Premium Only Content

Soccer's new M&A binge will mostly benefit players

Soccer's new M&A binge will mostly benefit

players

England’s Premier League is about to receive a giant cash infusion. But would-be owners of soccer giants like Manchester United (MANU.N) risk getting locked in a talent war, enriching players at the expense of everyone else.

A Qatari consortium is set to make a $6 billion offer for Man Utd, home to stars including Marcus Rashford, Bloomberg reported on Thursday. They’ll be up against other suitors like Mancunian chemicals magnate Jim Ratcliffe, and maybe even Saudi Arabian investors, according to media reports. The Financial Times reported that Iranian-American billionaire Jahm Najafi is preparing a $3.8 billion swoop on Harry Kane’s Tottenham Hotspur.Club prices are spiralling. Last year, London’s Chelsea sold to American businessman Todd Boehly’s consortium for $3 billion, or 5.7 times trailing revenue. The Qataris’ reported Man Utd offer of $6 billion would value the New York-listed club at 8.6 times trailing revenue.

Such high prices raise the question of how the new owners will make money. One idea is to wring more cash from a global army of fans. Man Utd, for example, has roughly 14 times as many followers on social media site Instagram as the U.S. Dallas Cowboys, but the National Football League side’s annual revenue is 58% higher, based on Forbes figures. Bidders might hope to close the gap by striking more commercial partnerships or charging fans for exclusive video clips or training footage.Yet, as always with soccer, the new revenue may simply end up in players’ pockets. Man Utd’s earnings show that the cost of wages and historic transfers almost match revenue. The same expenses have also risen at Tottenham. Chelsea splurged $350 million on new players over the winter, according to Transfermarkt, while Saudi-backed Newcastle United is also spending big. Increasingly wealthy owners may just end up bidding against each other to sign stars like German club Borussia Dortmund’s (BVB.DE) Jude Bellingham, chasing sporting success at the cost of financial oblivion.

Regulation is the main wildcard. The Premier League recently referred reigning champions Manchester City to an independent commission over more than 100 alleged breaches of financial rules, which the club denies. But it’s too soon to tell whether authorities are serious about tackling financial doping. Absent a crackdown, the final result will be buckets of red ink for the clubs and even greater riches for players.The author is a Reuters Breakingviews columnist. The opinions expressed are his own.)

Qatari investors including former Prime Minister Hamad bin Jassim bin Jaber Al Thani are planning a $6 billion bid for Manchester United, Bloomberg reported on Feb. 16.

Chemicals group INEOS, which is owned by lifelong Man Utd fan Jim Ratcliffe, joined the bidding for the up-for-sale soccer club back in January.

Man Utd, whose financial advisers are U.S. investment bank Raine Group, has set an initial Feb. 17 deadline for bids.

The Financial Times on Feb. 15 reported that Iranian-American billionaire Jahm Najafi was preparing a $3.8 billion offer for Tottenham Hotspur.

-

1:14:05

1:14:05

Tucker Carlson

18 hours ago“I’ll Win With or Without You,” Teamsters Union President Reveals Kamala Harris’s Famous Last Words

233K381 -

1:58:31

1:58:31

The Dilley Show

18 hours ago $36.92 earnedTrump Conquering Western Hemisphere? w/Author Brenden Dilley 12/23/2024

172K50 -

1:09:59

1:09:59

Geeks + Gamers

19 hours agoSonic 3 DESTROYS Mufasa And Disney, Naughty Dog Actress SLAMS Gamers Over Intergalactic

117K21 -

51:59

51:59

The Dan Bongino Show

20 hours agoDemocrat Donor Admits The Scary Truth (Ep. 2393) - 12/23/2024

943K3.14K -

2:32:15

2:32:15

Matt Kohrs

1 day agoRumble CEO Chris Pavlovski Talks $775M Tether Partnership || The MK Show

146K36 -

28:23

28:23

Dave Portnoy

1 day agoDavey Day Trader Presented by Kraken - December 23, 2024

176K45 -

59:29

59:29

BonginoReport

22 hours agoTrump, Murder Plots, and the Christmas Miracle: Evita + Jack Posobiec (Ep.110) - 12/23/2024

177K155 -

2:59:14

2:59:14

Wendy Bell Radio

1 day agoNothing To See Here

139K80 -

2:12:18

2:12:18

TheDozenPodcast

1 day agoIslam vs Christianity: Bob of Speakers' Corner

119K35 -

14:36

14:36

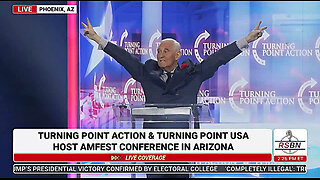

The StoneZONE with Roger Stone

2 days agoRoger Stone Delivers Riveting Speech at Turning Point’s AMFEST 2024 | FULL SPEECH

138K36