Premium Only Content

Marvell Technology: Explosive Surge On AI Narrative (NASDAQ:MRVL) - Seeking Alpha

🥇 Bonuses, Promotions, and the Best Online Casino Reviews you can trust: https://bit.ly/BigFunCasinoGame

Marvell Technology: Explosive Surge On AI Narrative (NASDAQ:MRVL) - Seeking Alpha

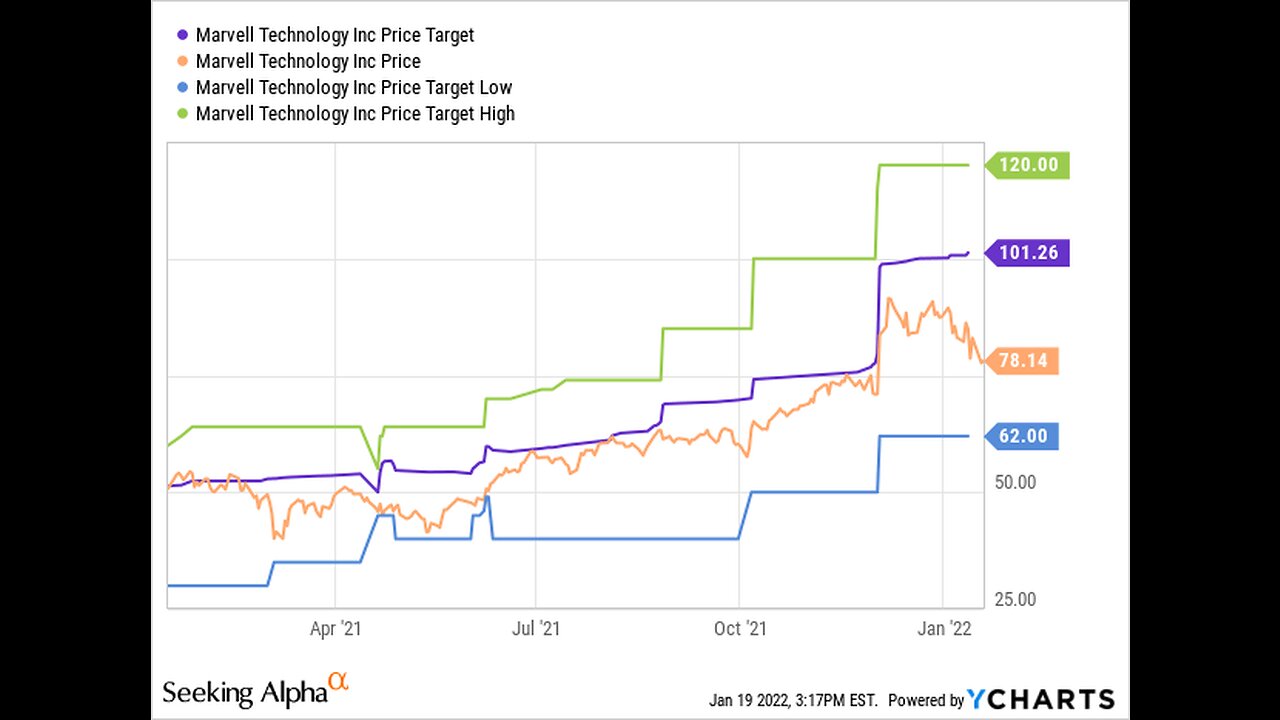

Leon Neal In my previous article on Marvell Technology, Inc. (NASDAQ:MRVL ), I updated investors that the leading enterprise and data center networking chips company is likely bottoming as "bulls are lurking." While the banking crisis in March led to a further selloff, after its FQ4'23 earnings release, dip buyers returned to defend the pullback. As such, MRVL held the lows it formed in January 2023, suggesting that long-term buyers likely saw attractive value. This week's earnings release for Marvell's fiscal first quarter (FQ1'24) saw MRVL stage a "rocketship-esque" vertical surge as AI investors piled into the stock. In addition, management fueled investors' and analysts' optimism as it significantly raised guidance for AI-related revenue. Accordingly, Marvell astutely quantified its AI revenue to help investors better assess the underlying growth drivers in AI. Therefore, management's ability to put robust forward projections to its AI tailwinds likely bolstered investors' confidence significantly about the sustainability of the growth inflection. Marvell updated investors that it expects a CAGR of 100% in AI revenue from FY23 to FY25. However, the AI base for FY23 was relatively small, as it accounted for just $200M (relative to Marvell's total revenue of $5.92B). However, management expects AI revenue to reach $800M by FY25. Based on the revised Wall Street estimates of $6.53B for FY25, AI revenue is expected to account for more than 12% of Marvell's total revenue by FY25. Therefore, the optimism and fair value upgrades are justified, as Marvell benefits from data center tailwinds as cloud service providers retool their architecture. Management reminded investors that AI is "a significant opportunity for Marvell, with its importance and potential increasing rapidly." Putting solid numbers behind the hype indicates that AI is not just a bubble but probably something more sustainable for the leading chip companies. Marvell's leading solutions in networking are expected to critically underpin the AI growth inflection as data centers remodel the requirements for generative AI. Management underscored why AI proffers such substantial potential for the company, as CEO Matt Murphy articulated: Today's AI workloads require a truly massive data sets. To efficiently process this data, the architecture for AI data centers is significantly different than standard cloud infrastructure. Rather than dual-socket [CPU] servers as the core element in, the primary building block in AI is a system containing multiple accelerators such as GPUs. In large