Premium Only Content

Some Ideas on "How to Create a Diversified Retirement Portfolio with Multiple Investment Plans"...

https://rebrand.ly/Goldco

Sign up Now

Some Ideas on "How to Create a Diversified Retirement Portfolio with Multiple Investment Plans" You Should Know, retirement savings investment plan

Goldco assists customers shield their retirement savings by rolling over their existing IRA, 401(k), 403(b) or other professional pension to a Gold IRA. ... To learn how safe haven precious metals can assist you build and also shield your riches, and also even safeguard your retired life phone call today retirement savings investment plan.

Goldco is just one of the premier Precious Metals IRA firms in the United States. Shield your riches as well as livelihood with physical rare-earth elements like gold ...retirement savings investment plan.

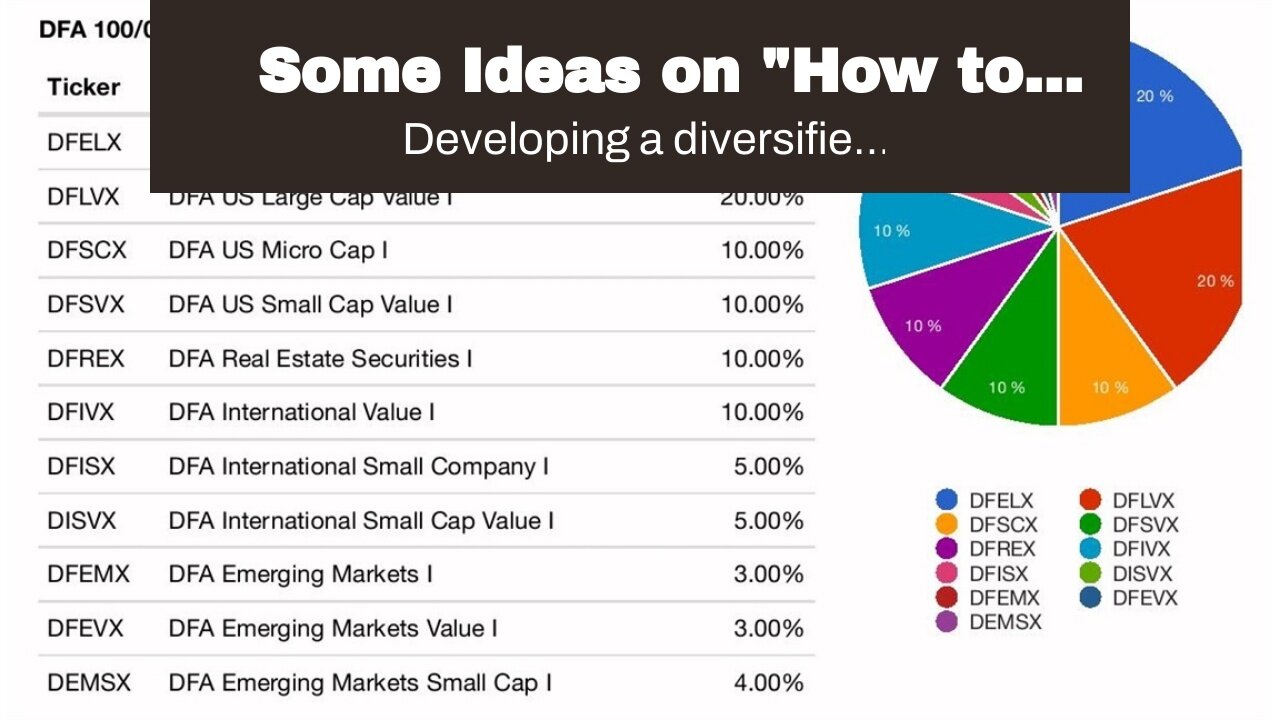

Developing a diversified retirement profile is an crucial facet of individual monetary planning. A well-diversified profile with a number of expenditure planning can easily deliver a dependable revenue stream in the course of retired life, safeguard against market dryness, and make sure that you achieve your long-term monetary objectives. In this write-up, we will look into the actions entailed in producing a diversified retired life portfolio with various assets program.

