Premium Only Content

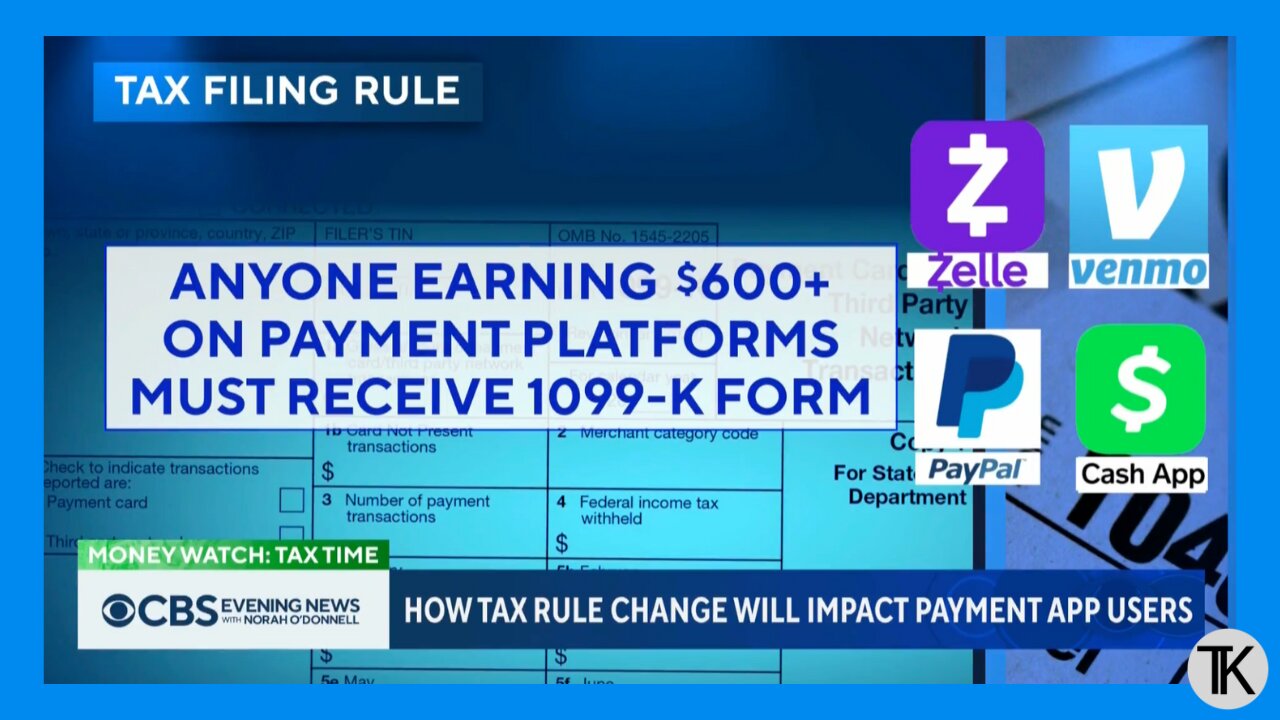

CBS News: Next Year, Anyone Earning Over $600 on Payment Apps, will Receive a 1099-K Form

COLBURN: “I was supposed to have a house call today.”

MACFARLANE (voice-over): “Monica Colburn helps run a Virginia hair salon. But like a growing number of Americans, she uses the flexible hours to earn some extra cash.”

MACFARLANE (on camera): “How many different side hustles do you have?”

COLBURN: “I think last year I had eight 1099s.”

MACFARLANE (voice-over): “She works weddings and promotes musicians collecting most of her income through payment apps like Venmo.”

COLBURN: “If I didn’t have multiple ways that somebody could pay me, I feel like I would lose business.

MACFARLANE: “The apps are easy to use. But starting next year, filing taxes for millions of people could become trickier. A new IRS rule will require anyone earning more than $600 on payment apps in 2023 to receive a 1099-K form. The old threshold was earning $20,000 over 200 transactions.”

Greene-LEWIS: “This is not a tax law change. This is just a reporting requirement for those third parties like Venmo, PayPal and the credit card companies.”

MACFARLANE: “The IRS expects an initial surge of 4 million of these forms next year, which it says it can handle.”

MACFARLANE (on camera): “But there are businesses concern handling all the paperwork from this change could be like taking on a whole another job in and of itself.”

MACFARLANE (voice-over): “Businesses like Dennis Turbeville, a Maryland furniture maker takes nearly all of his payments through apps and worries they’ll make a mistake when the government is asking for its cut.”

TUBERVILLE: “A $2,500 penalty for a business that’s doing $2 million a year, not a big deal. For somebody like me, that’s a big deal.”

MACFARLANE: “The IRS says money exchanged between friends shouldn’t be taxed and warns users to classify those transactions as personal, not goods and services. Scott MacFarlane, CBS News Alexandria, Virginia.”

-

14:37

14:37

Tony Katz

1 month agoObama's Race-Shaming Campaign in Michigan

9342 -

3:59:18

3:59:18

GamerGril

6 hours agoPAGING ALL ZOMBOIZ | DEAD ISLAND 2

14.7K5 -

42:24

42:24

MYLUNCHBREAK CHANNEL PAGE

13 hours agoA Century Gone

77.4K48 -

38:22

38:22

Stephen Gardner

7 hours ago🔥HOLD ON! The RUMORS about Kamala are TRUE...

115K251 -

1:22:44

1:22:44

Michael Franzese

1 day agoWill Trump’s Win Finally Convince Democrats to Stop The Woke Nonsense??

130K103 -

8:27:07

8:27:07

MDGgamin

10 hours ago🔴LIVE- Rumble Gaming To The MOON - Variety of Games & Chatting - #RumbleTakeover

71.3K1 -

27:24

27:24

Mr. Build It

5 days agoDECK DISASTER! How We Fixed a Botched Build

63K12 -

26:58

26:58

barstoolsports

11 hours agoZach Bryan Blocks All of Barstool | Stool Scenes

86.5K8 -

1:06:44

1:06:44

Talk Nerdy 2 Us

1 day ago🔥 Hackers vs. The World: From Amazon breaches to FBI-confirmed Chinese telecom spying

83.7K22 -

1:24:20

1:24:20

Vigilant News Network

1 day agoJoe Rogan Drops Shocking Election Claim | The Daily Dose

144K152