threat

10 hours agoBEST AND WORST OF 2024 + SQUID GAME SEASON 2 | Film Threat Livecast

55.3K5 -

1:06:04

1:06:04

The Big Mig™

23 hours agoGlobal Finance Forum Powered By Genesis Gold Group

46.5K2 -

34:38

34:38

Tudor Dixon

8 hours agoThe Changing Landscape Between Tech and Politics with Mike Benz | The Tudor Dixon Podcast

35.9K5 -

2:23:58

2:23:58

Matt Kohrs

19 hours agoRumble's Stock Is EXPLODING!!! || The MK Show

90.9K8 -

1:57:47

1:57:47

LFA TV

21 hours agoBOMBSHELL FINAL REPORT: BIDEN ADMIN SUPPRESSED WUHAN LAB LEAK | LIVE FROM AMERICA 12.27.24 11am EST

56K8