Premium Only Content

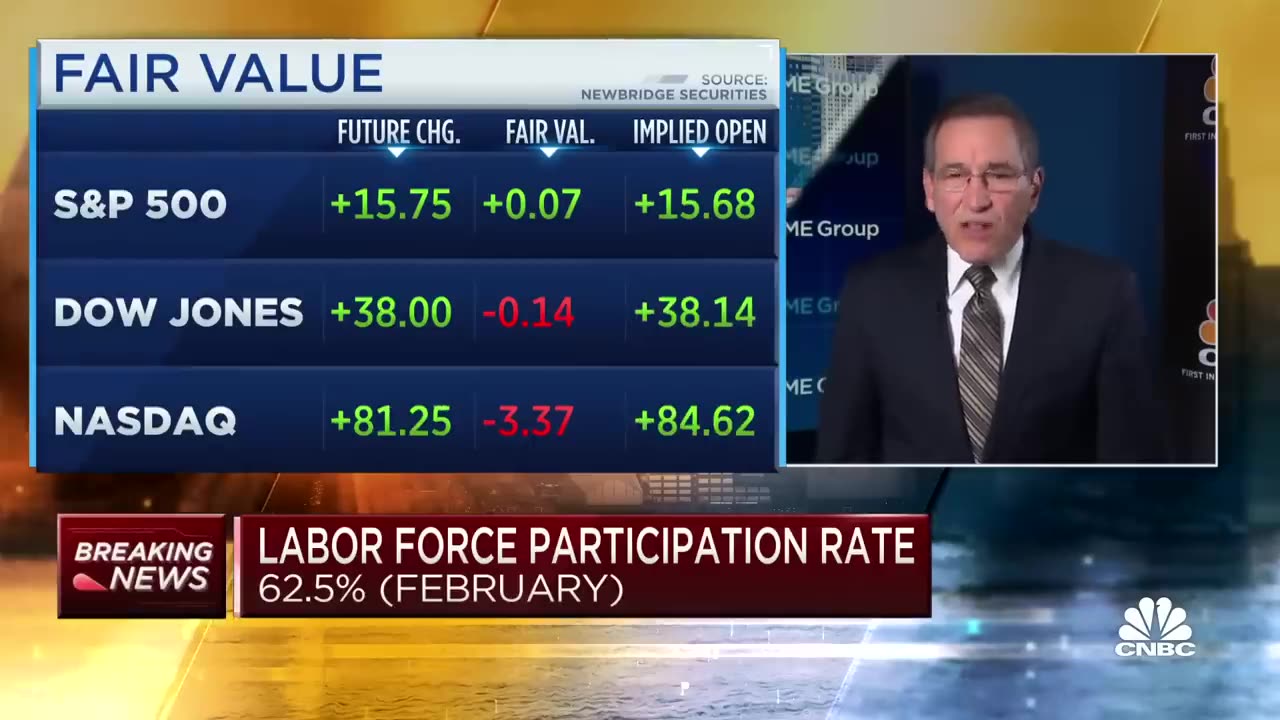

U.S. economy adds 311,000 jobs in February as growth stays hot

CNBC's Rick Santelli reports on the latest data from the February job report. For access to live and exclusive video from CNBC subscribe to CNBC PRO: https://cnb.cx/2NGeIvi

» Subscribe to CNBC TV: https://cnb.cx/SubscribeCNBCtelevision

» Subscribe to CNBC: https://cnb.cx/SubscribeCNBC

Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide.

Connect with CNBC News Online

Get the latest news: http://www.cnbc.com/

Follow CNBC on LinkedIn: https://cnb.cx/LinkedInCNBC

Follow CNBC News on Facebook: https://cnb.cx/LikeCNBC

Follow CNBC News on Twitter: https://cnb.cx/FollowCNBC

Follow CNBC News on Instagram: https://cnb.cx/InstagramCNBC

https://www.cnbc.com/select/best-cred...

