Premium Only Content

Housing IS NOT The Business Cycle

If you follow me, you know that I have said over the past year that the real estate news industry has exaggerated both good and bad news.

One prime example of this is Fortune Magazine's Real Estate Editor Lance Lambert, whose Twitter tagline is "Housing IS the Business Cycle."

Now, obviously, as the real estate editor, he has every reason to exaggerate the importance of the area he covers, but is he correct? Is housing the business cycle?

Well, obviously, it's an exaggeration. I know, nothing new for real estate news. But I think there is a more important message that he is missing, that the housing industry was becoming slightly less important in the business cycle after a few years in a larger portion.

Historically, the housing industry has been just below 16% of the overall economy, only moving significantly above that during the last housing crisis and during the past two years during the global pandemic. And after two years of housing being an oversized portion of the business cycle, it is returning to a more normal level.

This also explains why home sales are slowing down and yet not crashing, as the industry returns to a more normal pre-COVID level.

Because by all standards, the market is healthy, and slowing is more of a correction than a crash. The most important indicator is inventory, which remains at levels between the past 2 years and below any period pre-COVID.

And as much as the increase in mortgage rates has slowed the housing market, it has caused at most a slowing or a correction. Here is a great chart from John Burns Real Estate Consulting that shows the doubling of interest rates has reduced the pool of buyers by 40%

But remember, when rates were at 3%, we had 10 or more offers per property. Reducing the population by 40% merely takes an overheated market to a historically average market. In fact, Redfin reports that the bidding war went from as high as 70%! of all properties down to "only" 40% last month.

I included this graph even though it is classic data born, in that to make it more "scary" notice the scale of the history goes from 30% to 70%, rather than say 9 to 100%, to exaggerate that the current market is at ONLY 40% of sales with multiple offers.

So, if rates went up, how are sales not collapsing? Well, 2 groups are increasing their activity despite the rates.

One is cash buyers The higher rates are wreaking havoc on stocks, so investors are looking for returns and paying cash for properties to improve their yields. The share of cash buyers closed at almost 32% of sales, the highest since 2014

Another group taking advance of the increased rates are first-time buyers and those using FHA loans. During the red-hot COVID period, many sellers were unwilling to consider FHA loans due to their increased condition requirements as well as tighter loan underwriting. Now, with a more normal level of activity, sellers are able to review all offers, including FHA buyers, and as a result, FHA loans increase to their pre-COVID levels.

So, the market looks like many factors are helping the overall industry return to normal, pre-COVID levels.

Now, our award this week for misleading news goes to the Cal; California Association of Realtors and its "Beyond the Headline" section. It is a weekly feature that I review to see what the Association is pushing, and if there is one consistent theme is that the market is all about buyers. 4 of the 5 articles are buyer focused, and their consistent editorial position is to view real estate through the eyes of a buyer. Yet, for every buyer, there is a .... seller, theoretically also represented by a real estate agent. When business is viewed as a zero-sum game, anything "good" for buyers would be "bad" for sellers, and the reverse. But, in fact, a healthy economy benefits everyone. It's unfortunate that our California Association of Realtors takes such a flawed approach to our industry. The really sad part is that the CAR has consistently taken this position while the percentage of home ownership has plummeted in California, and it s continues to support policies that make homeownership harder for 1st time home buyers.

--

Bill Gross, The LAProbate Expert

I am a real estate broker in Los Angeles, CA focused on probate real estate and the leader of a team of over 1,100 agents nationally probate experts.

Join my live stream weekly on probate real estate: www.ProbateWeekly.com

#probateattorney #probatesales #probaterealestate

-

1:14:05

1:14:05

Tucker Carlson

3 hours ago“I’ll Win With or Without You,” Teamsters Union President Reveals Kamala Harris’s Famous Last Words

71K227 -

1:58:31

1:58:31

The Dilley Show

3 hours agoTrump Conquering Western Hemisphere? w/Author Brenden Dilley 12/23/2024

59.7K9 -

1:09:59

1:09:59

Geeks + Gamers

4 hours agoSonic 3 DESTROYS Mufasa And Disney, Naughty Dog Actress SLAMS Gamers Over Intergalactic

32.7K9 -

51:59

51:59

The Dan Bongino Show

5 hours agoDemocrat Donor Admits The Scary Truth (Ep. 2393) - 12/23/2024

569K1.59K -

2:32:15

2:32:15

Matt Kohrs

16 hours agoRumble CEO Chris Pavlovski Talks $775M Tether Partnership || The MK Show

90.7K27 -

28:23

28:23

Dave Portnoy

16 hours agoDavey Day Trader Presented by Kraken - December 23, 2024

112K32 -

59:29

59:29

BonginoReport

7 hours agoTrump, Murder Plots, and the Christmas Miracle: Evita + Jack Posobiec (Ep.110) - 12/23/2024

126K113 -

2:59:14

2:59:14

Wendy Bell Radio

10 hours agoNothing To See Here

106K60 -

2:12:18

2:12:18

TheDozenPodcast

1 day agoIslam vs Christianity: Bob of Speakers' Corner

99.8K24 -

14:36

14:36

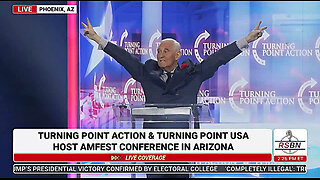

The StoneZONE with Roger Stone

1 day agoRoger Stone Delivers Riveting Speech at Turning Point’s AMFEST 2024 | FULL SPEECH

121K28