Premium Only Content

Not known Details About "Gold Rate vs Stock Market: Which One is a Safer Investment?"

https://rebrand.ly/Goldco2

Join Now

Not known Details About "Gold Rate vs Stock Market: Which One is a Safer Investment?" , gold rate investing

Goldco helps clients secure their retirement financial savings by surrendering their existing IRA, 401(k), 403(b) or various other qualified pension to a Gold IRA. ... To find out exactly how safe house precious metals can assist you build and also safeguard your wealth, and also also safeguard your retired life telephone call today gold rate investing.

Goldco is just one of the premier Precious Metals IRA business in the United States. Shield your wide range as well as livelihood with physical precious metals like gold ...gold rate investing.

Spending in Gold Costs: Long-Term versus Short-Term Approaches

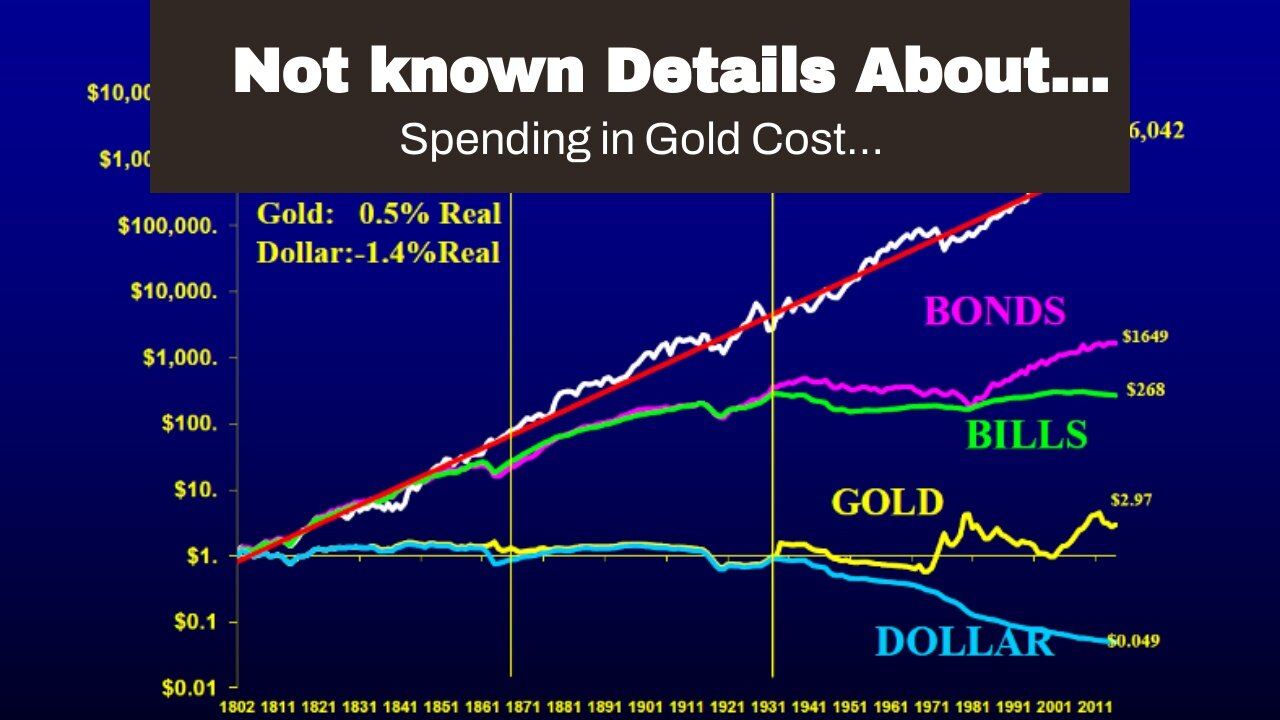

Gold has been a preferred investment choice for centuries, and its allure proceeds to bring in investors appearing for a safe shelter in times of economic anxiety. Its unique properties, featuring its sparsity and longevity, have made it a retail store of value throughout record. Nevertheless, when it comes to investing in gold rates, capitalists frequently locate themselves faced with the predicament of deciding on between long-term and short-term methods.

