Premium Only Content

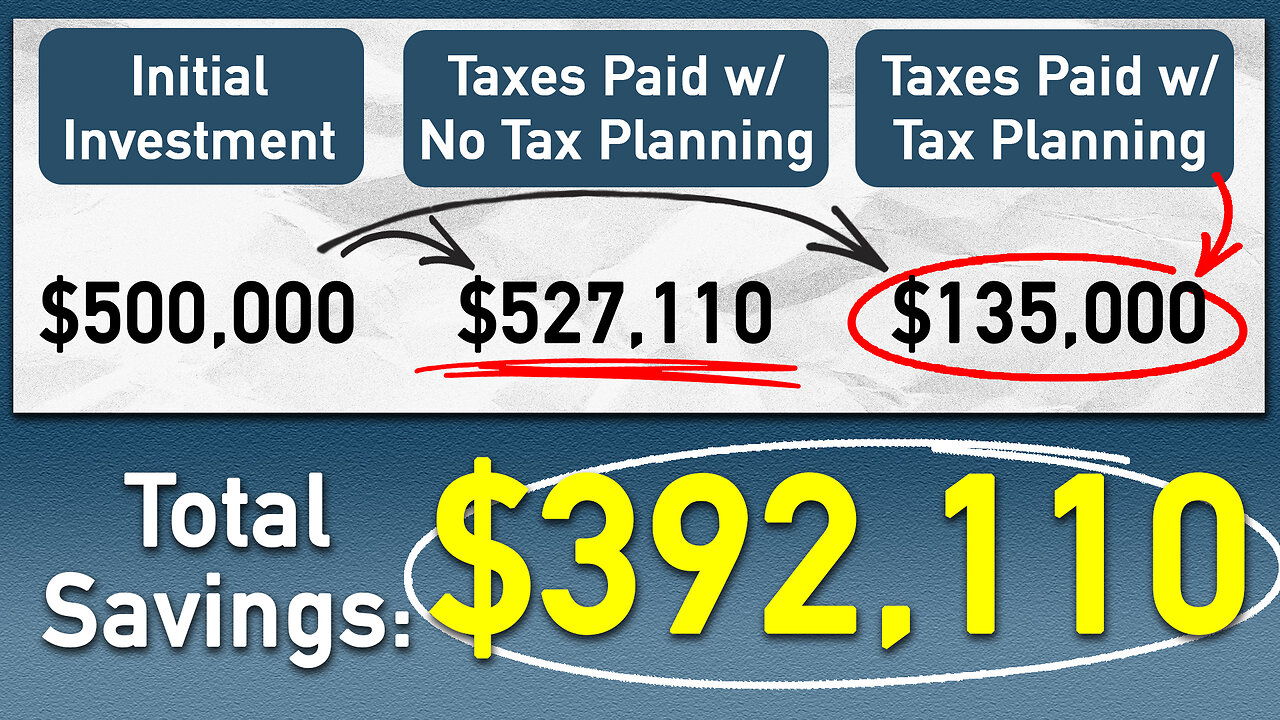

How to Save Over $300k in Taxes Over Your Lifetime!

In this video, we discuss a tax planning strategy that can help you save over $300,000 in taxes over your lifetime. We walk through a case study of a couple who are 64 years old and have $500,000 in tax-deferred dollars. We explore their current plan, which involves paying taxes on required minimum distributions (RMDs), the impact of social security taxes, and taxes paid by beneficiaries. We then introduce a simple strategy of converting their $500,000 to a Roth IRA over the next three years, which involves paying $120,000 in taxes upfront, but offers tax-free growth and eliminates taxes on RMDs, social security, and taxes paid by beneficiaries. By implementing this strategy correctly, you can save a significant amount in taxes over your lifetime. If you're interested in running your personal numbers in this tax calculator, please reach out to us for a consultation!

Please note, this video discusses factors that could apply to a hypothetical couple. Your specific circumstances may vary materially.

Are you interested in receiving expert help in planning for your financial future?

If so, give us a call at (614)500-4121 or visit us at https://peakretirementplanning.com/schedule-a-meeting/

🟥 I Love Roth IRAs and Roth Conversions! 🟥

https://www.kiplinger.com/retirement/retirement-plans/roth-iras/604539/i-love-roth-iras-and-roth-conversions

🎥 Subscribe to our channel:

https://bit.ly/430T9Lv

🤝 Join our Insider's List:

https://peakretirementplanning.com/resources/

📞 Talk with us:

https://peakretirementplanning.com/schedule-a-meeting/

#retirement #retirementplanning #taxes

Disclaimer: Since we do not know your specific situation, none of this information can serve as tax, legal, financial, insurance, or financial advice, and may be outdated or inaccurate. The information comes from sources believed to be reliable but cannot be guaranteed. This content is prepared for educational purposes only. If you need advice, please contact a qualified CPA, attorney, insurance agent, financial advisor, or the appropriate professional for the subject you would like help with. Peak Retirement Planning, Inc. is an Ohio based registered investment adviser and able to offer advisory services in Ohio and in other states where registered or exempt from registration.

-

4:28:12

4:28:12

KataJade

5 hours agoHappy Apex Friday

11.3K -

LIVE

LIVE

The tooth entertainment

3 hours agoGears Of War Judgment Livestream lets get to 300 followers #GamingOnRumble

209 watching -

DVR

DVR

xBuRnTx

7 hours agoHappy Friday Everyone!

9.27K1 -

2:34:48

2:34:48

Laura Loomer

6 hours agoEP112: MS-13 EVICTED By President Trump

44K22 -

2:53:28

2:53:28

Toolman Tim

4 hours agoCommunity Gaming Night!! | Among Us

15.1K -

2:34:47

2:34:47

GamerGril

4 hours agoMost Dangerous Gril This Side Of The Mississippi

17.6K -

3:44:43

3:44:43

ZWOGs

4 hours ago🔴LIVE IN 1440p! - FiveM Fridays!! GTAV RP!! | Dwindle Digby | - Come Hang Out!

11.8K -

2:05:43

2:05:43

TimcastIRL

6 hours agoTrump Admin Notifies Congress USAID Is CLOSED, Fires EVERYONE, ITS OVER w/Dan Holloway | Timcast IRL

205K136 -

51:18

51:18

Man in America

10 hours agoClear Skies Coming? States Rally to Ban Geoengineering as RFK Jr. Calls Out ‘Toxic Dousing'

38.6K63 -

2:22:55

2:22:55

BlackDiamondGunsandGear

11 hours agoThe time is NOW! / EDC / Preps / Load Out

15.1K