Measure 1: Assess Your Danger Tolerance Level

The initial measure in establishing a varied retired life profile is to evaluate your threat tolerance degree. Risk resistance refers to the amount of economic risk that an entrepreneur is ready to take. Different entrepreneurs possess various threat endurance amounts based on their age, revenue, net worth, financial investment encounter, and private circumstances.

If you are youthful and possess many years until retirement, you might be a lot more relaxed taking on higher-risk investments like inventories or reciprocal funds. On the other hand, if you are closer to retired life grow older or possess a lower internet worth, you may wish to consider low-risk investments like connections or CDs.

Action 2: Determine Your Investment Objectives

The second action in generating a diversified retirement life profile is to identify your investment targets. Investment targets refer to the details goals that you wish your expenditures to obtain. These purposes might include creating income during retired life, giving for your children's learning expenditures, or leaving behind cash for charitable source.

Once you have recognized your expenditure objectives, it will certainly be less complicated to decide on the appropriate mix of investments for your profile. For instance, if generating revenue is one of your primary purposes in the course of retirement, after that putting in in dividend-paying stocks or real real estate investment leaves (REITs) may be suitable.

Measure 3: Pick Multiple Investment Program

After determining your risk resistance level and determining your expenditure goals, it's opportunity to decide on a number of assets planning for your diversified retirement profile. A well-diversified profile need to consist of a mix of resource classes such as sells, connections, real estate expenditures count on (REITs), exchange-traded funds (ETFs), and common funds.

Supplies: Supplies are an ownership allotment in a business. Spending in sells can easily deliver high gains but likewise lugs higher threat as the worth of the stock can easily vary commonly depending on market conditions.

Bonds: Connects are financial debt instruments that deliver a fixed enthusiasm cost for a particular period. Putting in in connections can easily provide stable money flow, but they use lesser gains than inventories.

REITs: Genuine real estate investment relies on (REITs) commit in income-generating properties like apartment or condos, workplace buildings, and shopping centers. They use a dependable profit stream and diversity perks.

ETFs: Exchange-traded funds (ETFs) are identical to mutual funds but field like sells on an substitution. ETFs deliver diversity perks and low fees.

Mutual Funds: Mutual funds pool cash coming from numerous clients to buy securities such as stocks, connections, or other possessions. Shared funds deliver professional monitoring and diversification benefits.

Measure 4: Assign Your Resources

Once you have selected various financial investment program for your diversified retirement profile, it's time to designate your possessions among them. Resource allocation recommends to the procedure of breaking down your financial investm...

-

22:39

22:39

The Mel K Show

2 hours agoMel K & Representative Brandon Gill | Our Constitutional Republic is Being Restored | 4-26-25

8.95K12 -

LIVE

LIVE

VapinGamers

1 hour ago📣 Fortnite Family Night! - Games and Dubs with BrianZGame - !rumbot

29 watching -

LIVE

LIVE

ThePope_Live

20 minutes agoLIVE - First time playing The Finals in over a YEAR! Still good? with @Arrowthorn

79 watching -

LIVE

LIVE

TruthStream with Joe and Scott

6 hours agoRoundtable with Patriot Underground and News Treason Live 4/26 5pm pacific 8pm Eastern

674 watching -

8:52

8:52

Tundra Tactical

3 hours ago $4.82 earnedSCOTUS Denies Appeal, Minnesota Courts Deal 2a Win!

9.63K7 -

LIVE

LIVE

a12cat34dog

5 hours agoONE WITH THE DARK & SHADOWS :: The Elder Scrolls IV: Oblivion Remastered :: FIRST-TIME PLAYING {18+}

214 watching -

22:27

22:27

Exploring With Nug

12 hours ago $9.26 earnedSwamp Yields a Chilling Discovery in 40-Year Search for Missing Man!

24.5K15 -

1:23:26

1:23:26

RiftTV/Slightly Offensive

7 hours ago $8.48 earnedThe LUCRATIVE Side of Programming and the SECRETS of the "Tech Right" | Guest: Hunter Isaacson

39.3K16 -

27:57

27:57

MYLUNCHBREAK CHANNEL PAGE

1 day agoDams Destroyed India

50.7K19 -

LIVE

LIVE

Phyxicx

7 hours agoLast minute practice before Sunday - 4/26/2025

241 watching