Premium Only Content

Stock Market Crash in 2022? Party Like its 1929 and 4 Investing Alternatives

Will we see a stock market crash in 2022? To be a good investor one studies economics. To be a stellar investor one studies history, and human psychology. Why we may be poised for a crash and 4 investing alternatives to the stock market.

******DISCLAIMER: am not your broker, this is not financial advice, use at your own risk and always do your own diligence*****

Major declines in the stock market over the past few days but if you read the news, most pundits are suggesting that the this is a slight blip, AND things have to go up again soon, and in fact there are some great deals to be had in the stock market. Motley Fool here suggesting Disney at $95 down from about $180 is a bargain.

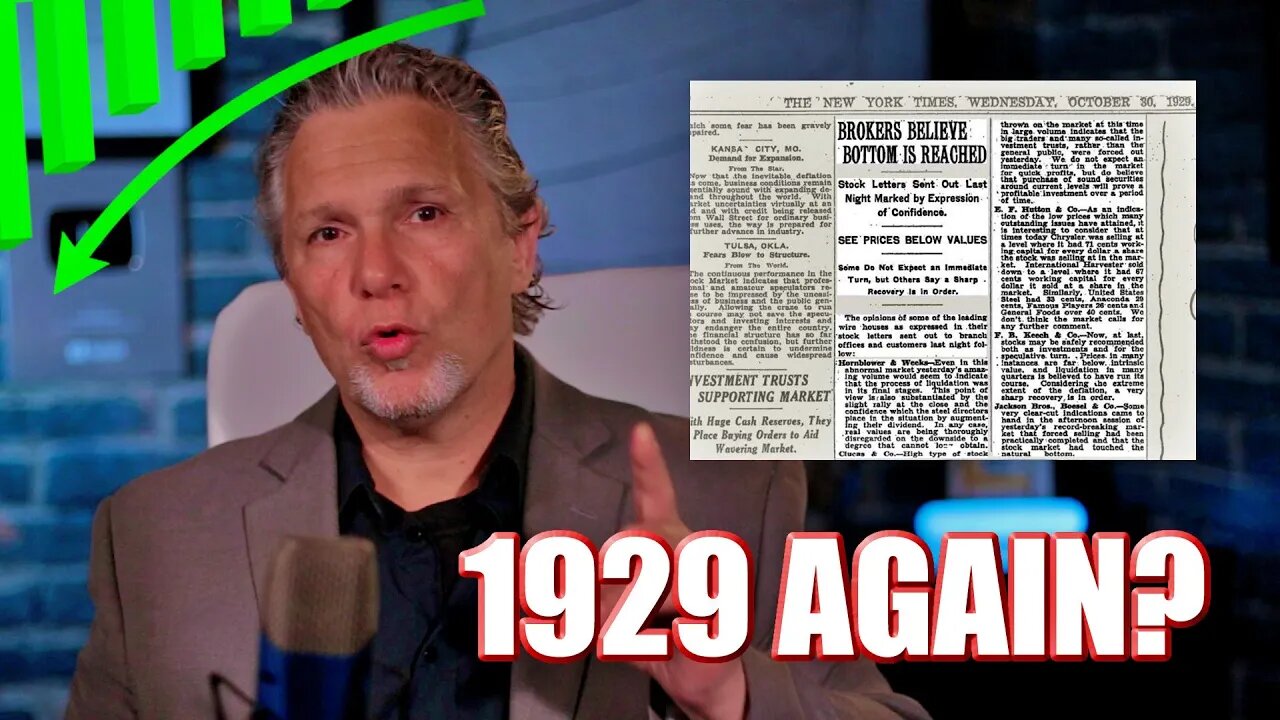

Maybe it is. Or maybe we are in a similar situation to just before the great depression. Take a look at this New York Times article written on October 30, 1929 and tell me you don't see similarities. "Brokers believe bottom is reached" "Stock letters sent last night marked by expression of confidence". We have several of the top stock brokerages in the article stating things like "Even in this abnormal market yesterdays amazing volume seems to indicate liquidation is in its final stages" and "Now at last stocks may be safely recommended both as investments and for the speculative turn". Every single broker expressing what seemed like great technical reasons for people to jump back into the markets. Lets look at what actually happened. That article was written way up here on the chart and stocks slid downward for more than 2 years until July 1932 with the Dow at 41.22 representing an almost 90% loss over 3 years. If you invested at or near the peak as the "experts" suggested, you would not have broke even for 20 years.

