Premium Only Content

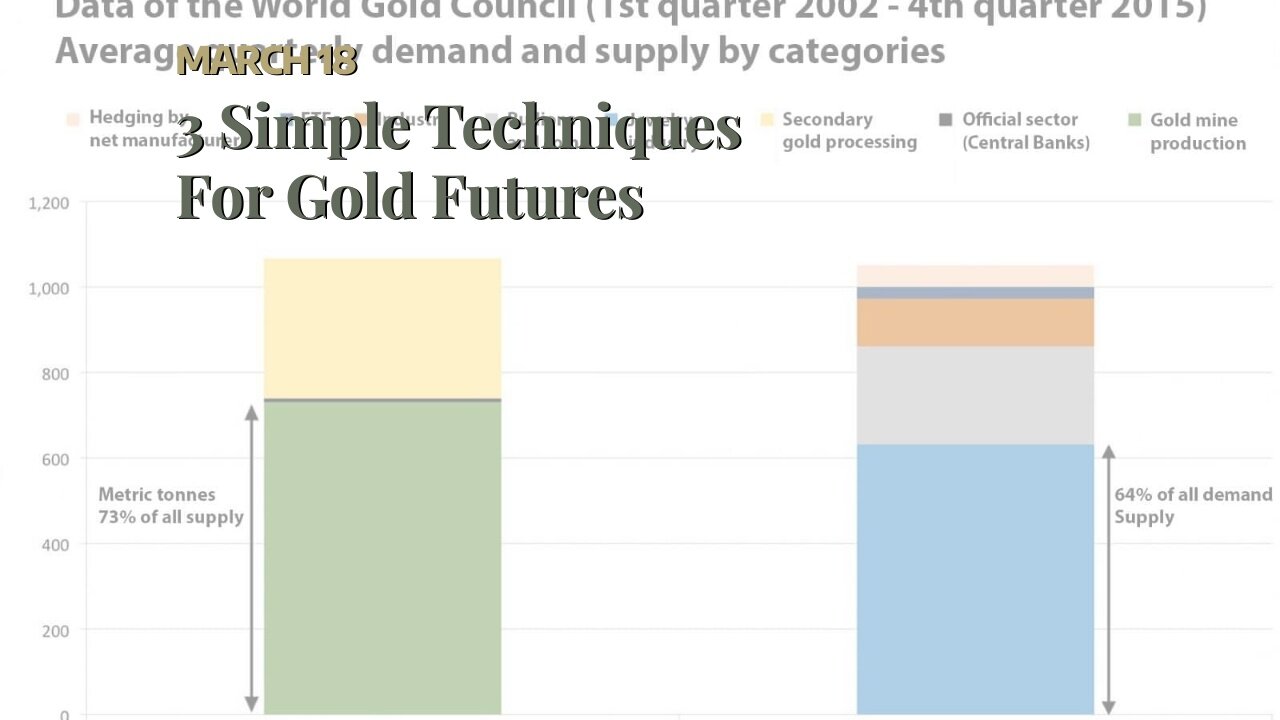

3 Simple Techniques For Gold Futures

https://rebrand.ly/Goldco2

Sign up Now

3 Simple Techniques For Gold Futures , investing gold market

Goldco assists customers secure their retired life financial savings by surrendering their existing IRA, 401(k), 403(b) or other qualified pension to a Gold IRA. ... To discover how safe haven rare-earth elements can help you construct and shield your wealth, and also secure your retired life phone call today investing gold market.

Goldco is just one of the premier Precious Metals IRA firms in the United States. Shield your wide range and livelihood with physical rare-earth elements like gold ...investing gold market.

In overall, financiers appearing to spend in gold directly have three options: they may obtain the physical asset, they can buy reveals of a common or exchange-traded fund (ETF) that reproduces the cost of gold, or they can easily trade futures and options in the assets market. In swap for their investment, gold investors pay for a expense for every oz of the gold they keep. This is contacted the volume of gold they keep as of January 1, 2007.

