Premium Only Content

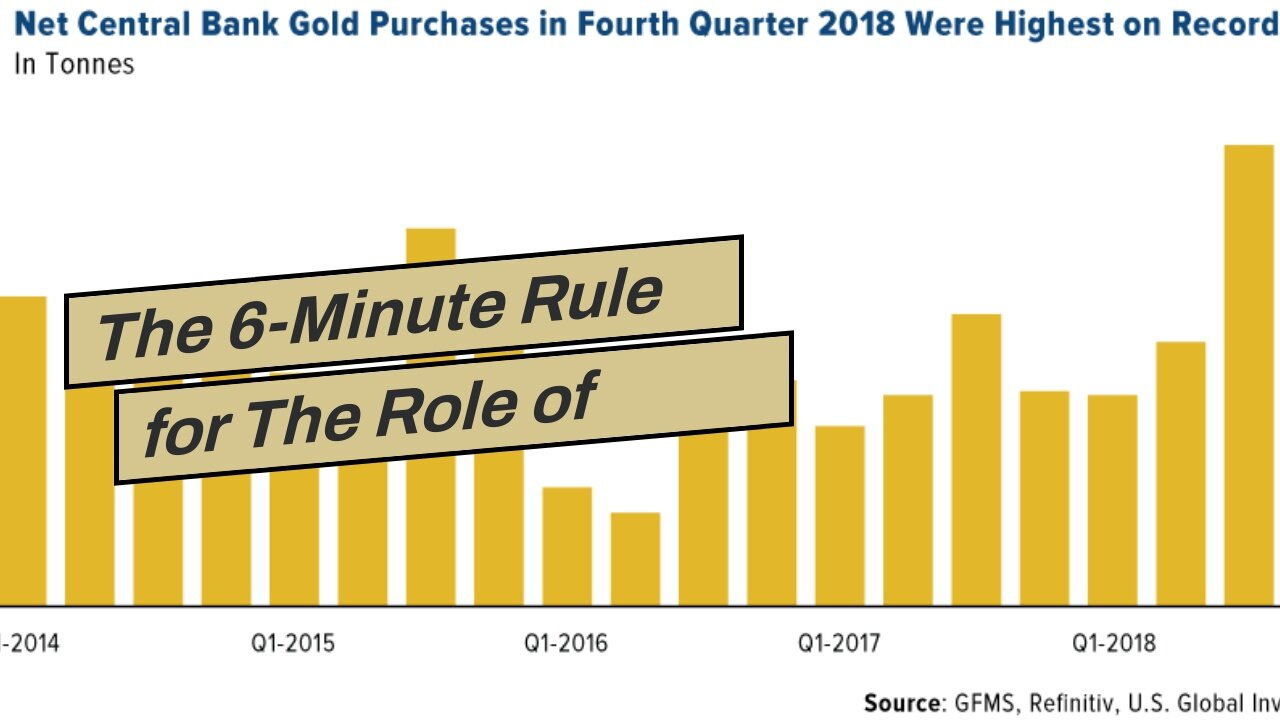

The 6-Minute Rule for The Role of Central Banks in the Gold Market and Its Impact on Gold Inves...

https://rebrand.ly/Goldco3

Get More Info Now

The 6-Minute Rule for The Role of Central Banks in the Gold Market and Its Impact on Gold Investors, gold investor gold

Goldco helps clients safeguard their retirement savings by surrendering their existing IRA, 401(k), 403(b) or other certified pension to a Gold IRA. ... To find out just how safe haven precious metals can assist you develop and also protect your wide range, and even safeguard your retirement telephone call today gold investor gold.

Goldco is among the premier Precious Metals IRA firms in the United States. Protect your wealth as well as livelihood with physical precious metals like gold ...gold investor gold.

The Psychology of a Successful Gold Investor: Understanding Market Sentiment and Producing Informed Choices

Gold has been a important commodity for centuries, and its appeal as a risk-free shelter investment has just grown more powerful in recent years. Entrepreneurs switch to gold throughout times of economic anxiety, political irregularity, and inflationary stress. Nonetheless, spending in gold is not without risks, and understanding the psychological science responsible for prosperous gold investing is vital for making informed choices in this market.

