Premium Only Content

Schwab, Citadel Securities, Fidelity and other Wall Street Firms Start Bitcoin/Crypto EDX Exchange!

A Crypto exchange backed by financial giants Charles Schwab, Fidelity Digital Assets and Citadel Securities has officially launched trading in four Crypto assets, the company said Tuesday. News of this sent the price of Bitcoin up $1k+ in just a few hours.

EDX Markets first announced its launch plans for a “non-custodial” exchange in September, about two months before the collapse of FTX. Paradigm, Sequoia Capital and Virtu Financial are among the other early backers.

The announcement comes days after BlackRock filed an application to launch what would be the first spot bitcoin ETF in the U.S., confirmation that despite the crypto industry’s black eye from FTX and other bad actors in 2022, and the chill from U.S. regulators this year, long-term institutional interest has not diminished.

The EDX exchange allows trading of Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH) and Litecoin (LTC) – none of which were named “Crypto Asset Securities” in the lawsuits the Securities and Exchange Commission (SEC) brought against Binance and Coinbase two weeks ago.

EDX has said it strives to “meet the needs of the world’s largest and most sophisticated financial institutions” – many of which remain crypto curious but skeptical of centralized crypto services providers, if not because of the failures of many in 2022 then because of the regulatory uncertainty the remaining players now find themselves in.

To quell any fears about misuse of funds, EDX plans to operate as a “non-custodial” exchange, meaning that rather than handling customer assets directly it will act as a platform on which a network of firms can execute and settle trades between crypto assets and fiat currencies.

EDX also has plans to launch a clearinghouse business this year to facilitate the settlement process but will still keep customer assets held at third-party banks and a crypto custodian.

The company is set to announce Tuesday that it has closed a second funding round with new investors, including the options-exchange operator Miami International Holdings and affiliates of proprietary trading firms DV Trading, GTS, GSR and Hudson River Trading.

🦁 www.MAGAlionHAT.com 🦁

-------------------------------------------------------------------------------------------------------

Enjoy the content I provide? Please help support this renegade channel with PayPal! 💰

PayPal: MAGAlionHAT@Gmail.com

Or, if you like you can Buy Me A Coffee: https://www.buymeacoffee.com/MAGAlionHAT

Crypto wallet addresses below. If you have a type of Crypto you wish to donate that I don't have a wallet for, email me and I will create one! 🤑

It keeps me afloat while I'm working to produce informative and entertaining videos while finding and providing gems from other creators for you to enjoy! 🤗

Any donation would be GREATLY appreciated! Thank you and God Bless! 🙏

₿itcoin (BTC):

bc1q63xshh2c2u4tvc6jksl5crlhtp554qu0l4nn8j

₿itcoin Cash (BCH):

qqms8t79e6rk5z5djad360d38y9kkqnh7yfpxkkuy5

₿itcoin SV (BSV):

1F6oH8qkMjswViJSwq965gRivE3DqKuJKC

Litecoin (LTC):

LgxrUdjUxnmFGLtsAbh76C3aAm3dXAGDFV

Dogecoin (DOGE):

DGn5bkC9WM1E2oM79HWiYoVxE3rHuEGkoS

Ethereum Classic (ETC):

0xC03AEe5333D50a20810e1A7585D9BB3f77E0B773

Ethereum (ETH):

0x27d5493Ac22D56B68cF36F5f77594BDC8e6FAc5E

Shiba Inu (SHIB):

0x27d5493Ac22D56B68cF36F5f77594BDC8e6FAc5E

Chainlink (LINK):

0x27d5493Ac22D56B68cF36F5f77594BDC8e6FAc5E

Polygon (MATIC):

0x27d5493Ac22D56B68cF36F5f77594BDC8e6FAc5E

Ripple (XRP):

rwvGofsMZQMyqro9YPe7swpo6C6Kagpg2e

VeChain (VET):

0x6410f2e05fEF8169bd1A6935884B9D4D56D9017b

-

1:03

1:03

MAGA Lion HAT

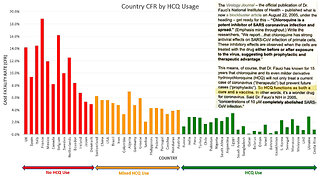

4 days agoHCQ was banned for COVID because EUA for the mRNA shot required that No Alternative Treatment Exists

2081 -

LIVE

LIVE

The Rubin Report

1 hour agoDetails About Joy Reid’s Weeping Farewell No One Noticed with Co-Host Megyn Kelly

1,941 watching -

LIVE

LIVE

Benny Johnson

44 minutes ago🚨Epstein Files COVERUP EXPOSED: FBI Sabotaging Trump, DELETING Evidence?! | Tapes 'MISSING'?!

5,130 watching -

59:29

59:29

Steven Crowder

2 hours agoCrafting Crowder's Comedy Gold | Behind the Scenes

54.8K51 -

LIVE

LIVE

Tim Pool

1 hour agoTHE END OF THE WEST, Will We Survive Without Christianity? | The Culture War with Tim Pool

4,444 watching -

LIVE

LIVE

Right Side Broadcasting Network

1 hour agoLIVE: President Trump and Ukrainian President Zelenskyy Meet and Hold a Press Briefing - 2/28/25

3,411 watching -

LIVE

LIVE

LFA TV

14 hours agoBODYCAM FOOTAGE OF TRAFFIC STOP! | LIVE FROM AMERICA 2.28.25 11AM

3,605 watching -

48:58

48:58

BonginoReport

3 hours agoFake Epstein Files Fallout + Will Cain on the Government’s Internal Civil War (Ep.150) - 02/28/2025

72.6K191 -

22:54

22:54

Clownfish TV

11 hours agoJournalists are RAGE QUITTING! Mainstream Media's Free Ride is OVER!

7963 -

![🔴[LIVE TRADING] Market Crash, Inflation Report & Payday Friday || The MK Show](https://1a-1791.com/video/fwe1/ce/s8/1/g/J/Y/n/gJYny.0kob.1-small-The-MK-Show-Feb.-28th.jpg) LIVE

LIVE

Matt Kohrs

9 hours ago🔴[LIVE TRADING] Market Crash, Inflation Report & Payday Friday || The MK Show

1,317 watching