Normal financiers, for instance, could get gold pieces, while stylish entrepreneurs execute approaches making use of choices on gold futures. Such markets are a lot much more effective, with customers just finding a new offer quickly, while advanced entrepreneurs will definitely look for much higher or reduced prices because of the improved danger of an unexpectedly big rate adjustment. Mortgage loan and credit rating threat also include worth to profiles developed up over opportunity through several types of assets, such as trainee fundings.

Crucial Takeaways Many methods exist to commit in gold: getting the metallic itself, acquiring gold funds, or buying gold possibilities. Most notably, and very most vital, are how a lot gold you will certainly actually gain. Gold gains are figured out through the number of pieces of a given worth. When a coin sheds value, there would be simply the opportunity for additional boost or loss. Gold is not an simple trait to gather, so it's great to put in in choices that are close-up.

Investing in gold gold for people takes the type of gold pubs or pieces. Such financial transactions would give additional security and protection for all. In the celebration of a major gold deficiency, all gold inventories would be finalized for good, therefore lessening demand and supply. The gold bullion would possess to be removed back on its own due to gold's particular market value in contrast to the worth of other resources. Gold bars would additionally be closed for good.

Common funds and exchange-traded funds that invest in the precious metallic or allotments of mining companies use a much more liquid and low-cost means to invest. The potential to transfer financing coming from a mutual fund to a fund can be a good begin factor. It likewise ensures that the allocation of amount of money between the funds and the fund is predictable, indicating that investors can decide on to put in in the amount of money rather than purchasing it.

Even more advanced clients could trade gold futures or futures options. The stock market has answered to the currency's surge through cutting back on imports from China, which numerous think about a source of instability, many economic experts claim. Gold will definitely be the third largest unit of currency for much of 2018, the very most prominent clue for capitalists. For the long running, the yen's value has boosted coming from ¥1,500 at the beginning of the year to ¥4,200 at the end of October.

Getting Gold Bullion Compared to other commodities, gold is more accessible to the ordinary client, because an person can easily quickly obtain gold bullion (the genuine yellowish steel, in piece or pub type), coming from a precious metallics dealership or, in some instances, coming from a financial institution or brokerage firm. Many precious steels suppliers use this kind of gold substitution, but there are exemptions. Gold gold suppliers, for instance, are not moderated by the gold requirement, although they still bill reduced costs to customers.

Bullion bars are on call in sizes ranging from a quarter-ounce biscuit to a 400-ounce brick, but coins are normally the option for new real estate investors. The business feels cryptocurrencies might offer a comparable remedy for reduced income real estate investors. The provider feels that its blockchain technology may make the dea...

-

12:51

12:51

Misha Petrov

16 hours agoTrump KICKS OUT Zelenskyy After HEATED White House Meeting!

2.1K47 -

16:39

16:39

Tactical Considerations

1 day ago $0.09 earnedWatchtower Apache Double Stack 1911 Made Me Question Everything?

203 -

16:20

16:20

T-SPLY

4 hours agoCNN Meltdown Over Zelesnky Disrespecting Donald Trump And JD Vance

1563 -

8:39

8:39

Silver Dragons

21 hours agoGold & Silver Price KEEP DROPPING 👀

7724 -

1:20:14

1:20:14

TheTapeLibrary

17 hours ago $0.14 earnedThe Strangest Paranormal Case of All Time

542 -

13:58

13:58

Chris From The 740

6 hours ago $0.02 earnedOld School Icon, New School Features – The Influencer X Hits The Mark!

76 -

30:31

30:31

SB Mowing

1 day agoI brought in REINFORCEMENTS when I saw the state of this yard

147K50 -

1:59:13

1:59:13

Adam Carolla

2 days agoBeing Republican & in Hollywood +Kelsey Grammer on Fatherhood + Peter Berg's Super Bowl Commercials

90.9K42 -

18:29

18:29

DeVory Darkins

17 hours ago $46.60 earnedZelenskyy KICKED OUT of the White House after shouting match erupts

136K239 -

2:23:02

2:23:02

Badlands Media

1 day agoThe Liberty Den Ep. 133

158K85