Premium Only Content

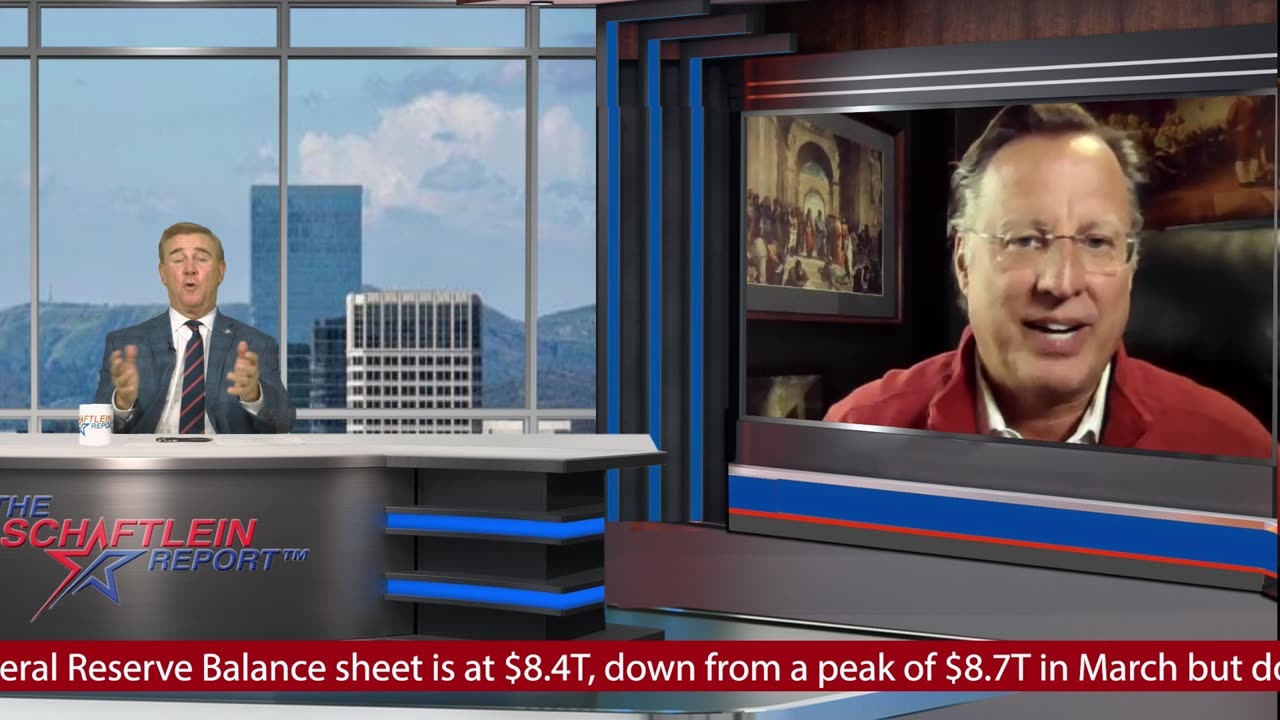

Schaftlein Report | Where is the Economy Now and is it headed to a "Soft Landing"?

Guest - Dave Brat

Dean - Liberty School of Business

1) Has the Stock Market Inflated Too Fast? The forward P/E is 19.5. AI mania or reality driving optimism?

1A) The Federal Reserve Balance sheet is at $8.4T, down from a peak of $8.7T in March but double the $4.0T in March 2020

1B) Stock prices are at the same level as they were in March 2022 when Interest Rates started to rise. Apple trading at 31X forward earnings versus long term average of 15X

Nvidia trading at 156X cash flow versus 14X over time

1C) The S & P 500 is closely tied to QE? What about QT happening now?

1D) The median Employee costs in the U.S. averages $62K. At META it is $300K and GOOG $280K. How soft or firm is the labor market?

2) China cutting interest rates. How much is their economy slowing or not growing out of Covid?

3) The Commercial real estate debacle hanging over SF and NYC - Crime, progressive policies, retailers leaving

4) Case Shiller Inflation Adjusted PE ratio is 31X versus a median of 17X

5) Should the Federal Reserve resume rate increases or leave as is and react to data? 4% Inflation seems low to most Americans

6) The recent spending agreement between the White House and Congress - Dave Brat gives his opinion

7) The political landscape and upcoming budget negotiations heading into the fall

-

29:26

29:26

Schaftlein Report

9 months agoSchaftlein Report | Guest - Drew Allen Headline - Illegal Immigration Wreaking Havoc

74 -

LIVE

LIVE

Scottish Viking Gaming

8 hours ago🔴LIVE | SUNDAY FUNDAY | Jump into my Sons of the Forest Game | DOO EET NOWWA!

1,006 watching -

24:01

24:01

Winston Marshall

4 days agoThe TRUTH About The UK Farmer Protest What No One Is Talking About...

51.1K150 -

3:21:56

3:21:56

Tate Speech by Andrew Tate

13 hours agoEMERGENCY MEETING EPISODE 93 - ME TOO!

208K146 -

3:21:42

3:21:42

FRENCHY4185

8 hours agoPRESTIGE AND CAMO GRIND : BLACK OPS 6

49.5K2 -

1:29:47

1:29:47

Real Coffee With Scott Adams

8 hours agoEpisode 2669 CWSA 11/24/24

67.6K29 -

13:52

13:52

Hershberger's Kitchen

20 hours agoTwo Delicious Dip and Spread Recipes to Try, Inspirational Thought

66.4K5 -

3:41:05

3:41:05

Sacred Sage

11 hours ago $4.46 earnedDaz3D: Attempting to Finish Zoe Conversation!

59.1K5 -

![[Stream #19 ] Gaming, Chatting, you know the drill!](https://1a-1791.com/video/s8/1/W/f/M/4/WfM4u.0kob-small-Stream-19-Gaming-Chatting-y.jpg) 8:14:24

8:14:24

OneRandomDolly

9 hours ago[Stream #19 ] Gaming, Chatting, you know the drill!

70.4K4 -

11:07

11:07

TimcastIRL

1 day agoElon Musk Suggests He’ll BUY MSNBC, Joe Rogan Will REPLACE Rachel Maddow

91.1K111