Premium Only Content

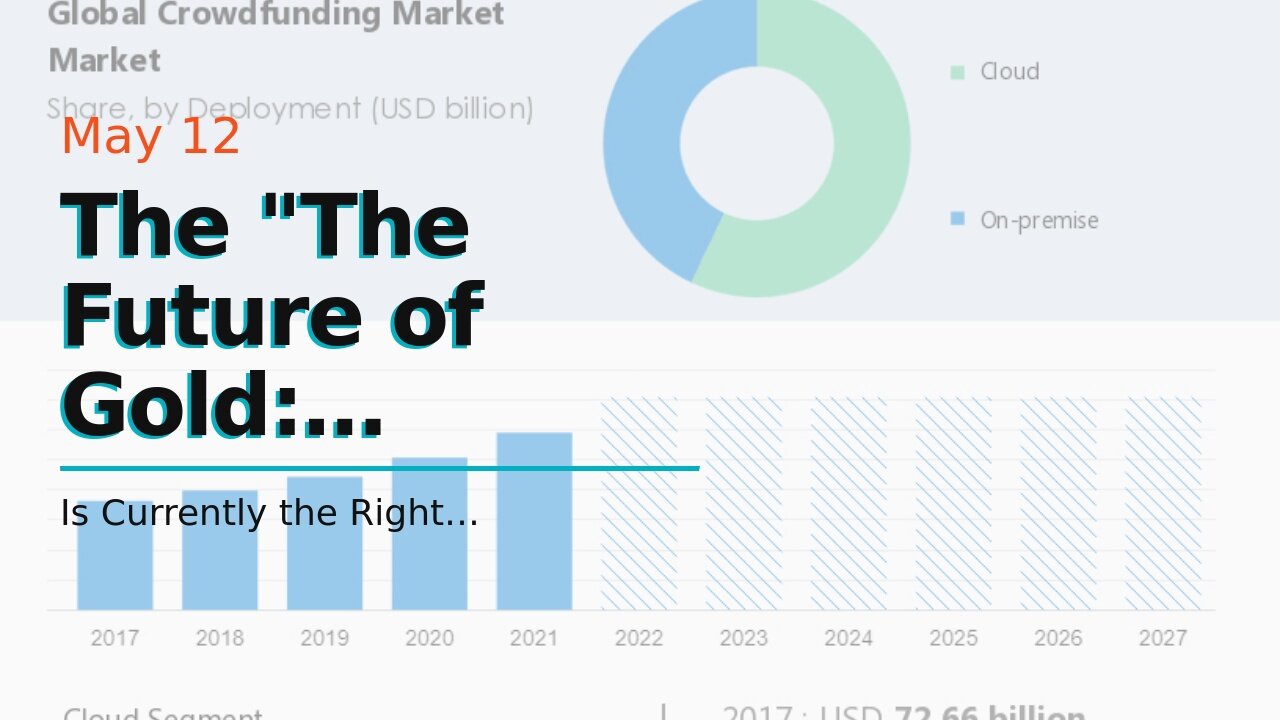

The "The Future of Gold: Predictions and Trends for Investors" Diaries

https://rebrand.ly/Goldco1

Get More Info Now

The "The Future of Gold: Predictions and Trends for Investors" Diaries , gold and investment

Goldco aids customers safeguard their retired life savings by rolling over their existing IRA, 401(k), 403(b) or various other certified pension to a Gold IRA. ... To discover just how safe house precious metals can help you construct as well as protect your riches, as well as even secure your retired life phone call today gold and investment.

Goldco is just one of the premier Precious Metals IRA business in the United States. Shield your wide range and livelihood with physical rare-earth elements like gold ...gold and investment.

Is Currently the Right Time to Put in in Gold?

Gold has regularly been looked at a safe financial investment alternative, particularly during the course of time frames of financial anxiety. It has been used as a kind of unit of currency for centuries and is still observed as a useful asset today. The price of gold can change considerably, relying on various variables such as international celebrations, rising cost of living rates, and enthusiasm rates. Along with the current condition of the economic climate, many folks are asking yourself if now is the appropriate time to commit in gold.