deployments, thousands of these systems are interconnected to form a data center-sized AI cluster. Bandwidth required to interconnect these systems is orders of magnitude higher than in standard cloud infrastructure. - Marvell FQ1'24 earnings call Bandwidth... that's the "magic" word, and that's where Marvell's solutions come into play. Murphy accentuated that the company is seeing robust growth in "PAM4 optics, PAM4 DSP, and some DCI solutions for AI traffic." In addition, Murphy indicated strong visibility into its growth, stressing that "next year's growth in AI will be fueled by the continued strong demand for PAM4 optics and the addition of cloud-optimized solutions." Moreover, the company highlighted it's confident that its revenue and profitability growth has bottomed, with sequential improvement over the FY. While the company could see weakness in storage and possibly enterprise in the second half, cloud and AI growth drivers should help mitigate their downside risks. MRVL quant factor ratings (Seeking Alpha) With MRVL's valuation ('F' grade by Seeking Alpha Quant) rated as a growth stock, the assurances by management are very well-received by investors. It helps to lower the execution risks for the company through FY25, helping to justify its growth drivers. However, the company has a significant revenue exposure to China (42% for FY23). As such, investors must assess China's nascent economic recovery from its post-COVID reopening, which has been surprisingly tepid. I assessed that MRVL is slightly overvalued at the current levels, but not excessively. MRVL price chart (weekly) (TradingView) However, MRVL's vertical momentum surge indicates that investors must be cautious if they decid...

-

4:03:43

4:03:43

Benny Johnson

8 hours ago🚨Pete Hegseth Senate Confirmation Vote Happening LIVE NOW | MAJOR Shakeup at Pentagon

169K409 -

2:14:18

2:14:18

FreshandFit

6 hours agoCastle Club Zoom Call Show

48.8K5 -

1:01:08

1:01:08

SNEAKO

6 hours agoFRIDAY NIGHT VIBES

37K2 -

1:16:47

1:16:47

Talk Nerdy 2 Us

12 hours agoTrump’s Biggest Sign, Sticker Mule’s Secrets & The Cybersecurity Threats They Don’t Want You to Know

19.6K5 -

4:57:20

4:57:20

Robert Gouveia

9 hours agoHegseth Final Vote; Trump SLAPS Biased D.C. Judge; Rebuilding North Carolina

40K58 -

47:40

47:40

Man in America

10 hours agoCan Trump Avert Economic Disaster Amid a $35T Debt Crisis? w/ Collin Plume

81.8K15 -

4:07:44

4:07:44

I_Came_With_Fire_Podcast

13 hours ago🔥🔥Trump’s FIRST WEEK, FTOs, Deportations, & JFK FILES🔥🔥

33.2K2 -

5:26:14

5:26:14

Barry Cunningham

10 hours agoTRUMP DAILY BRIEFING: PETE HEGSETH & KRISTI NOEM CONFIRMATIONS - TRUMP IN CALIFORNIA!

34.2K27 -

2:06:17

2:06:17

Joker Effect

5 hours agoWhy So Serious Gameplay: Making scrubs in Brawlhalla cry baby tears.

21.7K3 -

1:24:02

1:24:02

Roseanne Barr

9 hours ago $19.39 earnedDaddy's Home | The Roseanne Barr Podcast #84

52.9K102