Premium Only Content

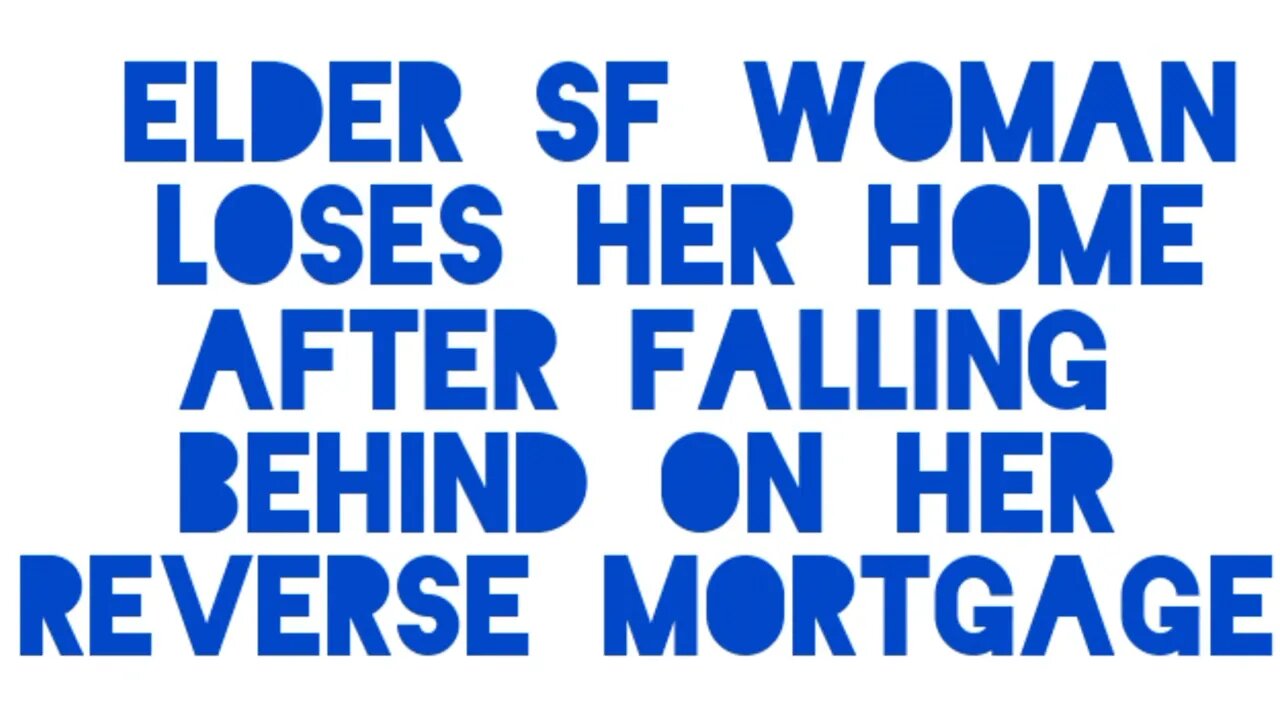

The story of an 81-year-old German immigrant losing her $1.4 million condo in San Francisco’s

The story of an 81-year-old German immigrant losing her $1.4 million condo in San Francisco’s Upper Haight district after taking out a reverse mortgage and falling behind on property taxes has recently made headlines. The woman, Rosemarie Benter, then took out a $9,519 loan, not realizing that her house became collateral and that she was at risk of losing it if she defaulted. The lender then foreclosed on her home and auctioned it off for $12,464, an amount much lower than its value.

This case has raised concerns about the vulnerability of elderly homeowners and the predatory practices of some lenders and brokers. Benter, who survived a stroke and suffers from severe arthritis, faced an uncertain future if she gets displaced. As of this week, another buyer had outbid the nonprofits and city supervisor who intervened to keep her in the home she owned for 30 years, and would inherit the debt to PHH Corp. if the sale closes.

This situation is not unique to San Francisco, as elderly homeowners across the country are at risk of losing their homes due to rising property taxes, predatory lenders, and complicated financial instruments such as reverse mortgages. According to the National Council on Aging, about 10% of homeowners aged 65 or older are at risk of foreclosure due to unpaid property taxes.

This vulnerability is compounded by the fact that many elderly homeowners may be medically frail and vulnerable, making consequential end-of-life decisions, often with few people to guide them. Housing advocates warn that older adults, particularly those who own a home in a city where real estate prices are escalating, are "walking targets" for financial abuse.

While it’s possible that every broker and lender who worked with Benter followed the law, they behaved in a manner that housing advocates saw as predatory. They sought undue influence over Benter’s finances at a moment when she was in and out of hospitals, grappling with the arcane rules of a reverse mortgage, and prone to trusting anyone who seemed knowledgeable and offered assistance.

This case highlights the need for greater protections for vulnerable homeowners, particularly the elderly. Laws aimed at protecting residents from getting pushed out in a foreclosure and to prevent the property from sitting vacant, such as the one cited by the San Francisco Community Land Trust, can help. However, more needs to be done to ensure that elderly homeowners are not subject to predatory practices and are able to stay in their homes for as long as possible.

As for Benter, her fate now hinges on the sympathy of a home buyer she doesn’t know. Advocates continue to apply pressure on the lenders to do the right thing and allow her to stay in her home, and are exploring other options to help her, but the outcome remains uncertain.

-

3:45:08

3:45:08

DLDAfterDark

7 hours ago $9.75 earnedDLD Live! SHTF Handguns! Which Would You Choose?

41.9K2 -

1:50:38

1:50:38

Mally_Mouse

10 hours agoSaturday Shenanigans!! - Let's Play: Mario Party Jamboree

52.2K -

1:13:00

1:13:00

Patriots With Grit

14 hours agoWill Americans Rise Up? | Jeff Calhoun

43.1K13 -

14:55

14:55

Exploring With Nug

14 hours ago $11.27 earnedWe Found Semi Truck Containers While Searching for Missing Man!

59.4K7 -

27:57

27:57

MYLUNCHBREAK CHANNEL PAGE

22 hours agoOff Limits to the Public - Pt 3

133K65 -

38:07

38:07

Michael Franzese

15 hours agoLeaving Organized Crime and Uncovering Mob in Politics: Tudor Dixon and Michael Franzese

106K15 -

2:42:54

2:42:54

Jewels Jones Live ®

2 days agoAMERICA IS BACK | A Political Rendezvous - Ep. 111

83.6K50 -

8:47:33

8:47:33

Due Dissidence

1 day agoLIVE: Workers Strike Back Conference ft. Chris Hedges, Jill Stein, Kshama Sawant, and More!

120K92 -

8:36:37

8:36:37

Right Side Broadcasting Network

5 days agoLIVE REPLAY: CPAC 2025 Day Three with President Donald J. Trump - 2/22/25

467K104 -

1:05:34

1:05:34

The Big Mig™

23 hours agoConfirmed Kash Patel New FBI Director, Bring On The Pain |EP483

112K31