One of the principal causes why financiers turn to gold is its capacity to behave as a hedge against inflation. When rising cost of living rises, therefore performs the rate of gold. This is because gold keeps its worth over opportunity and doesn't lose investment power like paper unit of currencies perform. Inflation can be induced through different variables such as an increase in funds source or an increase in requirement for goods and companies. Along with the existing economic condition led to through COVID-19 pandemic, a lot of clients are cautious regarding inflationary pressures that may emerge eventually.

An additional aspect that makes gold an appealing assets choice during times of economic anxiety is its capability to function as a safe sanctuary asset. When there is distress in monetary markets, investors tend to relocate their cash into more secure possessions such as gold and authorities connections. This is because these assets often tend to hold their worth much better than sells or various other riskier investments.

The worldwide pandemic triggered widespread panic one of capitalists when market characteristics were modifying at an unparalleled pace. As economies around the world carry on to deal with with COVID-19 pandemic's impacts, a lot of individuals are not sure regarding where they need to spend their cash next? While some may prefer supplies or actual estate properties; others may consider committing their funds into physical items like precious steels.

Gold likewise usually tends to do effectively in the course of times of geopolitical weakness and worldwide disputes since it's seen as a steady outlet of market value that isn't determined through political or financial celebrations in any sort of one country alone which provides it even more reliability than other assets like stocks or actual estate. It is often used as a means of diversifying assets profiles by decreasing risk direct exposure.

However, it's essential to note that gold isn't constantly a sure-fire way to help make funds. The price of gold can easily be impacted through different elements such as speculation, adjustments in supply and demand, and market conviction. In addition, spending in bodily gold can have its own collection of difficulty such as storage space costs and safety issues.

One substitute to committing in bodily gold is investing in exchange-traded funds (ETFs) that are backed by physical gold gets. This offers capitalists along with direct exposure to the rate of gold without possessing to worry regarding storing or safety issues.

The current economic circumstance triggered through COVID-19 pandemic has produced several real estate investors careful about the potential overview for their financial investments. While there is actually no sure-fire way to predict what will definitely occur next off, putting in in risk-free shelters like gold can give some level of defense against market volatility and unpredictability.

In final thought, while there is no best time or wrong opportunity to put in in gold; it's essential for real estate investors to very carefully take into consideration their assets objectives and thre...

-

55:28

55:28

Glenn Greenwald

11 hours agoGlenn Reacts to Trump-Zelensky Exchange and Takes Q&A from our Members | SYSTEM UPDATE #415

134K228 -

4:26:54

4:26:54

Nerdrotic

13 hours ago $38.63 earnedMarvel PANIC MODE! Kathleen Kennedy GONE?! Hollywood DEI Dead | Friday Night Tights 342 Nick Freitas

145K39 -

1:30:03

1:30:03

Flyover Conservatives

1 day agoZelensky Fail... God Called IT!; From Prison to the White House: Angela Stanton King’s Unbelievable Redemption Story | FOC Show

58.7K6 -

1:06:14

1:06:14

IsaacButterfield

13 hours ago $2.39 earnedFree Speech Is Dead | Did Trump Go Too Far? | Sexist Job

49.7K21 -

1:02:59

1:02:59

Sarah Westall

15 hours agoEpstein Files, Dueling Cabal Factions and Gold from Ancient Civilizations w/ Dave Hodges

77.9K23 -

3:15:08

3:15:08

I_Came_With_Fire_Podcast

13 hours ago“Trump-Zelensky BEATDOWN | Europe BUILDS MUSCLE | NEWSCUM Podcast”

22.3K2 -

41:25

41:25

CatfishedOnline

14 hours ago $2.21 earned23-Yr-Old Drove 2,650 Miles to Meet Online Girlfriend in Romance Scam

44K6 -

1:56:18

1:56:18

Bare Knuckle Fighting Championship

2 days agoCountdown to BKFC FIGHT NIGHT ALBUQUERQUE & FREE LIVE FIGHTS!

38.4K2 -

1:58:08

1:58:08

Anthony Rogers

12 hours agoHow To Beat Kids At Video Games

14.5K1 -

1:46:26

1:46:26

Vigilant News Network

15 hours agoDiddy’s Epstein Moment: Is the Fix Already In? | The Daily Dose

91.9K9