Premium Only Content

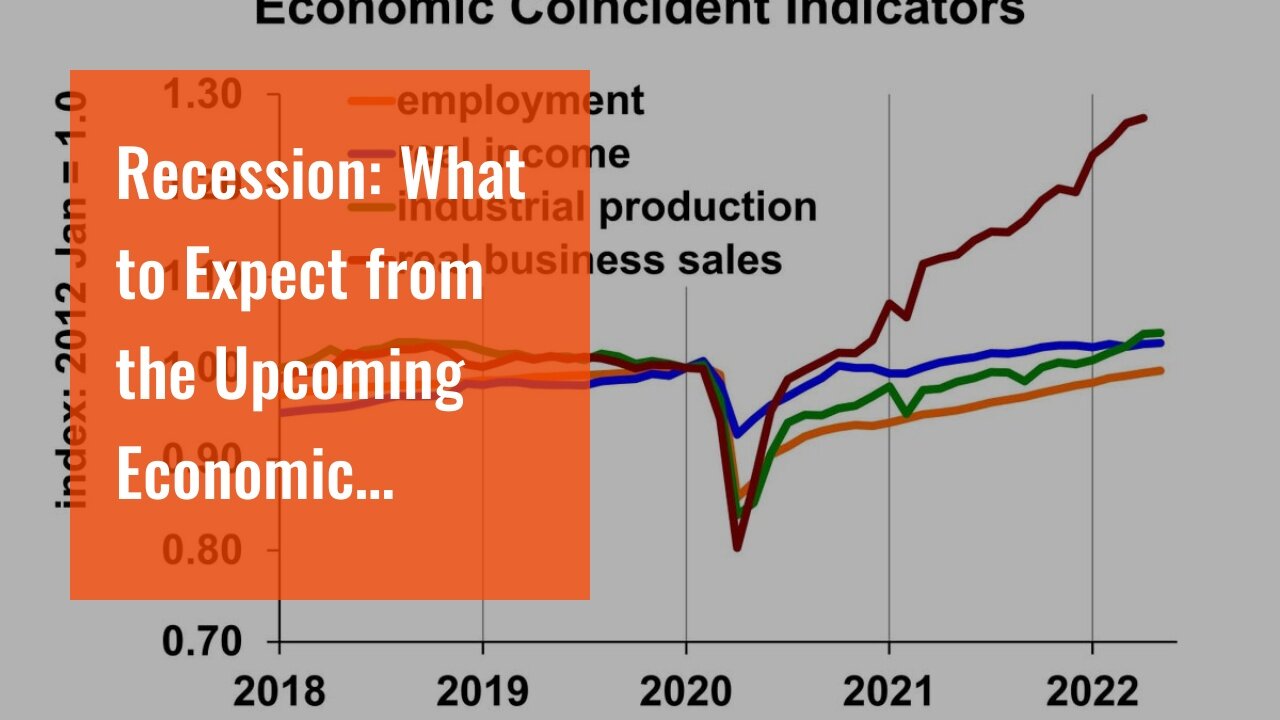

Recession: What to Expect from the Upcoming Economic Downturn?

Recession: What to Expect from the Upcoming Economic Downturn?

A recession is an economic downturn that usually lasts for a few months. It is characterized by a decrease in GDP, an increase in unemployment, and a decline in consumer spending. A recession can happen when there is a decrease in demand for goods and services, or when there is an increase in costs.

There are several warning signs of a recession, such as a decrease in stock prices, an increase in unemployment claims, and a decline in housing starts. To prepare for a recession, it is important to build up savings, invest in assets that will retain their value,...

https://finetimer.site/recession-what-to-expect-from-the-upcoming-economic-downturn/

A recession is an economic downturn that usually lasts for a few months. It is characterized by a decrease in GDP, an increase in unemployment, and a decline in consumer spending. A recession can happen when there is a decrease in demand for goods and services, or when there is an increase in costs.

There are several warning signs of a recession, such as a decrease in stock prices, an increase in unemployment claims, and a decline in housing starts. To prepare for a recession, it is important to build up savings, invest in assets that will retain their value, and to be aware of which industries are most likely to be affected.

