Premium Only Content

60 second Lithium ETF Analysis

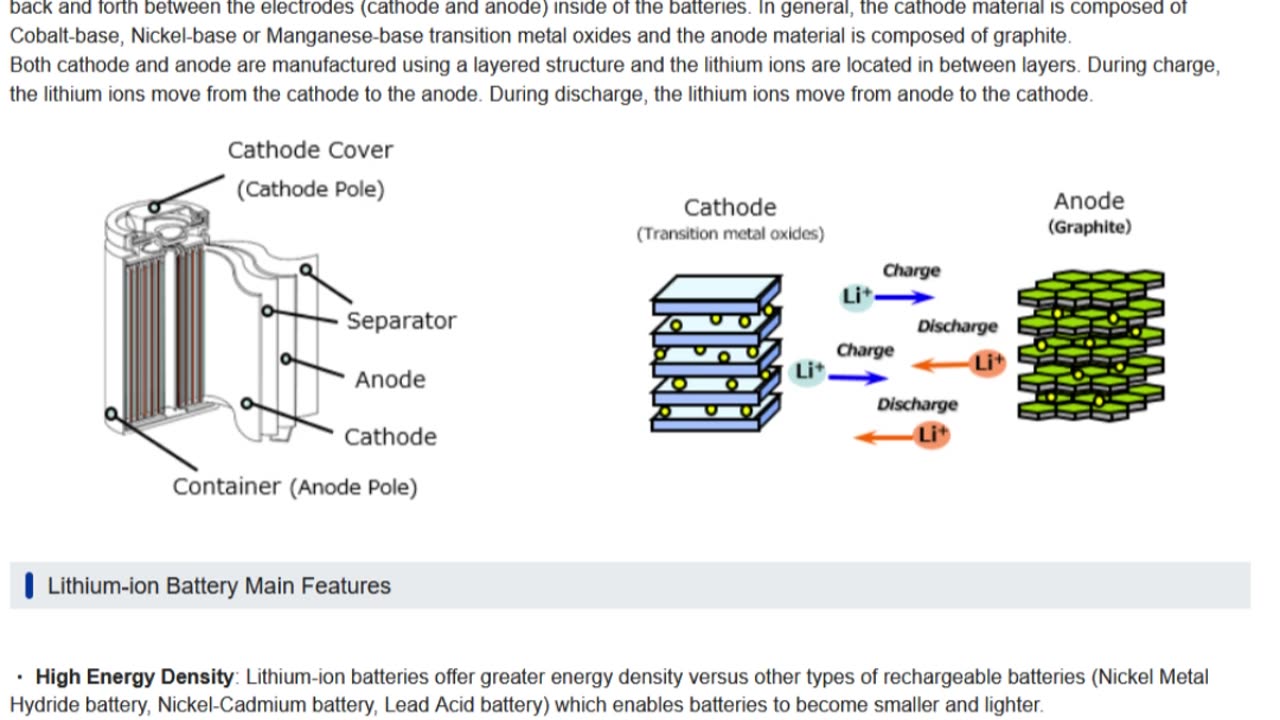

Lithium is essential to electric vehicles batteries, as well as for energy storage in general. Lithium ion batteries have fallen in price by almost 90% from 2010 to 2021. We are getting close to EVs being similarly priced to ICE vehicles.

Global X Lithium & Battery ETF, ticket LIT, invests in companies involved in various parts of the lithium industry including mining, refinement, and battery production. It invests across sectors and geography.

The one thing you can always control is how much you pay for your investment so I concentrate a lot on expense ratios. When I see a 0.75% expense ratio, I’m thinking that is very expensive. Do I really want to pay that much for an investment?

The top holding at 8.55% is Albemarle Corp. This company is exposure to lithium in Chile which is nationalizing the lithium industry. That concerns me.

The second largest holding is Panasonic which is a Japanese conglomerate. This isn’t much of a pure lithium play. It’s more a play on Japan.

The third largest holding is BYD which is a Chinese automobile manufacturer. Even if most of the cars they produce are EVs, this is more of a car maker and EV play than a lithium play.

Overall, I have concerns about this ETF not being really about lithium as it is a hodgepodge of various things that are loosely related by lithium.

Works Cited:

https://www.globalxetfs.com/funds/lit/

Tags:

lithium, lithium etf, ark etf analysis, lithium aktie, lithium aktien, global x lithium, global x lithium &, idrv etf analysis, nio stock analysis, pre market analysis, technical analysis, tesla stock analysis, lithium stocks, analysts, lithium demand and supply, lithium invesment, lithium & battery etf, lithium technology australia, global x battery and lithium etf, lithium and battery etf, global x lithium & battery tech etf, australian battery and lithium etf

-

3:46

3:46

The Last Capitalist in Chicago

1 year ago $0.06 earnedBeneficiary forms can override your will

289 -

DVR

DVR

megimu32

5 hours agoON THE SUBJECT: Will the Super Bowl Be WOKE??!

5.63K2 -

1:18:26

1:18:26

Redacted News

6 hours agoBREAKING! USAID Created and Funded COVID-19 Virus and Bioweapons, RFK and Tulsi pass major hurdle

127K186 -

50:54

50:54

Candace Show Podcast

6 hours agoBecoming Brigitte: Gaslighting The Public | Ep 1

178K185 -

4:41:05

4:41:05

Right Side Broadcasting Network

11 hours agoLIVE: President Trump Holds Press Conference with Israeli PM Benjamin Netanyahu - 2/4/25

210K99 -

1:11:49

1:11:49

Edge of Wonder

6 hours agoInception Is Real: How Ads Are Showing Up in Our Dreams

27.5K5 -

54:50

54:50

LFA TV

10 hours agoThe Trade War Ends | TRUMPET DAILY 2.4.25 7pm

26K7 -

2:05:37

2:05:37

Quite Frankly

10 hours ago"Capitol Hill Headlines & The Utah Case" ft Lauren Conlin, The Zells 2/4/25

31.8K7 -

1:33:29

1:33:29

The Big Mig™

16 hours agoKiller of Men To Healer of Men Dr. Joe Bannon

26.6K5 -

40:45

40:45

Chrissy Clark

4 hours agoUSAID’s Corruption, DC Airport Workers ARRESTED, & Ibram X Kendi Canceled?! I Underreported Stories

17.9K6