Premium Only Content

The Stock to Flow Ratio - Is this a MASSIVE Bitcoin Loophole?

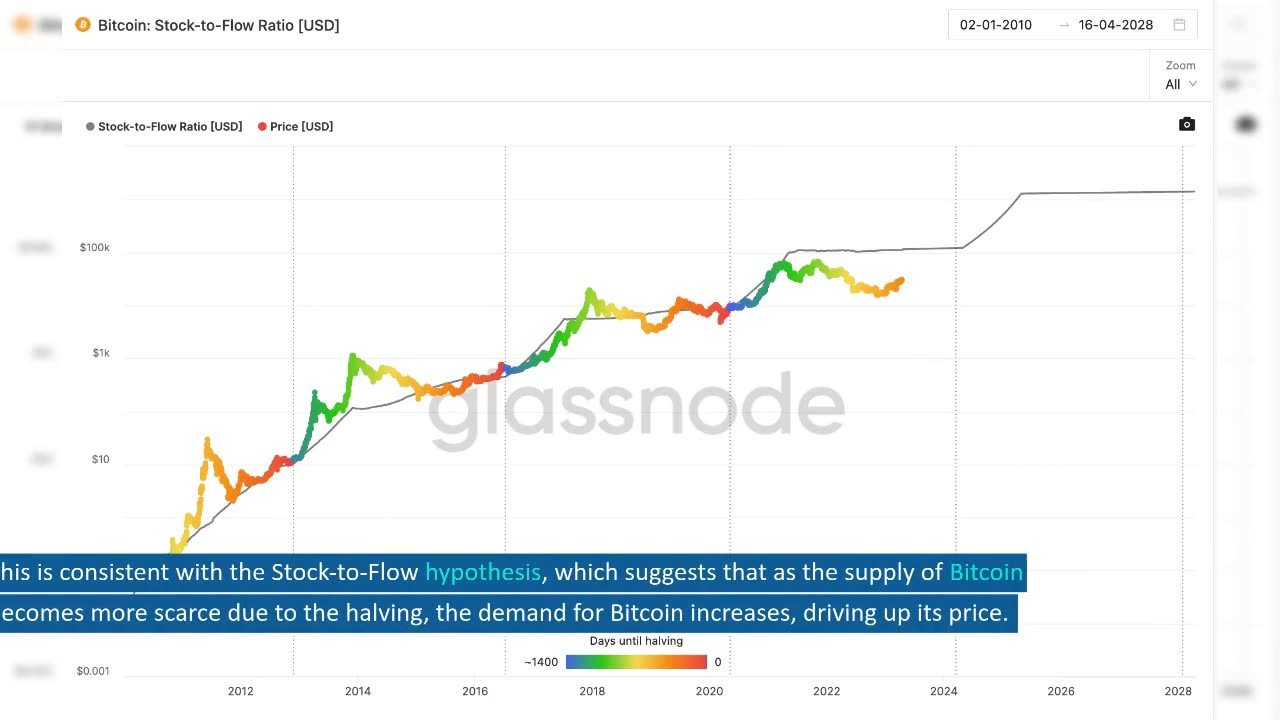

The Stock-to-Flow hypothesis is a theory that suggests scarcity is a significant driver of value. Specifically, the hypothesis argues that when the scarcity of an asset increases, its value should also increase. This hypothesis has been applied to Bitcoin, where it is argued that the Bitcoin halving cycle doubles the scarcity of the asset, leading to a corresponding increase in value.

Data shows that the value of Bitcoin has indeed increased during each halving cycle when the Stock-to-Flow ratio (S2F) has doubled. This is consistent with the Stock-to-Flow hypothesis, which suggests that as the supply of Bitcoin becomes more scarce due to the halving, the demand for Bitcoin increases, driving up its price.

However, if the value of Bitcoin were to decrease post halving, the Stock-to-Flow hypothesis would be rejected. This would suggest that scarcity is not the primary driver of value for Bitcoin, and that other factors such as market sentiment or speculation are more significant.

Interestingly, there is a profitable trading rule based on the Stock-to-Flow hypothesis. The rule suggests that investors should buy Bitcoin six months before each halving and sell 18 months after the halving. This trading rule has been shown to outperform a buy and hold strategy in terms of both risk and return.

Of course, this assumes that the correlation between the Stock-to-Flow ratio and Bitcoin value is not spurious, and that the Stock-to-Flow hypothesis holds true in the future. As with any investment strategy, there are risks involved, and investors should conduct their own research before making any investment decisions.

In conclusion, the Stock-to-Flow hypothesis suggests that scarcity is a significant driver of value for Bitcoin. Data shows that the value of Bitcoin has increased during each halving cycle when the Stock-to-Flow ratio has doubled. Additionally, there is a profitable trading rule based on the Stock-to-Flow hypothesis. However, as with any investment strategy, there are risks involved, and investors should conduct their own research before making any investment decisions.

-

![🔴[LIVE TRADING] Stock Market Crash: Turnaround Tuesday?! || The MK Show](https://1a-1791.com/video/fwe2/16/s8/1/4/K/F/r/4KFry.0kob.1-small-LIVE-TRADING-Stock-Market-C.jpg) LIVE

LIVE

Matt Kohrs

9 hours ago🔴[LIVE TRADING] Stock Market Crash: Turnaround Tuesday?! || The MK Show

3,418 watching -

LIVE

LIVE

BonginoReport

2 hours agoVictory Over Marxism: BLM Plaza Falls (Ep.157) - 03/11/2025

10,657 watching -

LIVE

LIVE

Dear America

10 hours agoMassive Cyberattack Against Elon's X Sparks Widespread CONCERN! + More Attacks On Tesla Vehicles?!

6,047 watching -

LIVE

LIVE

Wendy Bell Radio

4 hours agoOver The Target

11,119 watching -

LIVE

LIVE

Bitcoin Policy Institute

53 minutes agoBitcoin for America

594 watching -

34:43

34:43

Degenerate Jay

23 hours ago $2.60 earnedAssassin's Creed Was Always Anti-Religion?

21.5K4 -

6:41

6:41

Silver Dragons

18 hours agoCanadian Silver Maple Leaf Coins - Dealer Reveals Everything You NEED to Know

3.73K2 -

8:42

8:42

Dangerous Freedom

16 hours ago $0.85 earnedThe M&P Competitor SHREDS—But Did Smith & Wesson Screw It Up?

18.8K2 -

1:12:50

1:12:50

MTNTOUGH Fitness Lab

16 hours agoSTOP Living in Fear: Why Some People Rise From Tragedy AND OTHERS DON'T | Ryan Manion

13.7K -

8:03

8:03

Alabama Arsenal

1 day ago $0.34 earnedWoox Bravado | Modern Features Meet Timeless Style

20.1K1