Premium Only Content

"Retirement Investing Tips for Different Age Groups" Can Be Fun For Everyone

https://rebrand.ly/Goldco3

Sign up Now

"Retirement Investing Tips for Different Age Groups" Can Be Fun For Everyone, retirement investing basics

Goldco aids clients protect their retired life financial savings by rolling over their existing IRA, 401(k), 403(b) or other competent pension to a Gold IRA. ... To find out how safe house precious metals can aid you develop and also safeguard your wide range, as well as also protect your retired life phone call today retirement investing basics.

Goldco is one of the premier Precious Metals IRA business in the United States. Safeguard your wealth and also resources with physical rare-earth elements like gold ...retirement investing basics.

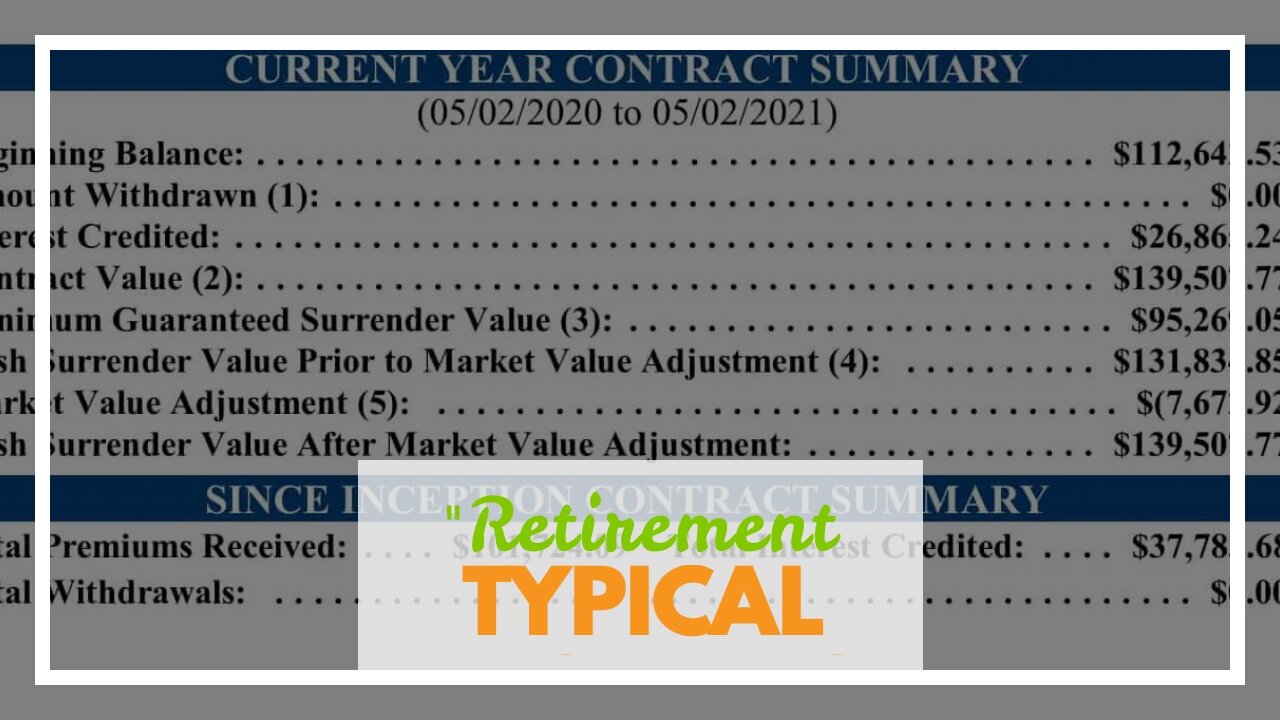

Typical Mistakes to Steer clear of in Retirement Investing

Retired life is a opportunity several folks look onward to. It's a time period of leisure, satisfaction, and the chance to seek hobbies and interests that might have been put on grip in the course of the working years. However, in order to definitely enjoy retired life, it's significant to possess a sound monetary program in location. This consists of making a good idea financial investment decisions that will certainly offer a consistent profit stream throughout those gold years.