#CNBC

#CNBCTV

Rick yes very exciting as we await the February jobs report and here we go non-farm payrolls three hundred and eleven thousand three hundred and eleven thousand and if you look at manufacturing payrolls they were down four thousand two-month uh net revision is minus thirty four thousand minus thirty four thousand and if you consider the unemployment rate it moved up to 3.6 3.6 from 3.

00:34

4 which happened to have been a 53-year low if you look at average hourly earnings month to month point two point two point two percent now if we look at average hourly earnings at 0.2 that is the smallest month over month change since February when it was unchanged if we look at year over year it is 4.6 4.6 now that indeed is better than a still unrevised four point 4 and 4.

01:04

4 was the lowest year over year since July of 21. average work week 34.5 34.5 and we are expecting 34.6 so that is a bit smaller than expected in last month's 34.7 moved to 34.6 labor force participation 62.5 one tenth better than expected and one tenth better than the rear view mirror and 62.5 is the best rate since 62.

01:40

6 in March of 2020 and if we look at the underemployment rate or U6 it is 6.8 I do want to point out at the end of last year this series was at 6.5 which was the lowest since 1994 record keeping if we look at what's going on interest rates on tens are going down interest rates on twos are below 470 and the stock market is gyrating a bit into Dow futures but it is moving up a bit and we need to obviously consider all the flight to safety that has distorted uh many of these metrics especially on the treasury side and the very simple reason is you know we had the biggest punch

02:20

bowl in world history for many years then we had coveted hit and we threw a bunch of money into the global economy and specifically the U.S economy Banks were flushed they purchased a lot of Securities uh much more in the Securities Camp than what they tried to loan out when they were flushed with all these deposits well with rates moving up and money markets so competitive they're losing deposits and all those Securities they have if they hold them to maturity they don't have to show the losses from

02:51

an accounting perspective although you can find it if you really look at their statements the point here is should they need to start liquidating because deposits keep moving in a way they're going to end up liquidating Securities that were held for sale or to be determined to be held to maturity if they liquidate those they have to show the losses and that's something to pay very close attention to back to the panel

-

1:00:37

1:00:37

Adam Does Movies

3 hours ago $0.88 earnedBatman II Update + Flash Director Fails + Movie Bombs! - LIVE!

27.4K3 -

2:26:24

2:26:24

We Like Shooting

17 hours agoWe Like Shooting 593 (Gun Podcast)

19.7K -

57:03

57:03

Flyover Conservatives

1 day agoJack Hibbs Blasts California Leaders: Must-Watch!; Can Trump Fix the Mess? How Long will it Take? - Dr. Kirk Elliott | FOC Show

44.5K7 -

2:00:50

2:00:50

DillyDillerson

4 hours agoTalking to the moon!! Just some live views of the FULL MOON!!

27.5K11 -

1:29:29

1:29:29

Glenn Greenwald

8 hours agoWith Biden Out, U.S. Finally Admits Harms of His Israel / Gaza Policy; Biden Pays Homage To George W. Bush; Insane Women’s Tennis Scandal: An “Abusive” Coach | SYSTEM UPDATE #388

62.9K84 -

3:12:23

3:12:23

Danny Polishchuk

10 hours agoWho's To Blame For LA Fires, Jewish Tunnels Update + Forbidden Anthropology

26.8K4 -

1:08:10

1:08:10

Donald Trump Jr.

10 hours agoOne Week Until Inauguration, Live with Rep Anna Paulina Luna & Sen Tommy Tuberville

127K194 -

1:00:13

1:00:13

The StoneZONE with Roger Stone

7 hours agoLAWFARE! Are Trump's Legal Assaults Winding Down? w/ Impeachment Lawyer David Schoen | The StoneZONE

36.3K -

1:01:43

1:01:43

Patriots With Grit

1 day agoShocking Changes Are Coming-7 ‘Mission Critical’ Steps Soon To Be Released That Will Leave You Speechless! | John Richardson

17.2K1 -

8:00:59

8:00:59

Dr Disrespect

13 hours ago🔴LIVE - DR DISRESPECT - MARVEL RIVALS - TOP 500 IN THE WORLD

158K29