Premium Only Content

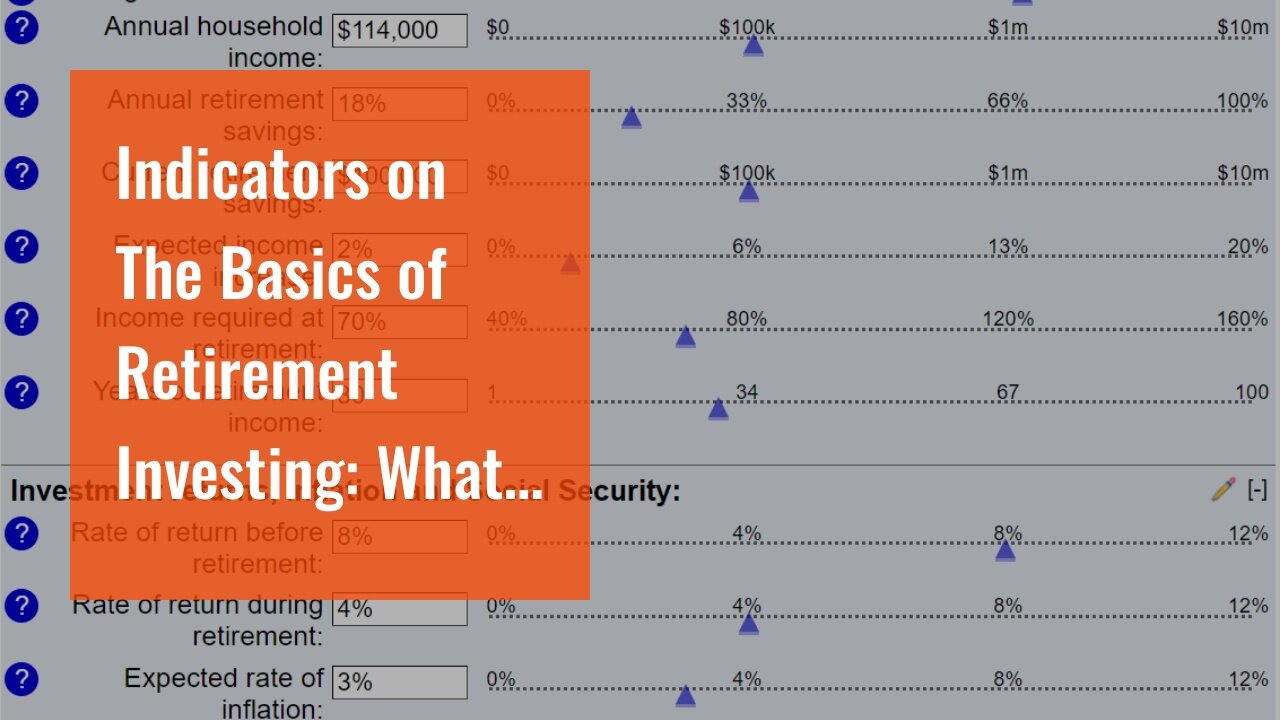

Indicators on The Basics of Retirement Investing: What You Need to Know You Should Know

https://rebrand.ly/Goldco5

Sign up Now

Indicators on The Basics of Retirement Investing: What You Need to Know You Should Know, retirement investing basics

Goldco assists customers shield their retired life financial savings by rolling over their existing IRA, 401(k), 403(b) or various other professional retirement account to a Gold IRA. ... To find out exactly how safe haven rare-earth elements can aid you build and protect your wealth, and also even protect your retired life telephone call today retirement investing basics.

Goldco is among the premier Precious Metals IRA firms in the United States. Shield your riches as well as livelihood with physical precious metals like gold ...retirement investing basics.

Top Tips for Successful Retirement Investing

Retirement life is a phase of lifestyle that several individuals look ahead to. It's a time when you can easily kick back, seek your pastimes, and spend high quality time along with enjoyed ones. Nevertheless, in order to enjoy a relaxed retired life, it's crucial to help make a good idea expenditure selections. This write-up will provide you with the best suggestions for successful retirement life investing.