Unfortunately, many people produce popular blunders when it happens to retirement life investing. These mistakes can easily possess major consequences and endanger their financial safety. In this post, we will definitely talk about some of the very most common mistakes folks create in retirement investing and how you can stay away from them.

1. Neglecting to start early: One of the biggest errors people help make is not beginning their retired life cost savings early enough. The energy of intensifying rate of interest can easilynot be ignored. The earlier you start conserving for retirement, the additional time your cash has to develop and gather riches. Starting early permits you to take advantage of long-term financial investments that usually tend to give greater profits.

2. Overlooking asset allocation: Resource allowance recommends to how you divide your investments one of different property lessons such as stocks, connections, and cash money substitutes. Numerous retired people make the error of placing all their eggs in one basket by putting in exclusively in one style of asset course without thinking about diversity. Transforming your profile aids minimize threat and delivers stability in the course of market fluctuations.

3. Dismissing rising cost of living: Inflation wears away acquiring energy over opportunity, which suggests that if you don't account for inflation when intending for retirement, your savings may not be sufficient to cover your expenses down the street. It's vital to put in in properties that use security against inflation such as inventories or real real estate.

4. Overlooking expenses: Expenses linked along with assets products may eat into your gains over opportunity if left out of hand. High control fees or excessive trading costs can easily substantially affect your total investment efficiency. Be sure to compare expenses and expenditures just before selecting an investment item or working with a economic advisor.

5. Failing to reflect on threat endurance: As you near retired life, it's essential to reflect on your danger endurance and readjust your assets approach correctly. When you possess a longer time horizon, you may afford to take on more risk in search of greater gains. Nonetheless, as retirement strategy, it's prudent to slowly move towards even more conventional expenditures that prioritize financing preservation.

6. Emotional decision-making: Making expenditure choices based on emotional states instead than sound economic study is a common error a lot of senior citizens make. Concern and greed can easily overshadow opinion and lead to spontaneous decisions that might not line up along with long-term targets. It's crucial to remain disciplined and stick to your investment program irrespective of short-term market variations.

7. Counting entirely on Social Security: While Social Security advantages are an crucial component of numerous retirees' revenue streams, depending entirely on these perks might not be enough to preserve the preferred standard of living during the course of retirement. It's vital to nutritional supplement Social Security profit with individual cost savings and investments.

8. Not seeking speci...

-

LIVE

LIVE

Rotella Games

7 hours agoGrand Theft America - GTA IV | Day 4

591 watching -

LIVE

LIVE

Scottish Viking Gaming

5 hours ago💚Rumble :|: Sunday Funday :|: Rumble Fam Knows What's Up!!

274 watching -

LIVE

LIVE

ttvglamourx

4 hours ago $1.55 earnedEGIRL VS TOXIC COD LOBBIES !DISCORD

208 watching -

3:19:17

3:19:17

LumpyPotatoX2

6 hours agoSCUM: Lumpy Land RP Server - Day #1 - #RumbleGaming

19.7K2 -

1:42:59

1:42:59

Game On!

18 hours ago $8.06 earnedTop 10 Super Bowl Bets You Can't Afford To Miss!

64.5K7 -

2:17:02

2:17:02

Tundra Tactical

23 hours ago $22.38 earnedTundra Nation Live : Shawn Of S2 Armament Joins The Boys

155K27 -

11:00:11

11:00:11

tacetmort3m

1 day ago🔴 LIVE - SOLO RANK GRINDING CONTINUES - MARVEL RIVALS

204K3 -

![Shadows Of Chroma Tower, Alpha Playtest [Part 1]](https://1a-1791.com/video/fwe2/1d/s8/1/5/Q/U/n/5QUnx.0kob-small-Shadows-Of-Chroma-Tower-Alp.jpg) 13:29:21

13:29:21

iViperKing

1 day agoShadows Of Chroma Tower, Alpha Playtest [Part 1]

167K8 -

54:05

54:05

TheGetCanceledPodcast

23 hours ago $13.75 earnedThe GCP Ep.11 | Smack White Talks Smack DVD Vs WorldStar, Battle Rap, Universal Hood Pass & More...

143K34 -

13:37

13:37

Exploring With Nug

1 day ago $10.07 earnedSUV Found Underwater Searching For Missing Man Jerry Wilkins!

102K4