Market sentiment plays a substantial function in the rate fluctuations of gold. Sentiment recommends to the general feeling or perspective that entrepreneurs have in the direction of an asset class. When market view is favorable, investors are confident regarding the future performance of gold and are more eager to purchase it. However, when feeling turns bad, real estate investors become afraid and tend to sell their gold holdings.

Understanding market view requires assessing various aspects that influence investor behavior. Financial clues such as GDP development costs, rising cost of living costs, interest costs, and lack of employment bodies all play a duty in shaping feeling. Geopolitical events such as battles, vote-castings, business issues, or organic disasters can easily also considerably influence market sentiment.

Psychological biases likewise influence investor actions when it comes to gold investing. Intellectual biases are fundamental psychological quick ways that people use when making selections under health conditions of uncertainty or restricted information. These biases can overshadow judgment and lead to illogical decision-making.

One popular prejudice among clients is the herd mentality or complying with the crowd. When everyone else is purchasing gold due to positive belief or rising prices, investors might experience urged to carry out the very same out of anxiety of skipping out on potential increases. This herd mentality may produce cost bubbles where valuations become removed coming from fundamentals.

Another bias is loss hostility - the propensity for individuals to really feel the ache of reductions a lot more acutely than they appreciate gains. This bias commonly leads financiers to keep onto dropping settings a lot longer than they ought to out of hope that costs will recoup instead than cutting their reductions early.

Verification prejudice is an additional psychological catch that financiers should be mindful of. This prejudice occurs when individuals look for out information that confirms their existing opinions while dismissing or dismissing conflicting documentation. Gold real estate investors who are high on the steel may simply spend interest to information or study that supports their positive outlook, thereby skipping out on important alternative perspectives.

Productive gold financiers recognize these emotional prejudices and job to conquered them. They realize the value of performing detailed investigation and study before making investment decisions. They do not count exclusively on market feeling but likewise evaluate basic factors such as supply and demand characteristics, central financial institution policies, and macroeconomic fads.

In addition, prosperous gold entrepreneurs preserve a long-term standpoint. They understand that short-term cost changes are unavoidable and do not allow short-lived market dryness shake their conviction in the worth of gold as a risk-free sanctuary asset. Through keeping emotional states in examination and focusing on long-term objectives, they prevent producing rash selections based on short-term market conviction.

Furthermore, productive gold capitalists expand their collections...

-

LIVE

LIVE

The Dan Bongino Show

1 hour agoThings Have Changed, It's Trump's GOP Now (Ep. 2390) - 12/18/2024

58,355 watching -

LIVE

LIVE

Steven Crowder

2 hours ago🔴 The True Cost of Fat Pride: How It's Destroying America

50,804 watching -

LIVE

LIVE

Matt Kohrs

8 hours agoFed's FOMC Decision Day Chaos || The MK Show

1,733 watching -

LIVE

LIVE

Caleb Hammer

33 minutes agoI've Never Met A Woman Like This | Financial Audit

301 watching -

LIVE

LIVE

LFA TV

14 hours agoREMOVE MIKE JOHNSON! | LIVE FROM AMERICA 12.18.24 11am EST

1,047 watching -

LIVE

LIVE

MYLUNCHBREAK CHANNEL PAGE

2 hours agoBuildings That Shouldn't Exist?

306 watching -

42:09

42:09

BonginoReport

2 hours agoLock Her Up (Ep.107) - 12/18/2024

50.4K74 -

LIVE

LIVE

Vigilant News Network

15 hours agoLiz Cheney’s Problems Just Got WORSE | The Daily Dose

1,545 watching -

22:04

22:04

Scammer Payback

17 hours agoTorturing a Scammer Till They Give Up

4.16K8 -

1:51:30

1:51:30

Game On!

14 hours ago $10.24 earnedConor McGregor vs Logan Paul: BIGGEST Boxing Match of the Century!

64.8K10