Premium Only Content

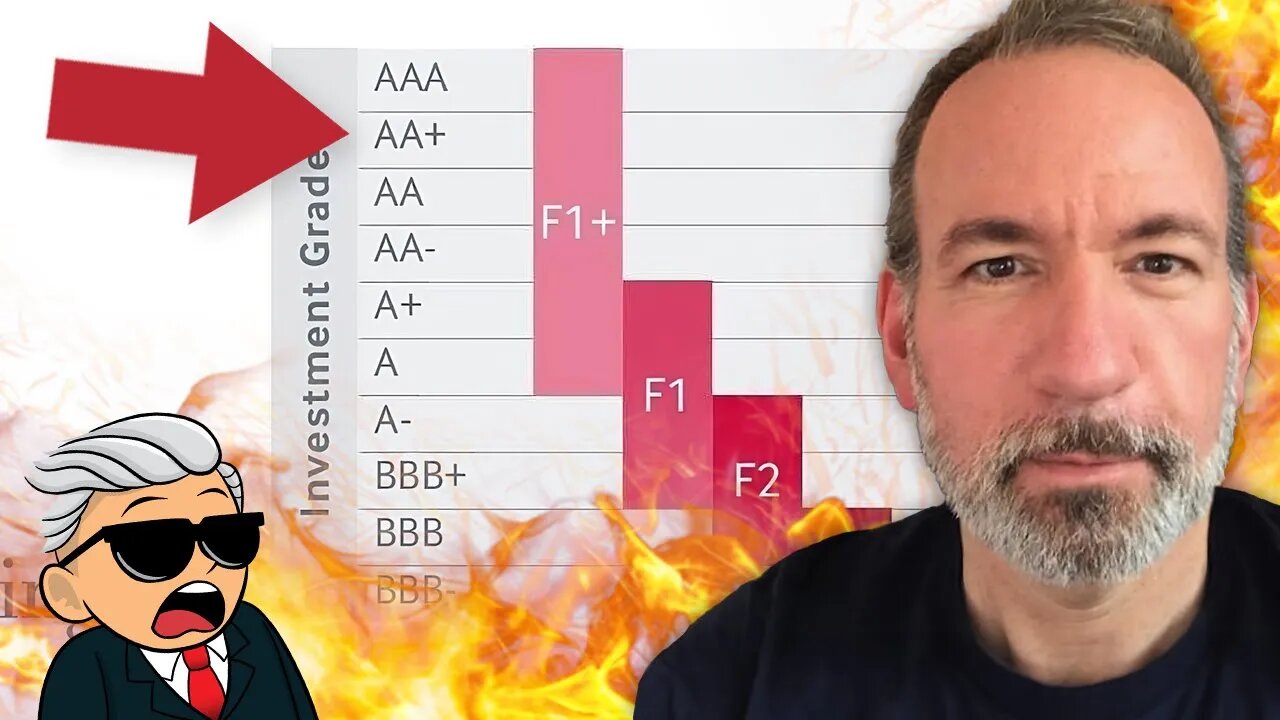

US Government Credit Rating Downgraded | Impact on Economy Explained! ft. Peter St Onge

In this video, Peter talks about the impact of Fitch's recent federal debt downgrade. With rising deficits and a risky debt-to-GDP ratio, the US faces higher interest rates on government debt, potentially pushing debt service to a staggering $2 trillion. Are we heading towards an economic crisis? Find out now!

Peter St Onge from @Profstonge has granted us permission to upload this video for our audience.

Peter's Twitter: https://twitter.com/profstonge?s=20

Peter's Substack: https://stonge.substack.com/

Peter's Website: https://peterstonge.com/

Twitter - https://twitter.com/WallStreetSilv

Instagram - https://www.instagram.com/wallstreetsilver/

Telegram - https://t.me/s/WallStreetSilver

Facebook - https://www.facebook.com/Wall-Street-Silver-103206701843254

Hey guys! Let’s try and break 1,000 likes on this video!

Don’t forget to SUBSCRIBE to the channel if you enjoy the video, and don’t forget to hit the bell so you don’t miss any future uploads!

DISCLAIMERS/TERMS/RULES:

► I am not a professional financial adviser, nor do I offer financial advice. This video is for entertainment only. Please consult your investment and tax experts for financial advice.

#silver #wallstreetsilver #gold #preciousmetals #silvergoldbull #Wall #Street #Reddit #Platinum #CurrencyReset #Reset #Silversqueeze #Fed #November2021 #2021 #worse #restart #financecommunity #stockexchange #inflation #preciousmetals #finance #banks #financecrash #gold #economy #money #economiccrisis #broke #credit #inflation #purchasingpower #systemchange #crisis #crash #marketing #insolvency #profit #bitcoin #Cryptocurrency #politics #media #stockmarket #stocks

-

3:06

3:06

Wall Street Silver

1 year ago $0.60 earnedAmericans Raiding Retirement Accounts! ft. Peter St Onge

2.11K4 -

LIVE

LIVE

Benny Johnson

3 hours ago🚨Robert F. Kennedy Jr. Confirmation LIVE Right NOW | Fauci and Big Pharma PANIC Over RFK!

20,866 watching -

LIVE

LIVE

LFA TV

17 hours agoRFK CONFIRMATION & MORE! | LIVE FROM AMERICA 1.29.25 11am

7,011 watching -

LIVE

LIVE

The Shannon Joy Show

1 hour ago🔥🔥Live Exclusive With Dr. Peter McCullough! RFK Jr. Confirmation Coverage & More!🔥🔥

316 watching -

2:07:01

2:07:01

Steven Crowder

3 hours agoTrump’s Funding Freeze: Fact-Checking the Mainstream Media Lies

194K129 -

DVR

DVR

Bannons War Room

1 year agoWarRoom Live

110M -

43:59

43:59

MYLUNCHBREAK CHANNEL PAGE

2 hours agoWho REALLY Built Our Cities?

8.89K6 -

38:25

38:25

Rethinking the Dollar

1 hour agoTrump Media Group Dives into Crypto with Truth.Fi Launch

5.47K1 -

1:30:06

1:30:06

Graham Allen

4 hours agoThe Border Is CLOSED!! 92% Less Crossings!! + Pete Hegseth Is GOING AFTER Mark Milley!

65.5K64 -

13:51

13:51

Dr David Jockers

2 hours agoUltimate Fat-Burning Hack: What They Don’t Tell You!

5.47K1