Long-term investing in gold involves acquiring and holding the priceless steel for an lengthy duration with the desire that its market value will certainly enjoy over time. This method is located on the idea that gold serves as a bush against inflation and currency changes. Through storing onto gold for years or also many years, capitalists target to secure their riches coming from wearing away due to economic recessions or geopolitical unpredictabilities.

One of the vital perks of long-term investing in gold is its potential to preserve purchasing electrical power over time. Gold has historically kept its market value during the course of durations of high rising cost of living when other resources, such as newspaper money or inventories, may devaluate significantly. This produces it an desirable alternative for those looking for to branch out their assets collections and guard against prospective financial dilemmas.

An additional benefit of long-term investing in gold is its possibility for financing gratitude. While the rate of gold can easily be inconsistent in the short phrase, historical record advises that it has presented steady growth over longer durations. For example, between 2001 and 2020, the price of gold improved by approximately 500%, surpassing many various other financial investment choices during this time frame.

Having said that, long-term investing in gold also happens along with particular problem. One such problem is storing expense linked with literally keeping the priceless metal. Capitalists who choose for bodily possession require to think about protected storing establishments or acquire extra expenses on insurance policy superiors.

On top of that, long-term capitalists must be prepared to survive market variations without caving in to panic selling. Gold prices can experience considerable dryness due to numerous elements, featuring improvements in rate of interest fees, geopolitical tensions, or financial clues. Nevertheless, investors who stay committed to their long-term method can possibly help from these cost swings and exploit on acquiring chances during market declines.

On the other hand, short-term investing in gold entails taking advantage of rate variations within a relatively short time frame. This tactic intends to profit from short-term market movements somewhat than relying on long-term gratitude. Short-term investors typically use specialized analysis devices and market signs to recognize prospective entrance and exit aspects for their business.

One conveniences of short-term investing in gold is the capacity for quick earnings. By actively monitoring the market and performing well-timed business, capitalists can easily exploit on short-lived cost fluctuations and create profits within a briefer timeframe reviewed to long-term strategies.

Additionally, short-term trading permits real estate investors to take conveniences of leverage used through derivative products like futures or possibilities arrangements. These monetary musical instruments enable investors to handle a much larger placement with a much smaller quantity of financing, possibly enhancing their increases if their prophecies about gold rate movements verify right.

No...

-

44:49

44:49

Chrissy Clark

14 hours agoThe Rise Of Female Shooters, ABC News’ $16M Settlement, & MORE I Underreported Stories

9.17K4 -

2:49:13

2:49:13

InfiniteWaters(DivingDeep)

22 hours agoIt's Over - The Matrix Is Cooked | Infinite Waters

6.54K9 -

15:49

15:49

Chris From The 740

1 day ago $2.57 earnedThe EAA Girsan Influencer X - Not Your Grandpa's 1911

19K2 -

25:38

25:38

Producer Michael

17 hours agoLuxury Souq's MULTI-MILLION DOLLAR Watch Collection!

80.1K5 -

17:06

17:06

Sleep is CANCELED

22 hours ago10 SCARY Videos To Keep You Up All Night!

59K2 -

2:37

2:37

Canadian Crooner

1 year agoPat Coolen | Let It Snow!

33.2K9 -

2:44

2:44

BIG NEM

13 hours agoWhat's Really Behind the Fake Alpha Male Epidemic?

28K4 -

57:20

57:20

State of the Second Podcast

7 days agoThe Inventor of Bump Stock Fights Back! (ft. Slide Fire)

19.2K5 -

1:04:12

1:04:12

PMG

1 day ago $17.83 earned"I’ll be DRONED for Christmas!"

63.2K12 -

23:38

23:38

RealitySurvival

1 day agoBest Anti-Drone Rounds For Self Defense

37.7K6