Premium Only Content

Global Health Insurance Plans in Canada

Global health insurance, also known as international health insurance or expatriate health insurance, is designed to provide comprehensive medical coverage for individuals or families living or traveling outside their home country, including Canadians residing or traveling abroad. Here’s an overview of global health insurance options for Canadians:

1. Coverage for International Travel:

Global health insurance provides coverage for Canadians traveling outside of Canada for business or leisure purposes. It offers benefits such as emergency medical expenses, hospitalization, outpatient care, emergency medical evacuation, repatriation, and coverage for accidental injuries or illnesses that may occur while abroad.

2. Coverage for Canadians Living Abroad:

For Canadians residing abroad, global health insurance offers long-term coverage that can span months or years. It provides access to healthcare services in the host country, including preventive care, doctor visits, hospitalization, maternity care, and specialist consultations, depending on the chosen plan.

3. Comprehensive Medical Coverage:

Global health insurance plans typically offer comprehensive coverage that goes beyond emergency medical care. They often include coverage for routine medical check-ups, vaccinations, prescription medications, mental health services, preventive care, and chronic condition management.

4. Worldwide Network of Providers:

Global health insurance providers often have extensive networks of healthcare providers, hospitals, and medical facilities worldwide. This network ensures that policyholders can access quality healthcare services within the provider’s network or through reimbursement arrangements.

5. Flexibility and Customization:

Global health insurance plans often offer flexibility in terms of coverage options, allowing individuals to customize their plans based on their specific needs and budget. Policyholders can choose from different levels of coverage, add-on benefits, and deductible options to tailor the plan to their requirements.

6. Pre-existing Conditions Coverage:

Some global health insurance plans may offer coverage for pre-existing medical conditions, either fully or with certain waiting periods or exclusions. It is essential to carefully review the policy terms and conditions to understand the coverage for pre-existing conditions.

7. Travel Assistance Services:

In addition to medical coverage, global health insurance plans may include travel assistance services. These services provide support in various situations such as emergency travel arrangements, translation services, lost document assistance, and 24/7 medical advice helplines.

8. Repatriation and Medical Evacuation:

Global health insurance plans often cover the cost of emergency medical evacuation to transport the insured person back to their home country for medical treatment if the required level of care is not available locally. They may also provide coverage for the repatriation of mortal remains in the unfortunate event of death while abroad.

9. Multilingual Customer Service:

Global health insurance providers typically have multilingual customer service teams that can assist policyholders in their native language, providing support and guidance with claims, coverage queries, and general inquiries.

10. Compliance with Visa Requirements:

Global health insurance plans may comply with visa requirements for certain countries, ensuring that policyholders meet the mandatory health insurance requirements when applying for visas or residency permits.

It is important for Canadians seeking global health insurance to research and compare different insurance providers, considering factors such as coverage limits, exclusions, premium costs, network of providers, and customer reviews. Working with an experienced insurance broker specializing in international health insurance can help navigate the available options and select the most suitable plan.

-

14:36

14:36

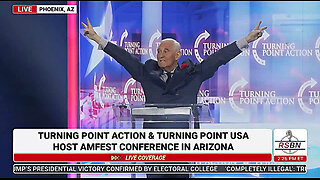

The StoneZONE with Roger Stone

1 day agoRoger Stone Delivers Riveting Speech at Turning Point’s AMFEST 2024 | FULL SPEECH

108K27 -

18:59

18:59

Fit'n Fire

14 hours ago $6.41 earnedZenith ZF5 The Best MP5 Clone available

63.1K2 -

58:34

58:34

Rethinking the Dollar

23 hours agoTrump Faces 'Big Mess' Ahead | RTD News Update

49K5 -

5:35

5:35

Dermatologist Dr. Dustin Portela

23 hours ago $2.30 earnedUnboxing Neutrogena PR Box: Skincare Products and Surprises!

62.6K5 -

11:20

11:20

China Uncensored

22 hours agoCan the US Exploit a Rift Between China and Russia?

74.8K23 -

2:08:48

2:08:48

TheSaltyCracker

17 hours agoLefty Grifters Go MAGA ReeEEeE Stream 12-22-24

272K715 -

1:15:40

1:15:40

Man in America

20 hours agoThe DISTURBING Truth: How Seed Oils, the Vatican, and Procter & Gamble Are Connected w/ Dan Lyons

161K146 -

6:46:07

6:46:07

Rance's Gaming Corner

22 hours agoTime for some RUMBLE FPS!! Get in here.. w/Fragniac

182K5 -

1:30:48

1:30:48

Josh Pate's College Football Show

21 hours ago $11.54 earnedCFP Reaction Special | Early Quarterfinal Thoughts | Transfer Portal Intel | Fixing The Playoff

112K2 -

23:55

23:55

CartierFamily

3 days agoElon & Vivek TRIGGER Congress as DOGE SHUTS DOWN Government

147K162