Premium Only Content

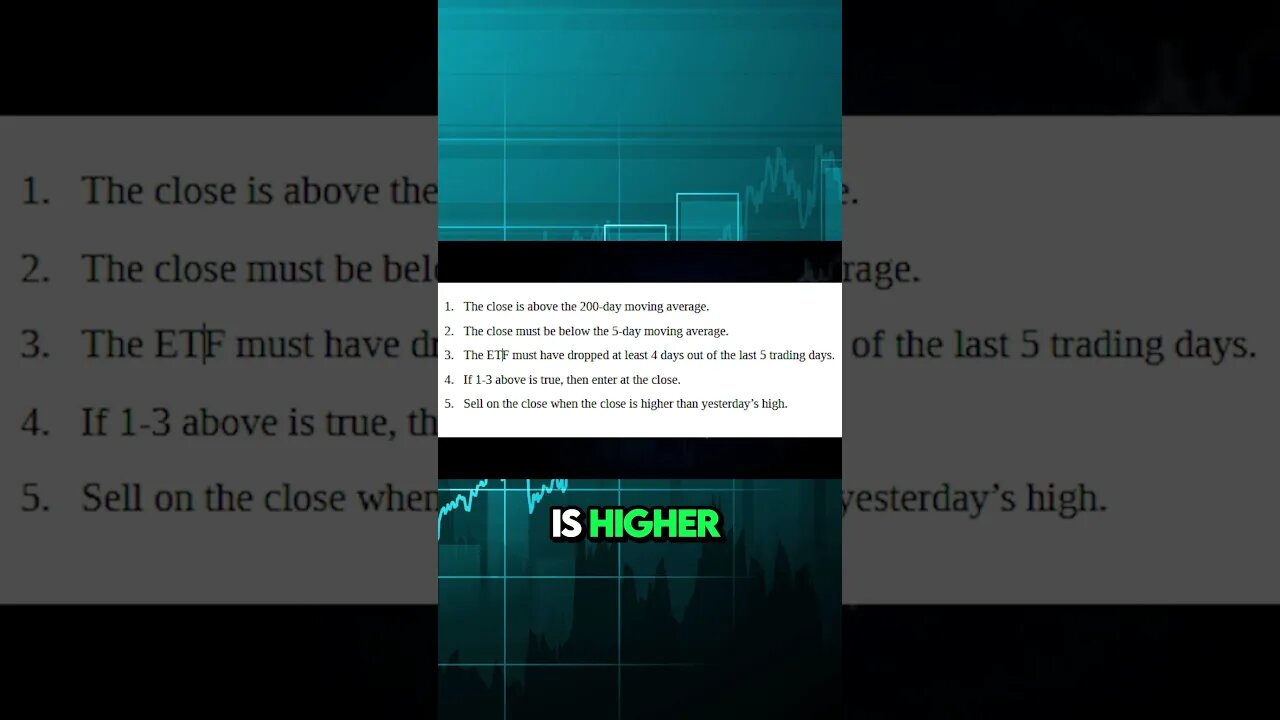

Multiple Up Days And Multiple Down Days Trading Strategy By Larry Connors

Visit our website For Over 200 Free Quantified Strategies: https://www.quantifiedstrategies.com/

Buy 24 of our Best Trading Strategies here: https://bit.ly/3r54NGH

In this video, I'm going to show you Multiple Up Days And Multiple Down Days Trading Strategy By Larry Connors.

======================================================

→ You can read more about our Trading Strategies here:

→ https://www.quantifiedstrategies.com/single-strategies-order

→ TWITTER: https://bit.ly/Twitter_QS

→ INSTAGRAM: https://bit.ly/Instagram_QS

→ NEWSLETTER - QUANTIFIED STRATEGIES

→ 30 000+ Traders read our free newsletter about trading strategies.

→ Sign up: https://bit.ly/substack_QS

======================================================

©Quantified Strategies - For all business inquiries contact sialofjord@gmail.com

This video is not to be reproduced without prior authorization. The original YouTube video may be distributed & embedded if required. If you need private coaching, book a call at quantifiedstrategies.com

#quantifiedstrategies #multipleupdaysmultipledowndays #tradingStrategy #LarryConnors #tradingstrategies

RISK DISCLAIMER

Quantified Strategies (SIA Lofjord) is not an investment advisor. The content and information provided are educational and should not be treated as financial advisory services or investment advice. Trading and investment in securities involve substantial risk of loss and is not recommended for anyone that is not a trained trader or investor – it shall be conducted at your own risk. It is recommended that you never risk more than you are willing to lose. Leverage can lead to substantial losses. Any use of leverage, margin, or shorting is at your discretion. Quantified Strategies (SIA Lofjord) is not responsible for any losses that occur as a result of its content and information.

Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, Since the trades have not been executed, the results may have under or overcompensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs, in general, are also subject to the fact that they are designed with the benefit of hindsight. No representations are made that any account will or is likely to achieve profit or losses similar to those shown.

-

35:50

35:50

BonginoReport

4 hours agoMy Dad's Senate Hearing - Kids, Chaos, and Everything! (Ep.120) - 01/16/2025

24.3K37 -

LIVE

LIVE

Vigilant News Network

14 hours agoBUSTED: O’Keefe Exposes Secret Pentagon Plot to Sabotage Trump’s Return | The Daily Dose

1,635 watching -

LIVE

LIVE

2 MIKES LIVE

11 hours agoTHE MIKE SCHWARTZ SHOW with DR. MICHAEL J SCHWARTZ 01-16-2025

149 watching -

43:10

43:10

PMG

11 hours agoHannah Faulkner and Jeff Younger | Father fights for his son!

284 -

1:24:14

1:24:14

Game On!

14 hours ago $3.41 earnedTaylor Swift SHOCKS Chief fans! Does NOT want Travis Kelce to retire!

25.9K7 -

4:27

4:27

Reforge Gaming

14 hours agoTHIS will not save Ubisoft.

42.4K4 -

7:35

7:35

Tactical Advisor

1 day agoNEW Springfield Prodigy Compact (FIRST LOOK)

67.8K7 -

16:45

16:45

IsaacButterfield

1 day ago $6.28 earnedWoke TikToks Are DESTROYING The World

37.1K32 -

1:09:27

1:09:27

State of the Second Podcast

18 hours agoThis is Why We Don’t Trust Politicians (ft. @stones2ndsense)

31.2K4 -

10:19

10:19

Chrissy Clark

15 hours agoCNN’s BILLION Dollar Defamation Trial

34.2K11