Premium Only Content

Simple Doji Reversal Strategy - Your Secret Trading Weapon?

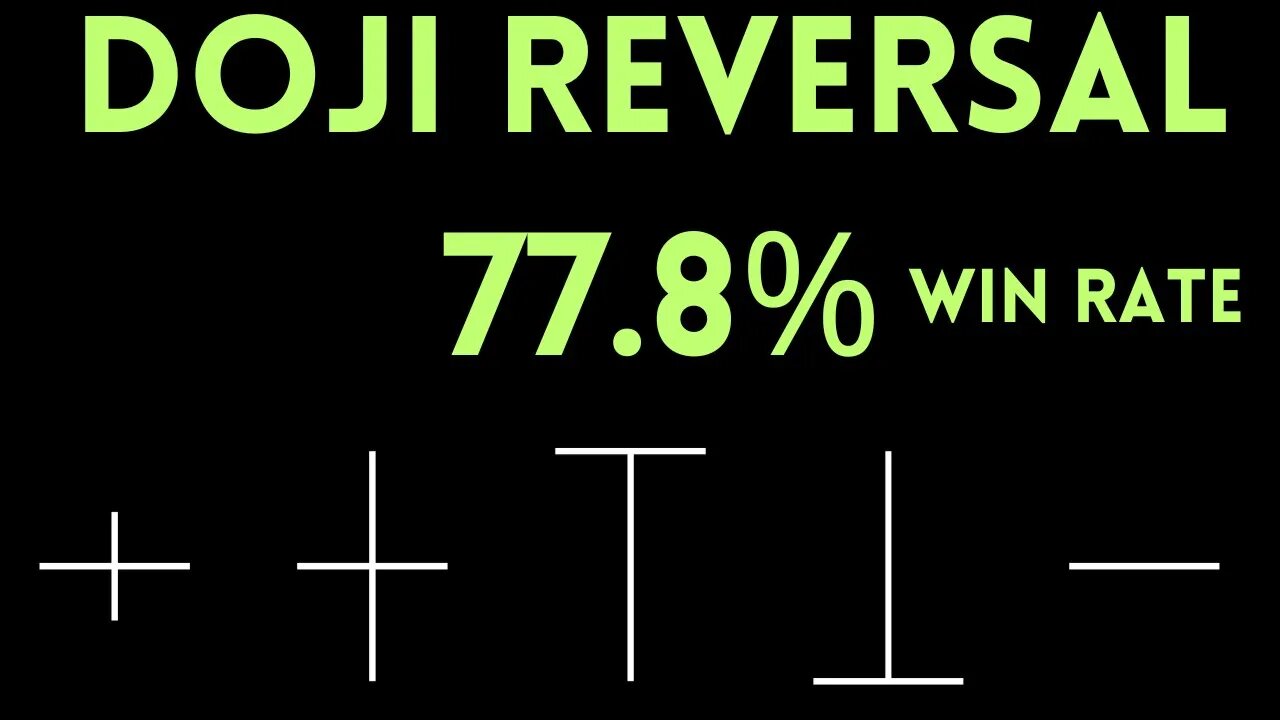

Doji Candlesticks Reversals.

In this video, we explore the doji pattern and its effectiveness in the stock market. We explain what a doji is and how to spot it on a chart. We backtest the doji pattern to determine its performance compared to random periods, using specific trading rules instead of anecdotal evidence.

We also improve the doji strategy by implementing improved exit rules. Our trading code is available for purchase on our website, where we have backtested and coded all candlestick patterns. The top ten candlesticks outperform buy and hold, even though they are invested only 35% of the time.

We cover the four types of dojis - Neutral, Gravestone, Dragonfly, and Long-Legged - and their signals. We use the S&P 500 (SPY) market for our trading rules, where we buy when we spot one of the four dojis and sell N-days later.

Our backtest shows that the doji pattern yields slightly better results than random periods. However, we add a sell criterion to exploit the mean reversion effect in the market, which yields an average gain of 0.32% per trade over a four-day holding period.

We also implement an RSI filter to buy when the market is somewhat oversold, resulting in only 62 trades but an improved average gain per trade of 0.54%. Although the equity curve is not particularly inspiring, these results demonstrate the effectiveness of the doji pattern when paired with specific trading rules.

Visit our website for more information on candlesticks and performance, and don't forget to like and subscribe to help us deliver more free videos. Good luck trading!

Chapters

0:00 Doji Candlesticks reversals

1:00 Different types of Doji

1:35 Trading Rules

1:43 Backtest result

2:07 Improvement

2:20 A Twist

#doji #DojiCandlesticks #TradingStrategy #StockMarket #TechnicalAnalysis #Backtesting #MeanReversion #RSIFilter #SP500 #TradingRules #Investing #CandlestickPatterns #MarketAnalysis #TradingTips #StockTrading #StockInvesting #InvestmentStrategy #DayTrading #SwingTrading #FinancialMarkets #Stocks

You can read more about it here:

https://www.quantifiedstrategies.com/

TWITTER

https://bit.ly/Twitter_QS

INSTAGRAM

https://bit.ly/Instagram_QS

NEWSLETTER - QUANTIFIED STRATEGIES

30 000+ Traders read our free newsletter about trading strategies.

Sign up: https://bit.ly/substack_QS

-

1:20:04

1:20:04

Tim Pool

4 days agoGame of Money

31.5K9 -

2:21:11

2:21:11

Nerdrotic

8 hours ago $12.94 earnedDown the Rabbit Hole with Kurt Metzger | Forbidden Frontier #090

81.9K17 -

2:41:13

2:41:13

vivafrei

14 hours agoEp. 251: Bogus Social Security Payments? DOGE Lawsduit W's! Maddow Defamation! & MORE! Viva & Barnes

205K249 -

1:19:23

1:19:23

Josh Pate's College Football Show

7 hours ago $2.14 earnedBig Ten Program Rankings | What Is College Football? | Clemson Rage| Stadiums I Haven’t Experienced

49.6K1 -

LIVE

LIVE

Vigilant News Network

12 hours agoBombshell Study Reveals Where the COVID Vaccine Deaths Are Hiding | Media Blackout

1,745 watching -

1:17:59

1:17:59

Sarah Westall

8 hours agoDOGE: Crime & Hysteria bringing the Critics & the Fearful - Plus new CDC/Ukraine Crime w/ Dr Fleming

36.6K3 -

45:39

45:39

Survive History

13 hours ago $3.76 earnedCould You Survive in the Shield Wall at the Battle of Hastings?

38.7K6 -

1:50:28

1:50:28

TheDozenPodcast

12 hours agoViolence, Abuse, Jail, Reform: Michael Maisey

90.7K4 -

23:01

23:01

Mrgunsngear

1 day ago $4.41 earnedWolfpack Armory AW15 MK5 AR-15 Review 🇺🇸

78.5K12 -

25:59

25:59

TampaAerialMedia

1 day ago $2.26 earnedUpdate ANNA MARIA ISLAND 2025

49.1K4