Premium Only Content

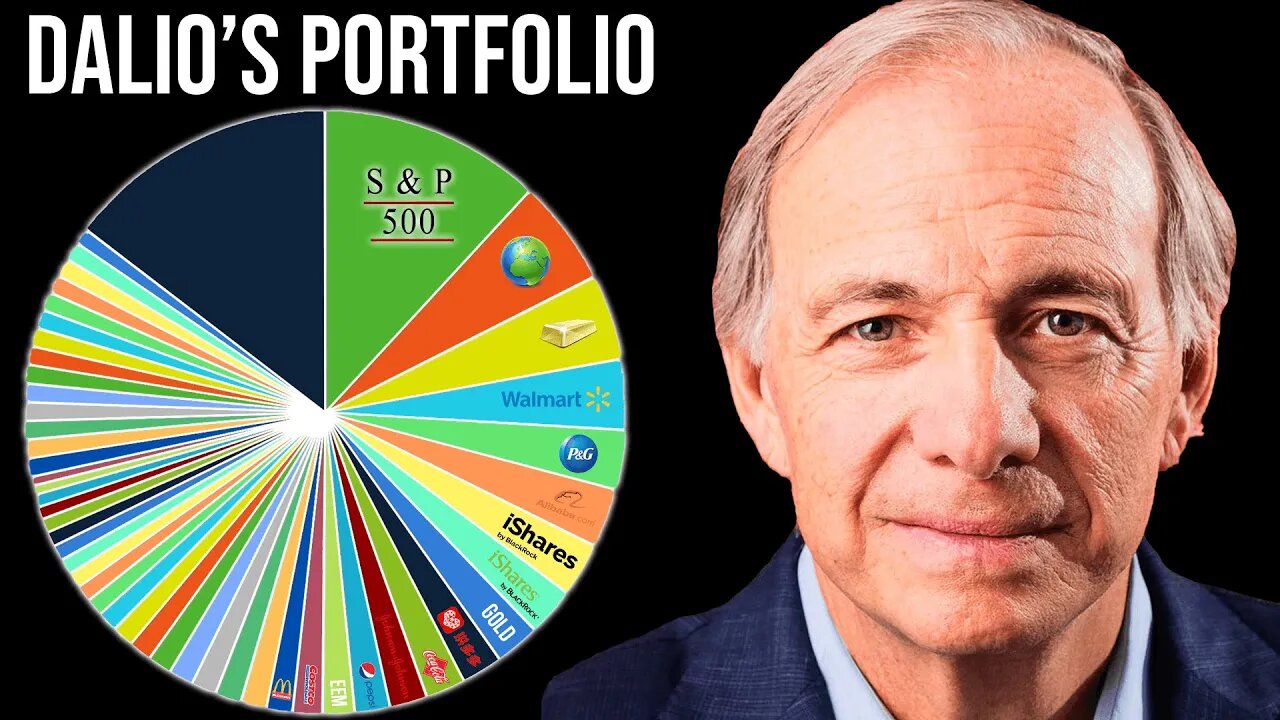

A Breakdown Of Ray Dalio’s 2021 Portfolio

See My Portfolio & Where Opportunity Is In The Market (Discount): https://theinvestingacademy.teachable.com/p/theinvestingacademy?coupon_code=SALE&product_id=4455382

Let's take a look at what Ray Dalio's portfolio looks like in 2021.

__________________________________

Ray Dalio. I’m sure you all know who he is, he’s the founder & manager of the largest hedge fund in the world Bridgewater. Dalio’s one of the most followed investors in modern times & in this video we’re going to reveal his portfolio at Bridgewater. I want to break each investment down piece by piece, tell you a bit about them, and see how his portfolio balances out. Let’s get into it…

Investment 1: SPDR S&P 500 ETF Trust

So the first investment is what’s known as an ETF. An etf is just a group of different stocks bunched together. In this case it’s the S & P 500. The S & P 500 is an index of 500 very large USA companies. These stocks are a good indicator of the entire USA market as a whole.

So straight away Dalio is exposing his portfolio to companies like Apple, Microsoft, Amazon, Facebook, Tesla, Alphabet, Berkshire Hathaway, Johnson & Johnson, those huge American companies.

This is the largest investment of Dalio’s portfolio making up 11.9% of it. He owns $1.38 billion dollars of the S & P 500, straight away allowing for diversification and the lowering of risk…

Investment 2: Vanguard FTSE Emerging Markets ETF

Now again his second largest position is an etf, but this is completely different. The vanguard emerging markets etf, instead of holding groups

of large USA companies, they own companies throughout emerging markets. In China, Brazil, Taiwan, and South Africa.

