Premium Only Content

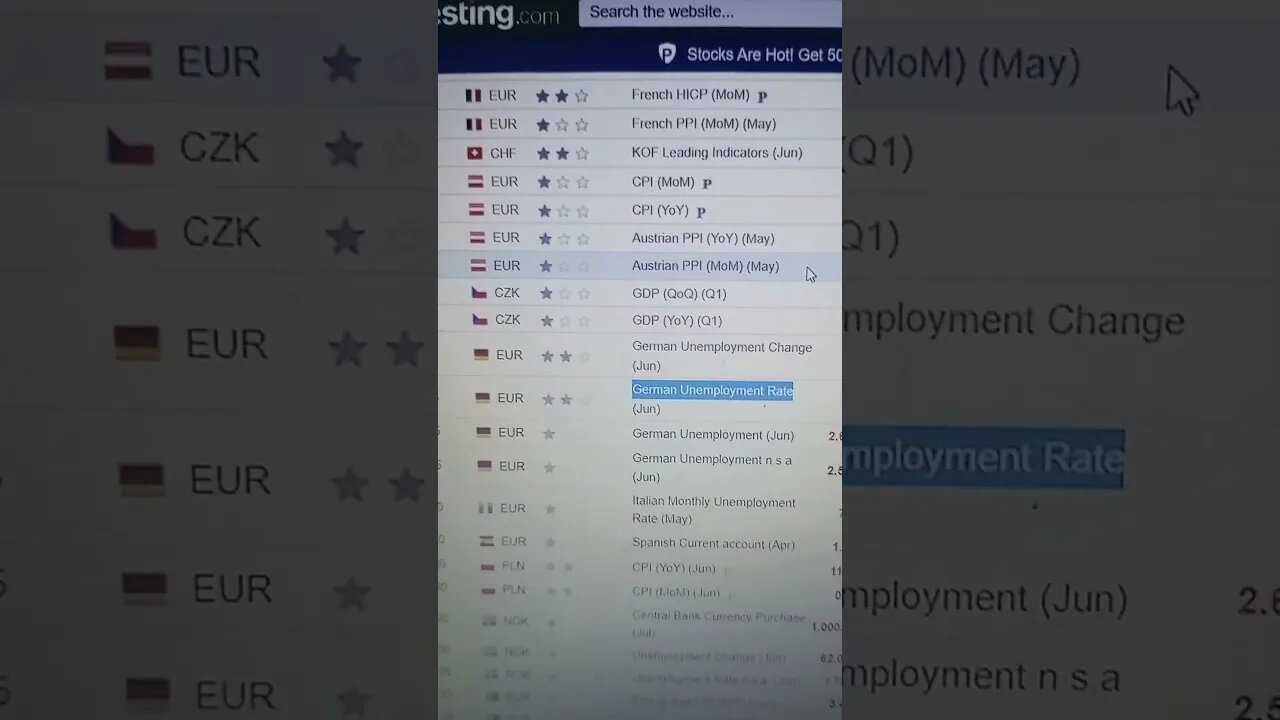

Today economic calendar is bearish for EURO

Forex Trading-https://bit.ly/40zXx2X

Binary Option Trading-https://bit.ly/3X734ec

Mazaya FX Shop https://bit.ly/3Z8gA2q

#investing #binary #economiccalendar #economics #eurusd #forex #forexmarket #forextrader #trading #binaryoption #shorts

The latest economic calendar forecasts a bearish outlook for the Euro today. The bearish trend signifies that the Euro might experience a downward price movement against other currencies. The economic calendar, a tool used by investors and traders to track market-moving events, has flagged several key indicators that suggest the Euro's value may decline.

One of the potential contributing factors could be the release of unfavorable macroeconomic data from the Eurozone. This could range from higher-than-expected inflation rates, to increasing unemployment numbers, a slowdown in GDP growth, or lower consumer confidence. These factors typically signal a weakening economy and, as a result, can negatively impact the value of the Euro.

Furthermore, the European Central Bank's (ECB) monetary policy also plays a significant role in the Euro's performance. If the ECB signals a more dovish stance, suggesting that interest rates will remain low or possibly be cut further, this could exert downward pressure on the Euro. Low-interest rates tend to make a currency less attractive to foreign investors, which can result in a depreciation of the currency.

The bearish forecast could also be influenced by global events. For instance, strong economic data from the United States could strengthen the US Dollar, which often has an inverse effect on the Euro. Similarly, uncertainties surrounding geopolitical issues, trade disputes, or global growth can also make investors seek safety in other currencies considered to be safe havens, leading to a sell-off of the Euro.

Traders and investors should pay close attention to these developments. While a bearish trend suggests potential losses for those holding the Euro, it may also present opportunities for forex traders looking to profit from the currency's depreciation. However, it's important to remember that currency trading involves high risk, and decisions should be made with careful consideration of the prevailing economic conditions and individual risk tolerance.

-

1:02:55

1:02:55

In The Litter Box w/ Jewels & Catturd

23 hours agoAmerica Is Under Attack! | In the Litter Box w/ Jewels & Catturd – Ep. 711 – 1/02/2025

78.5K75 -

1:45:25

1:45:25

The Quartering

6 hours agoHuge Update In Cybertruck Attack & Dark New Details From New Orleans Attacker & More!

113K54 -

16:04

16:04

Tundra Tactical

2 days ago $2.21 earnedHow Palmetto State Armory got so BIG!

46.6K3 -

13:41

13:41

MichaelBisping

9 hours agoBISPING: Jamahal Hill is BEEFING with EVERYONE before UFC 311?! | Hill vs Prochazka

10.9K1 -

12:57

12:57

BlackDiamondGunsandGear

1 day agoSingle stack that takes a Double Stack Mag?

7.53K1 -

3:21:21

3:21:21

DemolitionDx

6 hours agochecking out multiple games

44.3K -

2:14:38

2:14:38

Conspiracy Pilled

1 day agoPortal to Hell: The Elisa Lam/Cecil Hotel Case (S5 Ep 12)

60.1K5 -

14:31

14:31

DeVory Darkins

2 days ago $10.15 earnedScott Jennings Drops Brutal TRUTH BOMB

51.5K155 -

LIVE

LIVE

cbsking757

8 hours ago★TANKING RIVALS RANKED! GIFTED SUBS ARE LIVE! #marvel #marvelrivals

127 watching -

4:04:55

4:04:55

Tate Speech by Andrew Tate

15 hours agoEMERGENCY MEETING EPISODE 99 - 2024 - TIME VACUUM

256K119