Premium Only Content

Rumored Buzz on "Comparing physical gold vs. gold ETFs for investing purposes"

https://rebrand.ly/Goldco1

Get More Info Now

Rumored Buzz on "Comparing physical gold vs. gold ETFs for investing purposes" , investing gold market

Goldco helps clients safeguard their retirement cost savings by rolling over their existing IRA, 401(k), 403(b) or other qualified pension to a Gold IRA. ... To learn how safe haven precious metals can aid you develop and also safeguard your wide range, and also even safeguard your retired life telephone call today investing gold market.

Goldco is one of the premier Precious Metals IRA business in the United States. Shield your wealth as well as source of income with physical precious metals like gold ...investing gold market.

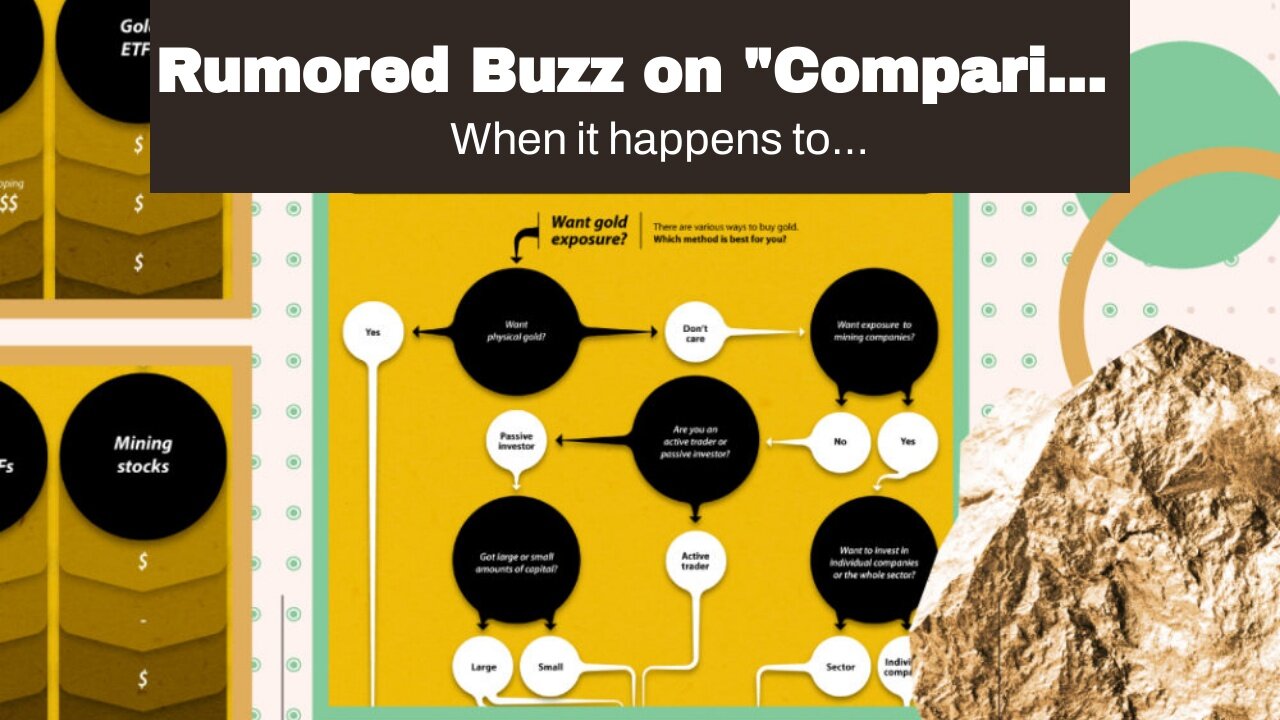

When it happens to spending in gold, there are two prominent possibilities: bodily gold and gold ETFs. Both possess their own perks and drawbacks, helping make it vital for capitalists to properly think about which option is best suited for their expenditure objectives.

Physical Gold

Physical gold refers to the positive steel that investors may literally hold in the form of pieces, pubs or fashion jewelry. The very most substantial advantage of committing in physical gold is that it offers a hedge versus rising cost of living and currency decrease. It is additionally taken into consideration a risk-free haven asset during times of economic anxiety, as its worth has a tendency to improve when various other properties such as inventories and connects decline.

