Premium Only Content

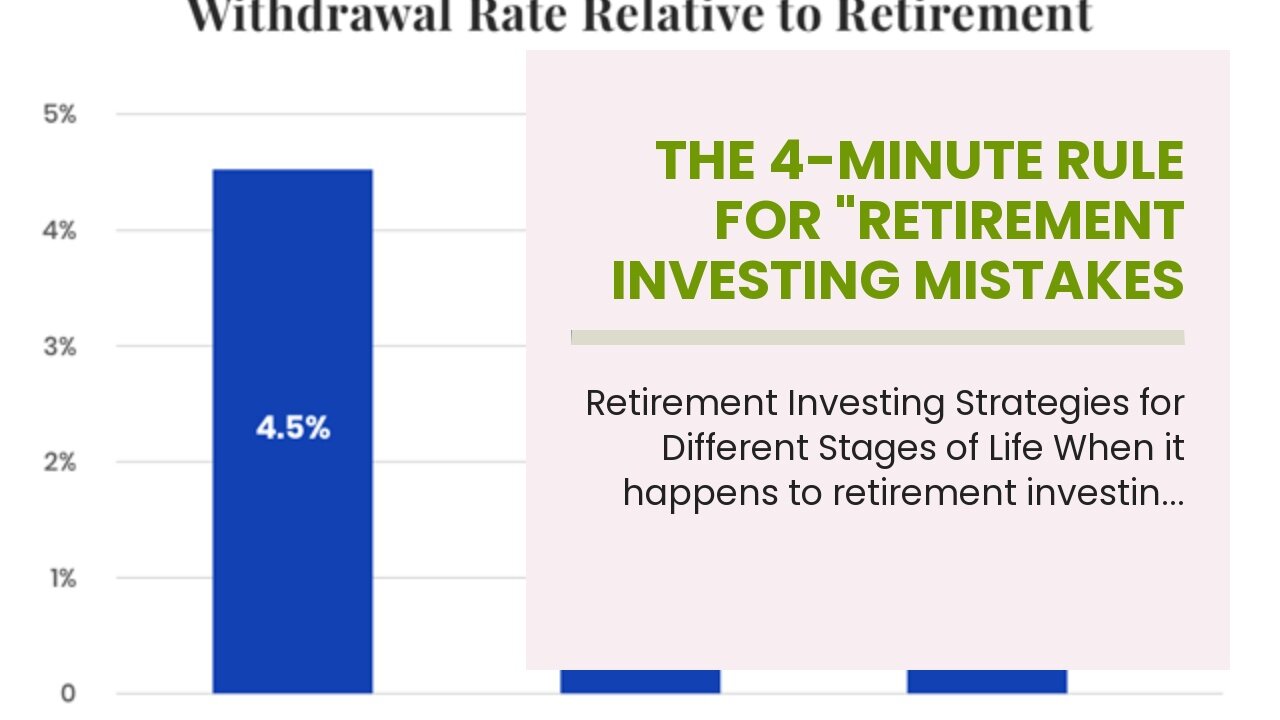

The 4-Minute Rule for "Retirement Investing Mistakes to Avoid at All Costs"

https://rebrand.ly/Goldco5

Get More Info Now

The 4-Minute Rule for "Retirement Investing Mistakes to Avoid at All Costs", retirement investing basics

Goldco aids customers shield their retired life cost savings by surrendering their existing IRA, 401(k), 403(b) or other competent retirement account to a Gold IRA. ... To discover how safe house precious metals can assist you construct and safeguard your riches, and also also protect your retired life telephone call today retirement investing basics.

Goldco is among the premier Precious Metals IRA companies in the United States. Safeguard your wide range and also income with physical rare-earth elements like gold ...retirement investing basics.

Retirement Investing Strategies for Different Stages of Life

When it happens to retirement investing, there is no one-size-fits-all technique. The methods you employ to expand and protect your home egg will differ relying on the stage of lifestyle you are in. Whether you are simply beginning your job, moving toward retirement life, or already appreciating your gold years, understanding the different expenditure strategies accessible can easily aid you make informed choices and protect a comfy future.

