Premium Only Content

August BRICS Summit hails death knell for the dollar

In this week’s episode of Live from the Vault, Andrew Maguire discusses the latest Basel III advancements and the indisputable impact of NSFR regulations on physical gold, following its reclassification as a “first tier” asset class.

The whistleblower dives deep into the major unwinding risks emerging on the ‘illusionary’ ETF markets due to BRICS’ positive influence on central banks’ gold purchases, prompting them to ditch derivatives and pursue the tangible asset.

Timestamps:

00:00 Start

01:40 The health of the precious metals markets in the Basel III environment

07:50 How are central bank gold purchases impacting the physical wholesale markets?

16:50 Are gold ETFs being affected by the demand for physical bullion?

22:08 Is the FED out of touch with gold as an asset class?

25:03 The potential rehypothecation of 8,133 tonnes of treasury gold

30:20 A report on the BRICS’ currency

37:48 How Russia have stepped up the ante on COMEX gold markets

40:45 An alternative gold back currency as a benchmark for commodity pricing?

47:20 What does Andrew predict for the silver market?

Learn more about Kinesis by visiting our website: https://kinesis.money/

Leave a comment below with who you want our expert analyst to discuss gold with and we'll see what we can do...

Twitter: https://twitter.com/KinesisMonetary

Facebook: https://www.facebook.com/kinesismoney/

Telegram: https://t.me/kinesismoney

Reddit: https://www.reddit.com/r/Kinesis_money/

Kinesis Forum: https://forum.kinesis.money/

-

UPCOMING

UPCOMING

Melonie Mac

3 hours agoThe Game Awards Live Reaction! Go Boom Live Ep 31!

7.41K1 -

LIVE

LIVE

Exploring With Nug

8 hours agoMissing Person Found After 25 Years With A Dark Past! What Did He Do?

186 watching -

1:02:09

1:02:09

In The Litter Box w/ Jewels & Catturd

22 hours agoFANI IN DEFAULT | In the Litter Box w/ Jewels & Catturd – Ep. 703 – 12/11/2024

63.7K19 -

3:21:08

3:21:08

Viss

7 hours ago🔴LIVE - Dominating The Delta Force Arena! - Delta Force Extractions

32.3K5 -

17:41

17:41

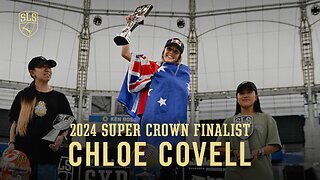

SLS - Street League Skateboarding

6 hours agoSuper Crown Finalist: Chloe Covell | Best of the 2024 SLS Championship Tour, so far…

21.9K1 -

2:09:10

2:09:10

Mally_Mouse

3 hours agoLet's Yap About It - LIVE!

67K2 -

2:31:13

2:31:13

Film Threat

9 hours agoJUSTINE BATEMAN SPEAKS! LIVE INTERVIEW | Hollywood on the Rocks

40.8K4 -

4:02

4:02

Guns & Gadgets 2nd Amendment News

3 hours agoBREAKING NEWS: FBI Director RESIGNS

25.6K42 -

11:24

11:24

Dr David Jockers

3 hours ago $1.11 earnedHow High Blood Sugar Destroys Your Arteries & How To Fix It

18.4K1 -

4:02:40

4:02:40

StoneMountain64

5 hours ago1st person FORTNITE is here.

37.9K3