Bulls suggest that measures were put in place since then to prevent this from reoccurring. Yet, we saw Black Monday 1987 the Dow Dropped 22% in a single day, and more recently March 16 2020 it fell almost 13% in a day. The crash in the 30's took years to drop that extent. So we do see that the markets still have the capacity to drop significant amounts quickly. If sentiment turns bullish we could still see a stock market crash.

So where are we at today. Record inflation, many people digging deeper into debt because they cant afford gas and food, and keep in mind your losses in the market are even greater than what you see if you calculate the inflationary effects. We have interest rates rising could very likely cause a recession, a rapidly cooling real estate market, inverted yield curves which almost always signal a recession, despite "experts" telling us not to worry, consumer confidence is down, supply chains are in trouble, we have a war and an administration that seemingly does not care or understand the threat of nuclear confrontation, nuclear war once unthinkable is now on the table. By the way smart investing for WW3 video link above and at the end. We have Iran at the stage of nukes, we have North Korea back to testing nukes, we have massive polarization in the country with 44% of all Americans and 53% of Republicans saying America is headed for civil war. We have 30 trillion in debt, and a global debt problem (slide) with multiple countries collapsing economically like Sri-Lanka, Nigeria, Lebanon, Venezuela, many others on the precipice. In USA West major droughts threaten to have a severe impact on agriculture and even power. US household debt increased by 1 trillion dollars in 2021 the most since 2007. Cryptocurrencies have been hit hard with stable coin Luna, and Celsius completely collapsing wiping out billions of dollars, Bitcoin dropped to just over $20k yesterday from a high of almost $70k, why people flock to buy at $70k and don't buy at $20k I don't understand, and we have yet to see the full ramifications of shutting down the global economy for almost 2 years.

The last tech bust lasted 915 days in 2000, it would have taken you 8 years just to break even again. The great recession lasted about 500 days, if you got in at the peak it would have taken you 7 years, just to get back to your starting point. There is no answer to whether stocks are bad or good, but only was your timing bad or good. Bulls tell you that over time stock market averages gains are double digits, but this is only over long periods of time.

If history tells us anything we know there is no eternal free lunch. Whether we see a stock market crash in 2022 or later corrections always come and it makes sense not to bet everything on an unknown. Top 7 investments for WW3 link above. Thanks for watching

SORRY YOUTUBE LIMITS TEXT TO 5000 CHARACTERS, PLEASE SEE VIDEO FOR STOCK INVESTING ALTERNATIVES

Top 7 investments for WW3: https://youtu.be/S5WVftHJWkA

#STOCKMARKETCRASH2022 #FRANCHISECITY

-

2:04:23

2:04:23

Kim Iversen

10 hours agoINCREDIBLE: Trump RELEASES JFK Files & BANS Central Bank Digital Currency

129K152 -

1:12:22

1:12:22

Side Scrollers Podcast

13 hours agoThe Real Game Awards: Official Live Stream

89.9K15 -

59:48

59:48

The StoneZONE with Roger Stone

6 hours agoJanuary 6 Victim Jeremy Brown Still in Jail Despite Trump Pardon | The StoneZONE w/ Roger Stone

53.5K11 -

1:45:44

1:45:44

megimu32

8 hours agoON THE SUBJECT: Make 90s Movies Great Again

43.3K10 -

59:46

59:46

Man in America

14 hours agoAI mRNA Vaccines, Turbo Cancer & Blood Clots... What Could Go Wrong?! w/ Tom Haviland

36.2K21 -

1:09:15

1:09:15

Precision Rifle Network

1 day agoS4E3 Guns & Grub - Trump a new era for gun rights?

70.6K9 -

1:05:31

1:05:31

Glenn Greenwald

9 hours agoSection 702 Warrantless Surveillance Ruled Unconstitutional: Press Freedom Advocate Seth Stern Explains; The Rise of Unions & the Impact of Trump's Populism with Author Eric Blanc | SYSTEM UPDATE #395

105K96 -

1:01:13

1:01:13

The Amber May Show

8 hours ago $2.98 earnedWomen Of Rumble | Amber, Kelly and Wendy Wild

44.2K4 -

1:16:38

1:16:38

Josh Pate's College Football Show

10 hours ago $2.05 earnedCFP Title Viewership | JP Poll Under Attack | Bama & Oregon Season Grades | Most To Prove In 2025?

43.5K -

5:10:59

5:10:59

VOPUSARADIO

14 hours agoPOLITI-SHOCK! "THE TIDE IS TURNING"! 3 SPECIAL GUESTS JOINING US TONIGHT!

28.7K2