Premium Only Content

Merged: pre-paid for t/young & paid into for t/old Retirement, w/a Gov. Budget to Secede

The new merged version is less costly, includes the Superior pre-paid current & future retirements, for the up to 25 year old age groups,

but does have slightly less gov income also.

The Old Style version, a Superior Version & a Merged Version

of retirement income (social security) & New Government Budget :

https://docs.google.com/spreadsheets/d/1-dn7zWllkgBBnjIy-cD64VmQqezXCpQU/edit?usp=sharing&ouid=105677774979635688715&rtpof=true&sd=true

add-in bonus:

The new working retirees starting at 64 would not pay into retirement anymore,

as they already would receive the set amount.

Therefore, less accounting work for their employers.

Making the young pre-paid retirement working group 18-25

& the retirees entering the system,

lucrative employees for businesses, because they would be only wages

and a small taxation to the government,

but no longer paying the extra hefty retirement tax.

0-25 pre-paid retirement in 8 yrs.

25-64 pay retirement tax

64 new retirees in the system starting at 64, receive a set amount.

The longer the system goes on, the 25-64 taxed group will have their

retirement tax burden widdled away, eventually to 0, like the younger ones.

After all the age groups 0-60 have been paid for, "one time only",

the system rolls on, for future persons to never have to pay for retirement.

-

LIVE

LIVE

LFA TV

17 hours agoTRUMP'S 1ST DAY! HE'S BACK!| LIVE FROM AMERICA 1.21.25 11am

6,960 watching -

2:31:20

2:31:20

Matt Kohrs

15 hours agoTrump Pumps Stocks, Pelosi's Trades & Breaking News || The MK Show

58.8K2 -

39:13

39:13

Rethinking the Dollar

1 hour agoDay 2 Drama: Did Trump Just Leave the Door Open for CBDCs?

7.53K2 -

1:03:18

1:03:18

2 MIKES LIVE

3 hours agoTHE MIKE SCHWARTZ SHOW with DR. MICHAEL J SCHWARTZ 01-21-2025

15.4K4 -

29:44

29:44

Neil McCoy-Ward

4 hours ago🔥 Day 2... And Things Are Heating UP!!! 🚨

16.5K18 -

27:22

27:22

BonginoReport

4 hours agoA Nation Reclaimed (Ep.122) - 01/21/2025

68.5K78 -

1:32:27

1:32:27

Game On!

12 hours ago $3.77 earnedOhio State DOMINATES Notre Dame! Chip Kelly FINALLY wins a National Championship!

55.1K3 -

48:58

48:58

World Nomac

20 hours agoWhat happens in the Philippines AFTER DARK 🇵🇭

74.4K6 -

40:28

40:28

Rethinking the Dollar

1 day agoTrump’s 200 Executive Orders (420+ & Counting): What’s Next for America?

82.1K28 -

1:48:38

1:48:38

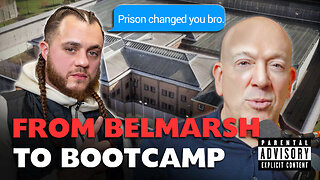

The Criminal Connection Podcast

1 day ago $3.68 earnedYUSEF BOUATTOURA Pro PT: Mean Streets of TOTTENHAM, Belmarsh to Bootcamp! (CRAZY Life Story)

65.3K2