1. Start Saving Early: One of the most vital suggestions for effective retirement life investing is to start sparing as early as possible. The power of worsening enthusiasm can easily function wonders over opportunity. By starting early, you offer your investments even more opportunity to increase and likely generate considerable profits.

2. Prepared Clear Goals: Before you start committing for retired life, it's crucial to set clear objectives. Find out how much cash you'll need to have during your retirement years and operate in the direction of achieving that target. Establishing particular goals are going to aid you stay focused and help make informed expenditure decisions.

3. Transform Your Profile: Diversification is key when it happens to retirement life investing. Dispersing your expenditures across various possession lessons such as stocks, bonds, true estate, and mutual funds can aid minimize danger while maximizing prospective profits.

4. Recognize Risk Resistance: Every entrepreneur has actually a distinct danger tolerance amount located on their financial scenario and private choices. It's important to know your threat endurance before creating any type of financial investment selections for your retirement life profile.

5. Frequently Assess Your Financial investments: Retirement investing is not a one-time activity; it needs normal screen and testimonial of your profile's efficiency. Keep upgraded along with market fads and economic health conditions that might influence your financial investments.

6. Take into consideration Tax-Efficient Methods: Taxes may considerably influence your assets gains in retirement life. Take into consideration tax-efficient methods such as adding to tax-advantaged accounts like Individual Retirement Accounts (IRAs) or 401(k) plans.

7. Find Professional Advice: If you're unclear regarding how to invest for retired life or yearn for personalized direction, look at looking for suggestions from a economic consultant. A qualified specialist may aid assess your economic situation, determine your goals, and make a adapted financial investment plan.

8. Stay clear of Mental Investing: Emotional states may usually cloud judgment when it happens to investing. Avoid producing spontaneous selections located on worry or greed. Catch to your expenditure plan and prevent responding to short-term market variations.

9. Maintain Costs Low: High fees and expenditures can eat in to your assets yields over opportunity. When picking expenditures for your retired life profile, think about low-cost options such as mark funds or exchange-traded funds (ETFs) that use extensive market direct exposure at a lesser cost.

10. Stay Consistent: Consistency is important in retired life investing. Stick to your long-term assets approach and avoid making regular modifications located on short-term market movements.

11. Planning for Inflation: Inflation wears down the acquisition energy of money over time. When planning for retirement life, it's vital to think about the influence of inflation on your future expenses and adjust your financial savings and assets objectives correctly.

12. Rebalance Your Collection: Over opportunity, the performance of various possession lessons may vary, creating imbalance...

-

1:15:12

1:15:12

Josh Pate's College Football Show

6 hours ago $6.54 earnedCFB’s Top 12 Programs | TV Executives & Our Sport | USC Changes Coming | Early Championship Picks

47.2K2 -

LIVE

LIVE

Vigilant News Network

11 hours agoUK Government BUSTED in Secret Plot to Extract Your Data | Media Blackout

1,491 watching -

1:03:32

1:03:32

Winston Marshall

3 days ago"War On Children!" The DEMISE Of The West Starts With Schools - Katharine Birbalsingh

102K64 -

48:02

48:02

Survive History

13 hours ago $5.71 earnedCould You Survive as a Sharpshooter in the Napoleonic Wars?

50.4K3 -

12:03

12:03

Space Ice

14 hours agoSteven Seagal's China Salesman - Mike Tyson Knocks Him Out - Worst Movie Ever

36.7K16 -

11:37

11:37

Degenerate Jay

14 hours ago $6.18 earnedJames Bond Needs Quality Over Quantity From Amazon

67.2K8 -

15:23

15:23

Misha Petrov

14 hours agoTrad Wives & Girl Bosses Go to WAR!

55.7K43 -

2:03:11

2:03:11

TheDozenPodcast

12 hours agoFootball villain fighting the state: Joey Barton

50.7K1 -

13:18:50

13:18:50

Scottish Viking Gaming

15 hours ago💚Rumble :|: Sunday Funday :|: Smash the Blerps and Vape the Terpes

90.2K8 -

1:45:00

1:45:00

RG_GerkClan

17 hours ago🔴LIVE Sunday Special - It's Time for World Domination - Civilization VII - Gerk Clan

84.8K27