The upcoming recession is expected to last for about two years and the most affected industries will be those related to housing and construction, manufacturing, and retail. However, there are several things that we can do to mitigate the effects of the recession, such as diversifying our investments, increasing our emergency savings, and being mindful of our spending. Photo by Amina Filkins on Pexels Recession: What is it and how does it happen?

What is a recession?

A recession is defined as a significant decline in economic activity lasting more than a few months, typically visible in production, employment, and investment. A recession begins when the economy reaches peak growth and ends when it reaches its trough, or lowest point.

In the United States, a recession is typically considered to be two consecutive quarters of negative economic growth, as measured by gross domestic product (GDP). However, this definition can vary from country to country.

Recessions are generally caused by a combination of factors, including asset bubbles bursting, monetary policy errors, fiscal policy mistakes, and real shocks to the economy such as an oil price shock or a natural disaster.

What causes a recession?

There are many potential causes of recessions. Some of the most common include:

Asset bubbles bursting: When asset prices (e.g., housing prices) rise too high and then suddenly fall, it can trigger a recession. This is because people may no longer be able to afford big-ticket items like homes and cars, which can lead to less consumer spending overall.

Monetary policy errors: If the central bank raises interest rates too quickly or fails to provide enough liquidity to the banking system during a period of economic stress, it can choke off credit and lead to a recession.

Fiscal policy mistakes: If the government raises taxes or cuts spending too much during an economic downturn, it can deepen the recessionary effects.

Real shocks: Shocks to the economy such as an oil price shock or natural disaster can also lead to a recession by disrupting production and causing consumers to cut back on spending.

What are the effects of a recession?

The effects of a recession can be both severe and long-lasting. They include higher unemployment rates, lower wages for those who are employed, reduced business investment, lower stock prices and home values, and increased borrowing costs. For countries with large debts, recessions can also lead to debt crises that further exacerbate the economic damage.

How can we prepare for an impending recession?

What are the warning signs of a recession?

The first and most obvious sign that a recession is on the horizon is declining economic growth. This can be measured by GDP, which is the total value of all goods and services produced in an economy. When GDP growth slows down, it’s a sign that businesses are struggling and consumers are spending less money.

Other warning signs of a recession include rising unemployment, falling stock prices, and declining housing prices. These all point to a decrease in consumer confidence, which can lead to even further decreases in spending a...

-

6:21

6:21

FineTimer

2 years agoHuobi Global: How to Get Ahead in the Digital World

4051 -

2:00:20

2:00:20

Glenn Greenwald

8 hours agoThe View from Moscow: Key Russian Analyst Aleksandr Dugin on Trump, Ukraine, Russia, and Globalism | SYSTEM UPDATE #414

46.2K17 -

1:10:55

1:10:55

Donald Trump Jr.

5 hours agoBREAKING NEWS: My Father Revokes Biden-Maduro Oil License, LIVE with Maria Corina Machado | Triggered Ep.220

126K159 -

1:25:29

1:25:29

Sarah Westall

4 hours agoX-Files True History, Project Blue Beam, Cabal Faction War w/ Former FBI Agent John DeSouza

41.4K3 -

7:03:49

7:03:49

Dr Disrespect

11 hours ago🔴LIVE - DR DISRESPECT - NEW PC VS. DELTA FORCE - MAX SETTINGS

129K26 -

49:04

49:04

Lights, Camera, Barstool

1 day agoIs The Monkey The Worst Movie Of The Year?? + Amazon Gets Bond

42.8K4 -

24:19

24:19

Adam Carolla

23 hours agoDiddy’s Legal Drama Escalates, Smuggler Caught Hiding WHAT? + Philly Eagles & The White House #news

49.2K8 -

10:12

10:12

Mike Rowe

2 days agoClint Hill: What A Man. What A Life. | The Way I Heard It with Mike Rowe

66.7K10 -

1:31:52

1:31:52

Redacted News

6 hours agoBOMBSHELL! This is war! FBI whistleblowers reveal Epstein files being destroyed? | Redacted News

144K335 -

48:55

48:55

Candace Show Podcast

7 hours agoSTOP EVERYTHING. They FINALLY Mentioned ME In The Blake Lively Lawsuit! | Candace Ep 152

129K120