Premium Only Content

June Stock Market Outlook - Unveiling Hidden Opportunities and Navigating with Caution

🟢 BOOKMAP DISCOUNT: https://bit.ly/3F8qdGb

🟢 TRADE IDEAS & DISCORD: https://www.patreon.com/figuringoutmoney

🟢 TRADE WITH IBKR: http://bit.ly/3mIUUfC

______________________________________________________________________________________________

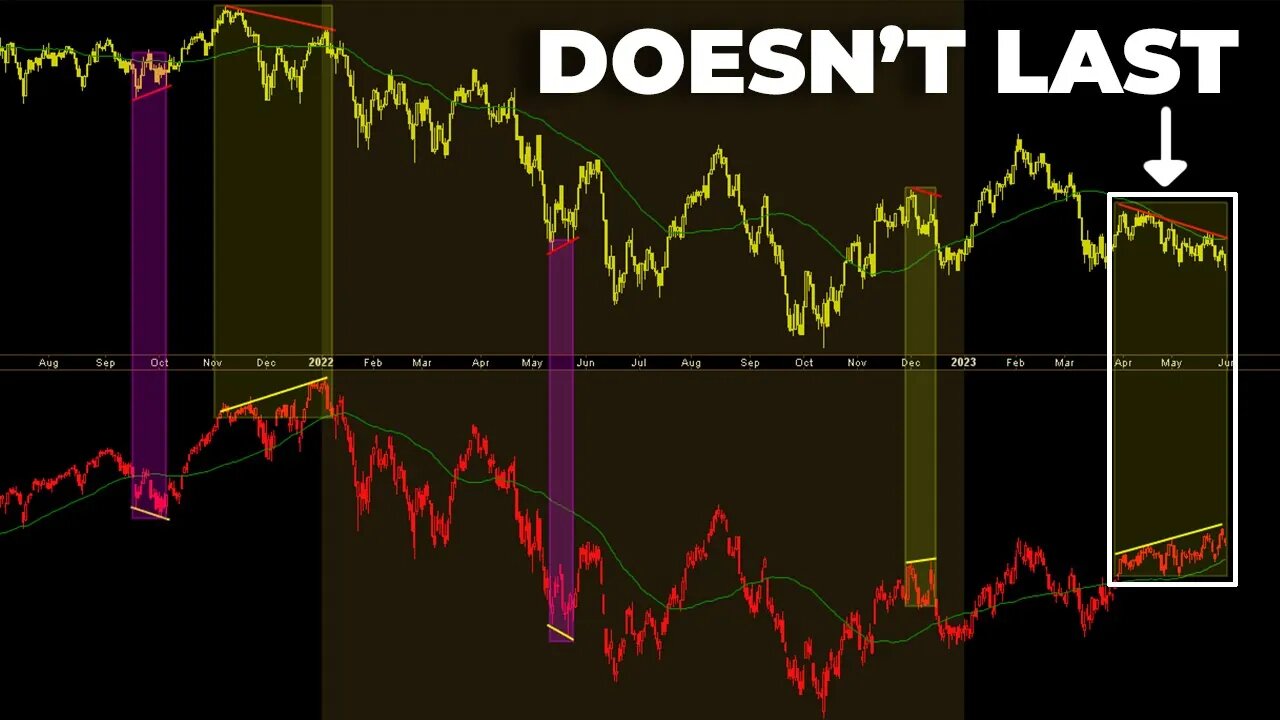

In this video, we discuss the market outlook for June. While May showed positive growth, we need to approach June tactically. The S&P 500 is facing resistance at 4,200 and may slide down if it falls below this level. The market breadth and stocks above moving averages are decreasing, indicating potential weakness.

Many stocks have experienced breakdowns in May, creating potential opportunities at lower levels. Sectors like crude oil, energy, retail, and Bitcoin have seen declines, while technology has led the market.

The tech-heavy Nasdaq has shown a strong upward move but may consolidate or pull back. Major stocks like Apple, Amazon, Microsoft, and Google may undergo corrective movements or sideways consolidation before resuming their uptrend.

Technology, discretionary, and communication services tend to perform well near market bottoms. Industrials may present opportunities as well. The Dow Jones Industrials holding above its 200-day moving average suggests a potential upward move.

Examining Dow theory, transports appear weak while industrials have shown a lower low. This suggests a possible opportunity for an upward move in industrials despite caution regarding transports.

In conclusion, approach the market cautiously in June. Look for opportunities in sectors that have declined, consider potential consolidations in overextended stocks, and remain mindful of intermarket relationships and market cycles for informed decisions.

🔔 Subscribe now and never miss an update: https://www.youtube.com/c/figuringoutmoney?sub_confirmation=1

📧 For business inquiries or collaboration opportunities, please contact us at FiguringOutMoney@gmail.com

📈 Follow us on social media for more insights and updates:

🟢 Instagram: https://www.instagram.com/figuringoutmoney

🟢 Twitter: https://twitter.com/mikepsilva

______________________________________________________________________________________________

______________________________________________________________________________________________

DISCLAIMER: I am not a professional investment advisor, nor do I claim to be. All my videos are for entertainment and educational purposes only. This is not trading advice. I am wrong all the time. Everything you watch on my channel is my opinion. Links included in this description might be affiliate links. If you purchase a product or service with the links that I provide I may receive a small commission. There is no additional charge to you! Thank you for supporting my channel :)

#stockmarket #sp500 #technicalanalysis

-

24:50

24:50

Figuring Out Money

1 year ago $0.01 earnedThe Stock Market's Biggest Competitor Is Looking Better And Better.

56 -

LIVE

LIVE

LFA TV

16 hours agoFLUSHING THE TURDS! | LIVE FROM AMERICA 2.26.25 11AM

4,737 watching -

1:07:54

1:07:54

Timcast

2 hours agoTulsi FIRED 100+ Deep State PERVS After Fed Kink Chat EXPOSED, Trump CLEANS HOUSE | Timcast LIVE

100K26 -

DVR

DVR

Bannons War Room

8 days agoWarRoom Live

2.03M373 -

LIVE

LIVE

House Committee on Energy and Commerce

4 days agoO&I Hearing: Examining the Biden Administration’s Energy and Environment Spending Push

200 watching -

2:10:18

2:10:18

Matt Kohrs

13 hours agoThe Crypto Crash, Stock Bounce & Breaking News || The MK Show

44.3K3 -

LIVE

LIVE

Caleb Hammer

1 hour agoFinancial Audit’s Dumbest Couple Ever

225 watching -

LIVE

LIVE

MYLUNCHBREAK CHANNEL PAGE

1 day agoA Little Season in the East?

499 watching -

56:48

56:48

VSiNLive

2 hours ago $1.30 earnedA Numbers Game with Gill Alexander | Hour 1

15.7K -

1:18:45

1:18:45

Dear America

3 hours agoTrump: Russia/Ukraine Peace Deal IMMINENT! + Tucker RESPONDS To Crenshaw!

56K15