Early Career: Developing the Foundation

Throughout the early stages of your profession, opportunity is your best resource. With several many years until retired life, you have the deluxe of taking on even more threat and putting in for long-term growth. Listed here are a few essential approaches to think about:

1. Start Saving Early: The quicker you begin sparing for retired life, the more time your financial investments possess to magnify and increase. Intend to add a part of your revenue to a tax-advantaged retired life account like a 401(k) or an Individual Retirement Account (IRA).

2. Spend in Supplies: Supplies deliver greater development ability over the lengthy condition contrasted to various other possession courses like connections or cash money matchings. Consider transforming your collection all over various sectors and market limits to minimize risk.

3. Take Perk of Employer Matching: If your employer uses a 401(k) suit plan, contribute sufficient to optimize their suit contribution. This is generally free money that can dramatically improve your financial savings.

Mid-Career: Balancing Growth and Stability

As you progress in your job and move toward middle age, it's essential to hit a equilibrium between growth-oriented investments and secure profit resources:

1. Determine Your Risk Endurance: As duties improve along with age (such as getting a property or starting a household), reassessing your danger tolerance comes to be essential. Look at changing your possession allocation by progressively switching some funds coming from equities into fixed-income protections like bonds.

2. Diversify Your Financial investments: Continue expanding around various property classes and geographies to disperse out risk. Genuine real estate, assets, and international investments may help hedge against dryness in the domestic market.

3. Provide to Retirement Accounts: Maximize your additions to retirement life accounts and take benefit of catch-up payments if you are 50 years or more mature. This permits you to give a boost to your cost savings before retirement.

Approaching Retirement: Preserving Resources

As retirement technique, capital conservation becomes a vital factor. The key target is to protect the wide range you have accumulated over the years while generating a steady revenue flow. Here are some approaches to take into consideration:

1. Switch Towards Conservative Investments: As you near retirement life, gradually minimize your direct exposure to capitals and improve expenditures in fixed-income assets like bonds and certificates of deposit (CDs). These investments offer dependable revenue and lower dryness.

2. Think about Allowances: Allowances may be an attractive choice for senior citizens looking for a promised income stream that lasts for life or a details time period. Nevertheless, it's necessary to properly review the terms and ailments before committing.

3. Create a Withdrawal Tactic: Establish how a lot cash you will need to have each year throughout retirement life and produce a withdrawal method that ensures your cost savings last as long as possible. Look at working along with a monetary specialist who can easily assist optimize your withdrawals based on...

-

1:50:38

1:50:38

Mally_Mouse

7 hours agoSaturday Shenanigans!! - Let's Play: Mario Party Jamboree

40.5K -

1:13:00

1:13:00

Patriots With Grit

11 hours agoWill Americans Rise Up? | Jeff Calhoun

29.1K10 -

14:55

14:55

Exploring With Nug

11 hours ago $9.92 earnedWe Found Semi Truck Containers While Searching for Missing Man!

47.6K7 -

27:57

27:57

MYLUNCHBREAK CHANNEL PAGE

19 hours agoOff Limits to the Public - Pt 3

98K62 -

38:07

38:07

Michael Franzese

11 hours agoLeaving Organized Crime and Uncovering Mob in Politics: Tudor Dixon and Michael Franzese

85.5K15 -

2:42:54

2:42:54

Jewels Jones Live ®

2 days agoAMERICA IS BACK | A Political Rendezvous - Ep. 111

73.1K48 -

8:47:33

8:47:33

Due Dissidence

1 day agoLIVE: Workers Strike Back Conference ft. Chris Hedges, Jill Stein, Kshama Sawant, and More!

110K57 -

8:36:37

8:36:37

Right Side Broadcasting Network

5 days agoLIVE REPLAY: CPAC 2025 Day Three with President Donald J. Trump - 2/22/25

449K101 -

1:05:34

1:05:34

The Big Mig™

19 hours agoConfirmed Kash Patel New FBI Director, Bring On The Pain |EP483

107K31 -

53:59

53:59

Tactical Advisor

15 hours agoThe Vault Room Podcast 009 | Everyone Getting $5000?!

85.6K12