The etfs 10 largest holdings from 1 to 10 are, Taiwan Semiconductor Manufacturing, Tencent, Alibaba, Meituan, Naspers, Ping Insurance, Reliance Industries, JD.com, China Construction Bank & last is NIO the electric car company.

This ETF makes up 5.7% of Dalios portfolio over at Bridgewater a total value of $659 million dollars. What you’ll notice, right from the start Dalio is diversifying across the globe. His biggest investments are in the USA, but second is those high growth emerging markets around the world…

Investment 3: SPDR Gold Trust

Anyone who has been a Dalio follower for a while will not be surprised by this investment. Dalio likes gold. One of his famous quotes is “If you don't own Gold, you know neither history nor economics.”.

And he’s put his money where his mouth is, the SPDR gold trust makes up his 3rd largest investment, at 4.6% of his portfolio. His total investment is $532 million dollars of Bridgewaters assets…

For any of you guys out there looking to own the SPDR gold trust, the ticker symbol is GLD, the expense ratio for holding this is 0.4% a year, and even I Cooper have owned this investment for some time now…

Investment 4: Walmart

Now we start getting into the individual stocks that Dalio has picked out…

His biggest individual stock position is Walmart, ticker symbol WMT on the nyse exchange. This makes up 3.8% of his portfolio, valued at $443.8 million dollars…

Walmart as we all know it’s the chain of discount department stores, scattered throughout America, Canada, Mexico & a couple of other countries. Altogether they have 11,443 stores, bringing in $548 billion dollars of total revenue, making them the largest company in the world based on that figure.

This stock exposes the portfolio nicely to a steady part of the market, which is retail. Retail, that’s a sector that’s been going on since humans started trading, and it will continue to do so…

The stock currently sells for $132 a share, generating yearly earnings of $4.75. Their dividend is $2.20 per share giving them a nice 1.65% annual dividend return…

Subscribe Here: https://bit.ly/2Y1kNq8

___

DISCLAIMER: It's important to note that I am not a financial adviser and you should do your own research when picking stocks to invest in. This video was made for educational and entertainment purposes only. Consult your financial adviser. * Some of the links on this webpage are affiliate links. This means at no additional cost to you, we earn a commission if you click through and make a purchase and/or subscribe. This has no impact on my opinions, facts or style of video.

-

1:09:33

1:09:33

Glenn Greenwald

12 hours agoMichael Tracey Reports from CPAC: Exclusive Interviews with Liz Truss, Steve Bannon & More | SYSTEM UPDATE #412

91.8K78 -

56:02

56:02

Sarah Westall

8 hours agoBiohacking & Peptides: Weight loss, Anti-Aging & Performance – Myth vs Reality w/ Dr. Diane Kazer

41.4K14 -

11:22

11:22

Bearing

18 hours ago"Anxious & Confused" Federal Workers FREAK OUT Over DOGE Efficiency Email 💥

56.3K61 -

1:31:20

1:31:20

Flyover Conservatives

1 day agoUS STOCK MARKET: Sinking Ship - Dr. Kirk Elliott; How I Fought Back Against Woke Schools & Stopped Gender Bathrooms - Stacy Washington | FOC Show

62.8K1 -

1:08:09

1:08:09

Donald Trump Jr.

13 hours agoFBI Dream Team, Plus Taking Your Questions Live! | Triggered Ep.219

202K268 -

7:32:37

7:32:37

Akademiks

12 hours agoDrake and PartyNextDoor '$$$4U' Album Sells 250K first week. BIG AK IS BACK.

120K18 -

3:12:08

3:12:08

MyronGainesX

11 hours ago $32.10 earnedDan Bongino Named As Deputy Director Of FBI And CPAC Recap

97.5K27 -

3:12:31

3:12:31

vivafrei

11 hours agoBarnes Live from Seattle - Defending Benshoof in a Case that is CRAY CRAY!

155K48 -

2:12:12

2:12:12

Robert Gouveia

11 hours agoLiberals EXPLODE over Elon's Email; Lawsuits FLY; Sanctions?? Congrats Dan!

116K38 -

1:33:36

1:33:36

Redacted News

12 hours agoBREAKING! PUTIN LAUNCHES MASSIVE OFFENSIVE IN UKRAINE AS EUROPEAN LEADERS PUSH FOR MORE WAR

193K260