One of the significant disadvantages of putting in in physical gold is the high cost connected with acquiring and storing it securely. Financiers should pay costs over the location cost when buying bodily gold products like coins or clubs from suppliers. Additionally, they require to consider storage expense if they want to maintain their investment secure. In addition, offering physical gold can easily be challenging because finding a buyer who is eager to pay out a fair cost may be difficult.

Gold ETFs

Gold ETFs (Exchange-Traded Funds) are economic instruments that permit investors to put in in a roundabout way in gold without possessing bodily metallic. Rather, these funds store derivatives or sells working with possession of physical gold kept through a custodian banking company.

One notable benefit of putting in in Gold ETFs is ease; real estate investors don't have to worry regarding acquiring or storing bodily steel. Also, ETFs use better versatility since they trade like sells on exchanges. This suggests that entrepreneurs can easily acquire and offer them rapidly without worrying regarding liquidity concerns.

Having said that, Gold ETFs come with some downsides also. One major drawback is that they might not deliver capitalists along with an ample hedge versus rising cost of living since they are topic to counterparty threat (the risk that the custodian bank may stop working). Moreover, expense ratios affiliated along with these funds can easily wear down yields over opportunity.

Conclusion

In review, both Physical Gold and Gold ETFs possess their pros and cons, and investors must analyze them thoroughly. For those who wish to have bodily gold and feel that it will enjoy dramatically in the future, Physical Gold might be the absolute best option. Nevertheless, real estate investors who really want visibility to gold but don't yearn for to work with the inconveniences of having bodily metallic could choose for Gold ETFs.

Eventually, investing in gold needs mindful point to consider of an investor's targets, threat tolerance and overall monetary scenario. As along with any type of expenditure, it is essential to perform complete research study prior to producing a choice.

Bear in mind that while gold may be a valuable enhancement to an financial investment profile, it must not be the only property. Variation is essential to handling risk and guaranteeing long-term monetary security.

In conclusion, investing in gold may be a brilliant move for capitalists appearing to transform their profiles and shield their wide range. Whether you decide on physical gold or Gold ETFs depends on your assets objectives, danger tolerance, and total financial circumstance. Each possibilities possess their respective perks and downsides, so it is important to conduct thorough analysis prior to helping make a selection.

If you choose to spend in physical gold, create certain you purchase it coming from trustworthy dealers and save it firmly. If you decide for Gold...

-

1:14:42

1:14:42

Anthony Rogers

9 hours agoThoughts on the L.A. Fires

20.3K4 -

2:37:32

2:37:32

Kim Iversen

8 hours agoTerrorism, Act of God or “Newscum” Incompetence: What REALLY Fueled The California Wildfires

48.2K131 -

2:16:33

2:16:33

Tucker Carlson

6 hours agoTucker Carlson and Michael Shellenberger Break Down the California Fires

199K291 -

58:50

58:50

Laura Loomer

4 hours agoThe Great Replacement (Full-Length Documentary)

30.2K27 -

LIVE

LIVE

Razeo

5 hours agoEp 31: Finishing March Ridge & onto Muldraugh tonight

184 watching -

1:00:37

1:00:37

Adam Does Movies

3 hours ago $0.88 earnedBatman II Update + Flash Director Fails + Movie Bombs! - LIVE!

27.4K4 -

2:26:24

2:26:24

We Like Shooting

18 hours agoWe Like Shooting 593 (Gun Podcast)

19.7K -

57:03

57:03

Flyover Conservatives

1 day agoJack Hibbs Blasts California Leaders: Must-Watch!; Can Trump Fix the Mess? How Long will it Take? - Dr. Kirk Elliott | FOC Show

44.5K7 -

2:00:50

2:00:50

DillyDillerson

4 hours agoTalking to the moon!! Just some live views of the FULL MOON!!

27.5K11 -

1:29:29

1:29:29

Glenn Greenwald

8 hours agoWith Biden Out, U.S. Finally Admits Harms of His Israel / Gaza Policy; Biden Pays Homage To George W. Bush; Insane Women’s Tennis Scandal: An “Abusive” Coach | SYSTEM UPDATE #388

62.9K84