Premium Only Content

Your Retirement Is at Risk if You Fall for THIS Fallacy!

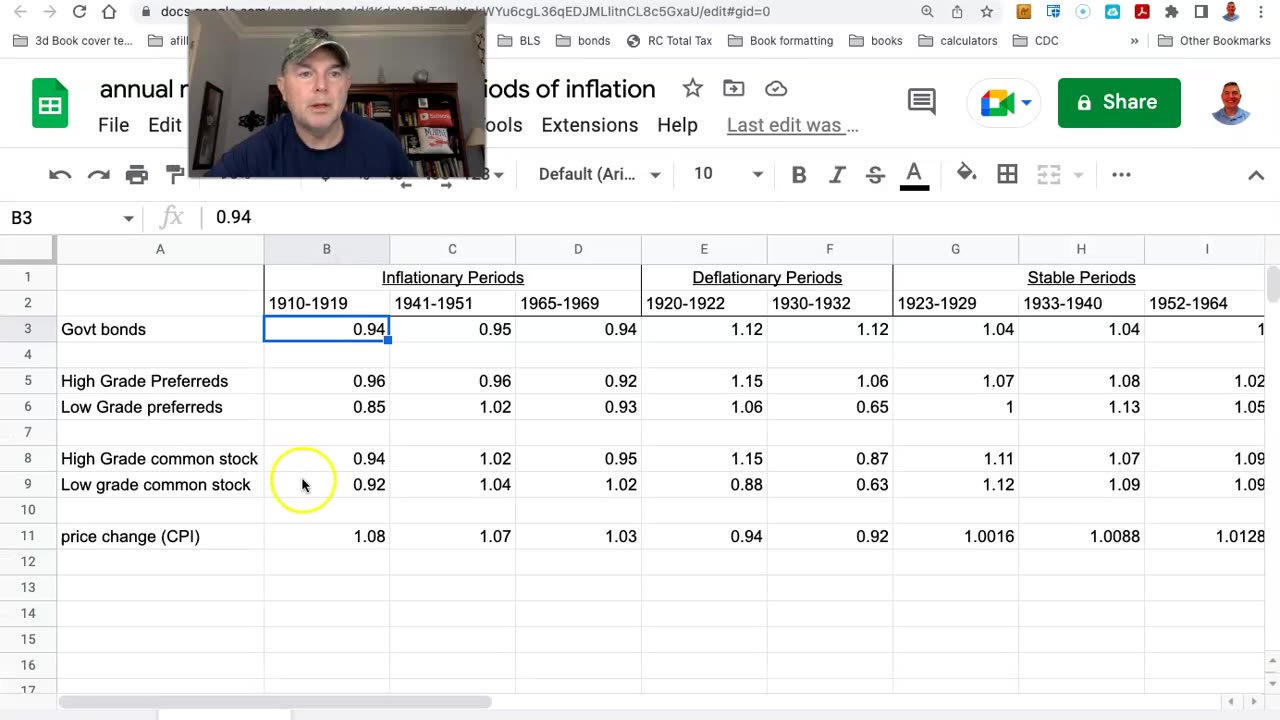

Folks, the idea that stocks are a hedge against inflation is not based on any reality. It's a fallacy. In this video I show you the inflation from 1910-1919. Stocks didn't hedge then

From 1969-1980 it didn't hedge either. We can run these numbers a million times to Sunday and you can not in good conscious claim that "stocks are a hedge against inflation."

Can they be? Sure. But that correlation does not equal a causation.

Are bonds a hedge against inflation? No. Can they be? Sure. The same logic applies from above.

But when it comes to pulling money out of your portfolio during retirement you can not afford another Oct 2007-Mar 9, 2009, or 2000-2003 or 1973-1974 or so many other instances where stocks did not only NOT hedge against inflation but got crushed.

Inflation is death by a thousand cuts. You'll be well gone before the 1000 cuts takes you out. A market collapse though, well that's an acute issue with a recovery that may never happen.

================================

Sign up for email list here. https://mailchi.mp/0a0c258dd676/sign-up-page

Find this video of value? Buy me a cup of coffee! https://www.buymeacoffee.com/joshscandlen

Get Your Own Pablo Retirement Gear: https://heritage-wealth-planning-3.creator-spring.com/

Follow me censorship-free!

https://joshscandlen.locals.com/

https://rumble.com/c/JoshScandlen

https://mewe.com/i/joshscandlen

-

14:30

14:30

Finance and Freedom

1 year ago $0.10 earnedCash, Cash, Cash and Cash!

439 -

20:41

20:41

Stephen Gardner

10 hours ago🔥You Won't BELIEVE What JUST Happened To Don Trump Jr.!!

105K145 -

58:00

58:00

The StoneZONE with Roger Stone

8 hours agoEuropean Leaders Resist Trump Peace Overtures To Their Own Demise | The StoneZONE w/ Roger Stone

73.3K12 -

9:29

9:29

AlaskanBallistics

9 hours ago $7.25 earnedWyoming Suppressors and Rifles at Shot Show 2025

82.6K4 -

1:06:40

1:06:40

Donald Trump Jr.

13 hours agoThe Left is Taking one L After Another, Live with Michael Knowles | Triggered Ep. 217

175K113 -

47:17

47:17

Kimberly Guilfoyle

13 hours agoWoke Gets DOGE’d, Live with AJ Rice & Jarrett Stepman | Ep. 197

129K43 -

20:11

20:11

Candace Show Podcast

12 hours agoBecoming Brigitte: Candace Owens x Xavier Poussard | Ep 6

193K330 -

8:25:38

8:25:38

Dr Disrespect

16 hours ago🔴LIVE - DR DISRESPECT - ELDEN RING DLC - REVENGE

194K22 -

54:22

54:22

LFA TV

1 day agoThe End of the Trans-Atlantic Alliance | TRUMPET DAILY 2.17.25 7PM

50.2K7 -

55:56

55:56

BIG NEM

15 hours agoUGLY COCO: The Rapper Who’s Tried EVERY PSYCHEDELIC 🌌

22.6K1